Bitcoin short-term holders entered panic mode as BTC price dropped below $90,000, resulting in aggregate losses.

Speculators sent over 80,000 BTC to exchanges at a loss as BTC/USD hit 15-week lows.

The latest data from blockchain analytics platform CryptoQuant suggests the largest loss-taking sell-off of 2025.

BTC Speculators Sell Below Cost

Bitcoin short-term holders (STHs) — those holding for up to 155 days — appear to have panicked during the latest crypto market downturn.

As BTC/USD dropped below $86,000 on February 25, these speculators sent a massive 79,300 BTC ($7 billion) to exchanges within a 24-hour period.

“This is the largest Bitcoin sell-off of 2025,” CryptoQuant contributing analyst Axel Adler Jr. commented while sharing the data on X.

The chart shows the highest rolling 24-hour loss-making transactions so far this year. While it doesn’t confirm whether users sold the coins sent to exchanges, the data highlights the atmosphere of uncertainty among newer market participants.

“Yesterday’s price drop likely triggered panic selling, and if further corrections occur, similar behavior could reemerge,” fellow contributor Avocado_onchain continued in a “Quicktake” blog post on February 26.

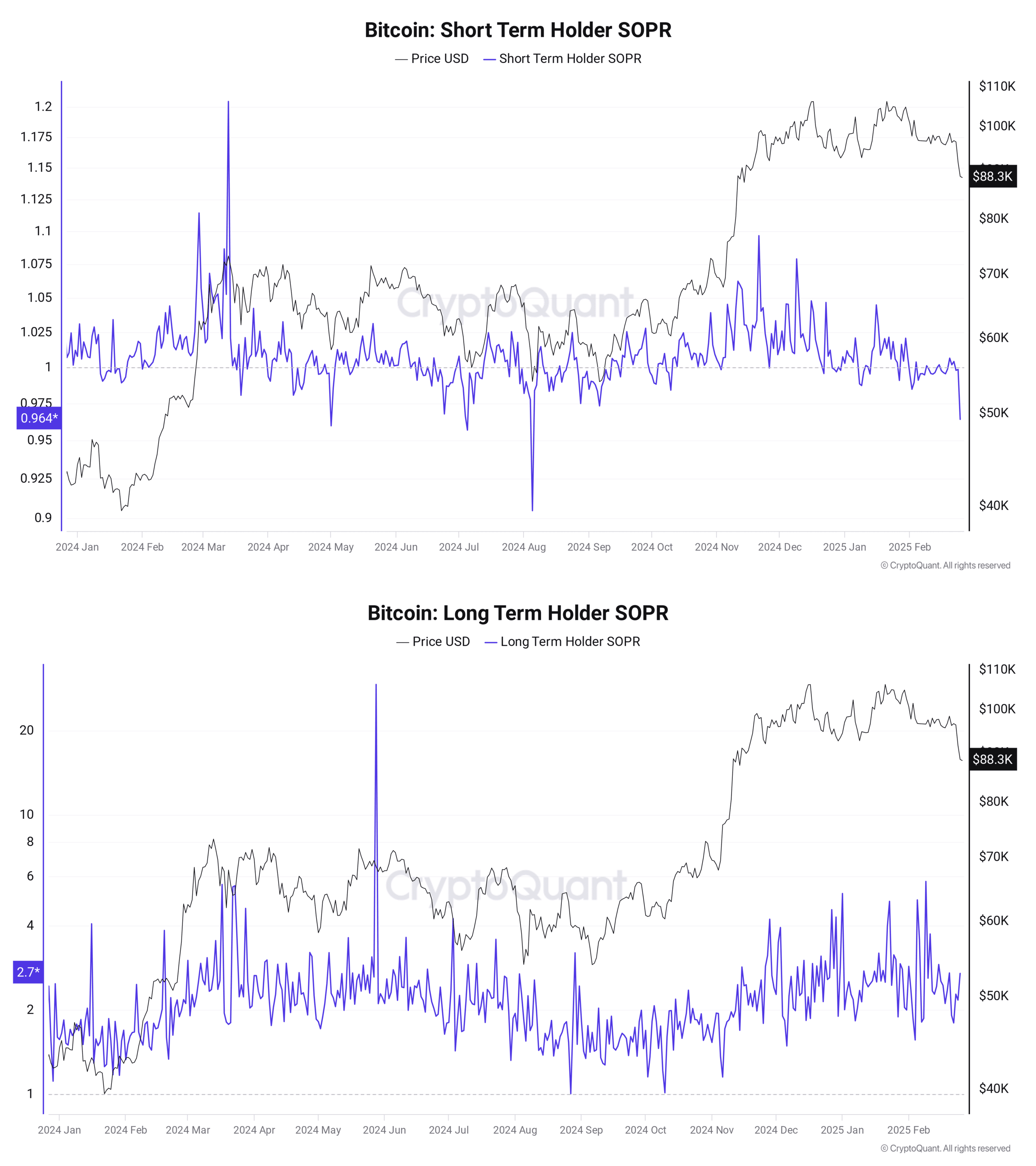

The post analyzed the spent output profit ratio (SOPR) metric, which tracks the ratio of coins moved at a profit or loss on-chain.

STH-SOPR dropped to 0.964 on February 25, marking its lowest level since the peak of the Japanese yen carry trade unwind in August of last year.

“On the other hand, long-term holders have remained largely unaffected by the recent downturn, continuing to hold their assets and providing support against further price declines,” Avocado_onchain observed.

“Nothing to Be Worried About”

Continuing, James Check, creator of the onchain data resource Checkonchain, noted that crossing the $90,000 mark for the STH group would be a key turning point.

“It’s interesting that the support level around $90,000 should hold, but below that, there isn’t much,” he said.

Check also pointed out that “very little” of the BTC supply has changed hands between the old highs and current local lows.

While discussing the panic-driven market behavior of the week, popular Bitcoin figures called for a more composed approach.

For digital asset lawyer Joe Carlasare, the euphoria following Bitcoin’s breakout above its previous all-time highs of $73,800 has skewed perceptions of its potential.

“The panic is palpable. In December, everyone said Bitcoin couldn’t go down. ‘Nation state bid is here, bro!’ Now they think it can’t go up,” he summarized on X.

“Reality? Bitcoin overshoots both ways. Could it go lower? Sure. But this is the buy zone. Nothing to be worried about.”

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.