The cryptocurrency market can be extremely fast-paced, volatile, and at times confusing. Especially for beginners, taking cautious and informed steps into this world is crucial. Here are 10 golden rules for those just starting out in crypto and stock investing:

1.Never Invest with Borrowed Money!

Avoid entering the crypto market by taking loans or borrowing money. When investing with borrowed funds, you lose the luxury of making mistakes. Panic decisions may force you to sell at a loss. Always trade with your own capital to keep your mind at ease.

2.Learn Both Technical and Fundamental Analysis

Another golden rule is understanding that relying solely on technical or fundamental analysis is insufficient. Learn basic technical indicators like RSI, support, and resistance levels. At the same time, develop a solid grasp of fundamental analysis to evaluate a coin’s category, circulating supply, and market cap. This will increase the reliability and success rate of your decisions.

3.Start Small

You don’t need large amounts to enter the crypto space. What matters most is gaining experience. You can even start with a small amount like $10. Use small trades to understand the market and practice buying and selling. Remember: this is a skill developed over time.

4.Never Put All Your Money into One Coin

Even the best project carries risks. Instead of investing everything in a single coin, diversify your portfolio. Allocate some funds to Bitcoin, some to Ethereum, and portions to AI projects and DeFi tokens. This helps spread and manage your risk effectively.

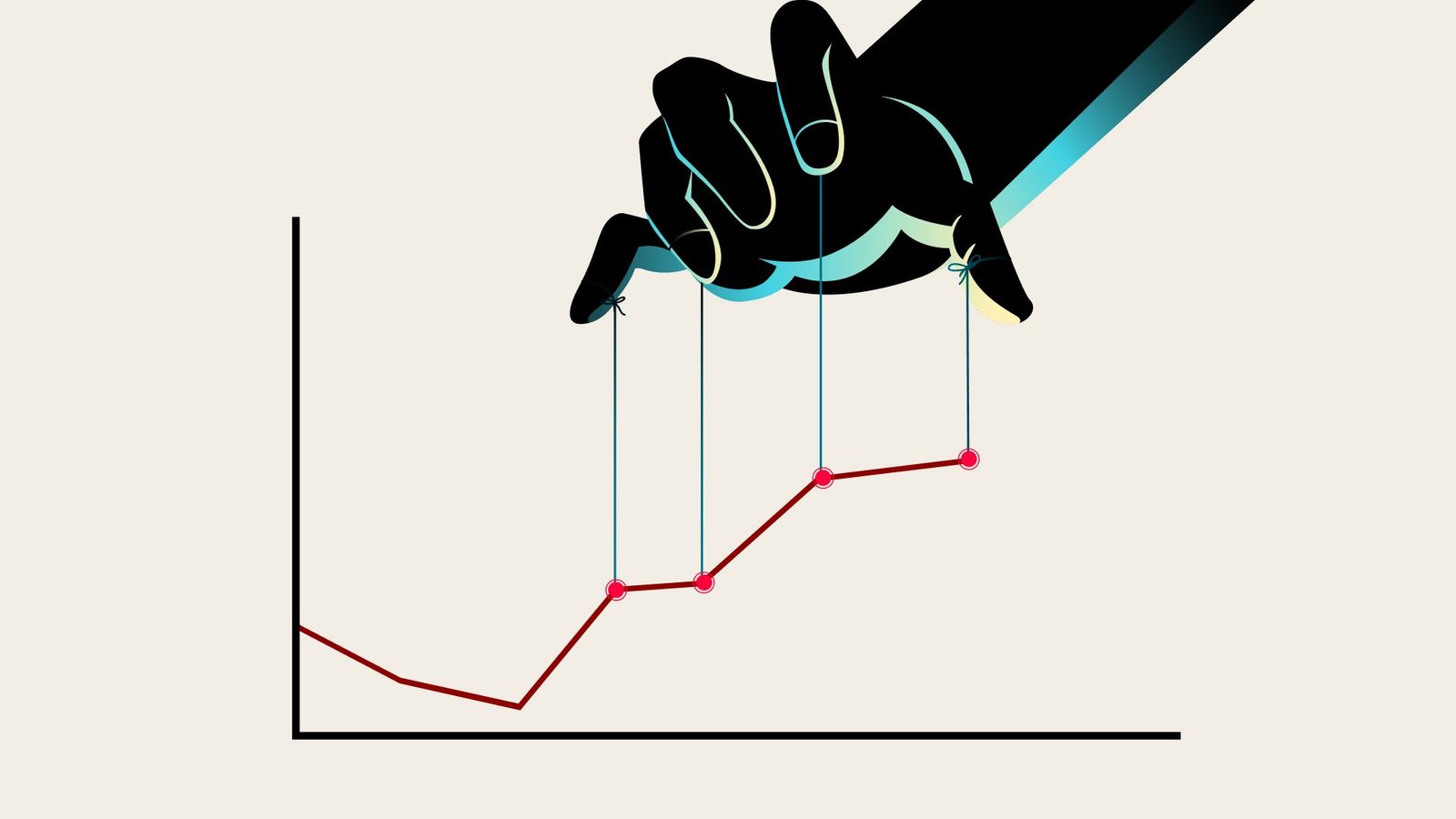

5.Act with Logic, Not Emotion

The crypto market is a psychological battlefield. Emotional decisions often lead to losses. Avoid “revenge trading” after a loss. Think critically, question your actions, and take breaks if needed. Sometimes, observing the market without trading can be more beneficial. Use this time to educate yourself.

6.Don’t Invest Based on Others’ Opinions

There are many influencers on social media, but opinions vary greatly. Do your own research and learn how to analyze independently. When everyone says the same thing, be cautious. In markets, the minority often profits, not the majority. Strengthen your probabilities by consulting diverse sources.

7.You Can Never Predict the Exact Bottom or Top

Forget the idea of “buying the dip and selling the peak.” Instead, use the Dollar-Cost Averaging (DCA) strategy. Invest a fixed amount regularly, regardless of price, to build a healthier long-term investment.

8.Keep Some Cash Reserves

Don’t invest all your money at once. Keep some cash aside as a backup. In case of major dips or unexpected opportunities, you can open positions with this reserve. Investing your entire capital at once leaves you vulnerable.

9.Avoid Over-Trading

Trading every day can exhaust you and lead to losses. Less is more when it comes to trading. Being constantly in the market exposes you to unnecessary risk. Be patient and wait for the right opportunities.

10.This Is Your Journey, Not Someone Else’s

Everyone’s crypto path is unique. Don’t focus on others’ profits or trades. Build your own strategy and learn from your personal experiences. We can guide you, but the journey belongs to you.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, please don’t forget to follow us on our Telegram ,YouTube and Twitter channels for the latest news and updates.