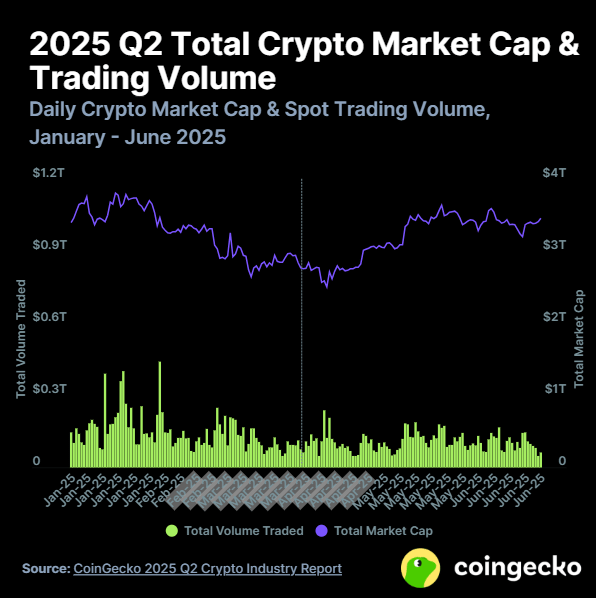

After a volatile first quarter, the crypto market made a notable recovery in Q2 2025. The total market cap surged by 24%, reaching $3.5 trillion—approaching its year-to-date highs. But beneath the surface of this bounce lies a significant reshaping of trading behavior, investor focus, and protocol dominance.

1. Crypto Market Cap Climbs Back to $3.5 Trillion

In Q2 2025, the global cryptocurrency market capitalization gained $663.6 billion, reversing most of the losses from Q1’s -18.6% drawdown. However, daily average trading volume dropped by 26.2% to $107.8 billion—marking the second straight quarter of declining spot activity, even as prices recovered.

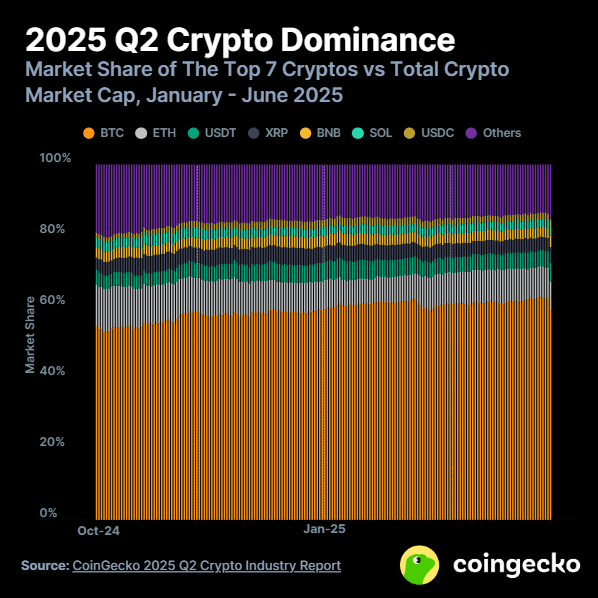

2. Bitcoin Crosses $100K, Dominance Hits 62.1%

Bitcoin (BTC) was the clear winner this quarter, breaking past the $100,000 mark and climbing to a market dominance of 62.1%, up 7.6 percentage points since the start of the year. Institutional capital continued to favor Bitcoin over altcoins, reinforcing its role as the market anchor.

Meanwhile, Ethereum (ETH) slightly improved its market share to 8.8%, up 0.8 percentage points. It was the only top-7 altcoin to increase in dominance. Stablecoins and other large-cap tokens saw marginal drops.

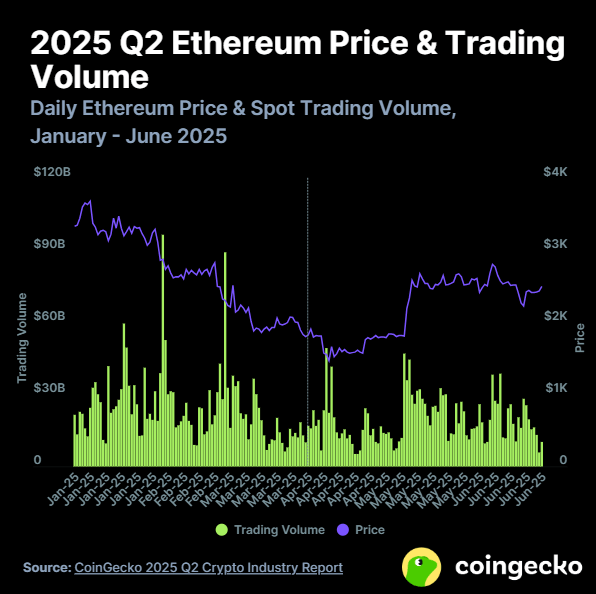

3. Ethereum Rallies 36%, Still Below 2025 Start

ETH closed Q2 at $2,488, delivering a 36.4% quarterly gain and outperforming most major coins, including Solana, XRP, and BNB. Yet, it’s still down from its 2025 opening price of $3,337.

Despite the price growth, daily trading volume fell from $24.4B in Q1 to $19.5B in Q2. This drop may reflect growing use of OTC desks by institutional players. On-chain activity showed a healthier picture, with daily transaction counts rising to 1.3M and average gas fees falling to 3.5 Gwei.

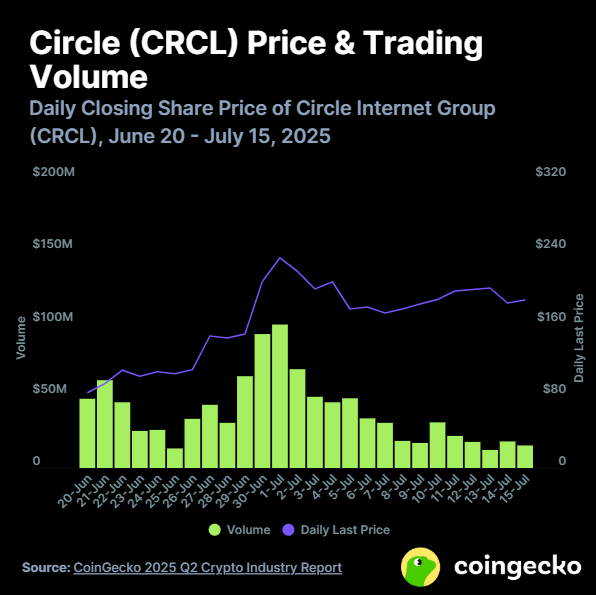

4. Circle’s IPO Sets New Milestones

One of the most anticipated events of the quarter was Circle’s IPO on the NYSE. Initially priced at $31 per share, it closed the first trading day at $83.23 and surged to an all-time high of $299—an impressive +864.5% return from its debut price.

This blockbuster performance has stirred speculation around upcoming listings from other major crypto firms like Kraken, Gemini, and Grayscale.

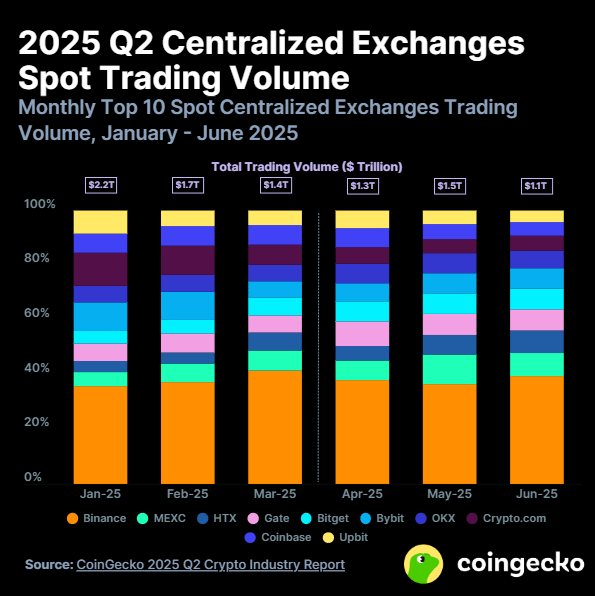

5. Centralized Spot Volume Drops Despite Bullish Sentiment

Even as prices soared, centralized exchanges (CEXs) saw a steep decline in spot trading volume. Q2 ended with $3.9 trillion in volume, down 27.7% quarter-on-quarter.

Binance retained the top spot with 37-39% market share but saw trading volume fall below $500 billion in both April and June. MEXC, HTX, and Bitget were the only CEXs to post growth, while Crypto.com suffered the sharpest decline—dropping 61.4% to fall from #2 to #8 in the rankings.

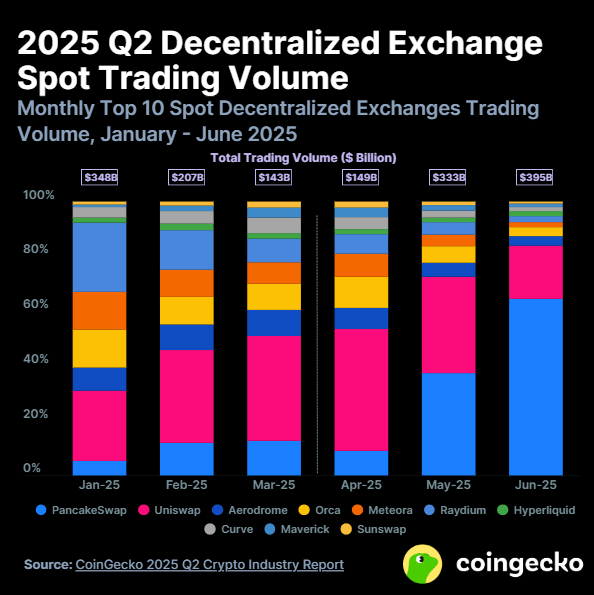

6. Decentralized Crypto Exchanges Hit All-Time Highs

Decentralized exchanges (DEXs) surged in Q2, with total spot trading volume climbing to $876.3 billion—up 25.3% from Q1. The DEX-to-CEX volume ratio reached an all-time high of 0.23.

PancakeSwap was the standout performer, growing 539.2% quarter-over-quarter and handling $392.6 billion in trades—making it the largest DEX by volume. This momentum was largely driven by Binance Alpha, which began routing trades through PancakeSwap in May, pushing BSC to the forefront of DEX activity.

In contrast, Solana-based DEXs such as Orca, Meteora, and Raydium experienced heavy volume declines, losing up to 73.4% compared to Q1.

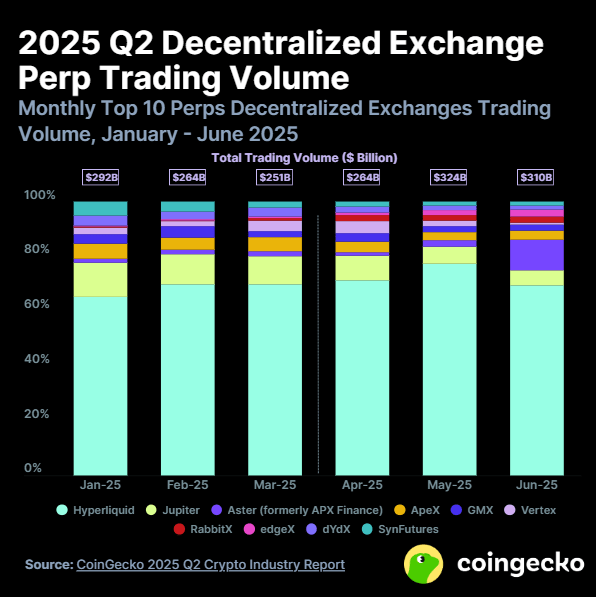

7. Perpetual DEX Volume Sets New Record: Hyperliquid Leads

Q2 also marked a record-setting quarter for perpetual trading on decentralized platforms, with total volume reaching $898.0 billion. Hyperliquid dominated the space, commanding a 72.7% market share with $653.2 billion in volume. This made it the eighth-largest perp exchange overall, including both DEXs and CEXs.

Other gainers included Aster (formerly APX Finance), RabbitX, and EdgeX. Aster doubled its volume after launching its Pro mode. Meanwhile, former leader dYdX continued to slide, managing just $5.3 billion in monthly average volume.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram ,YouTube and Twitter channels for the latest news and updates.