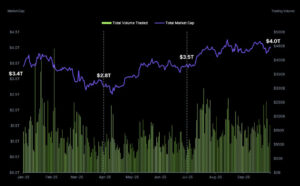

Q3 2025 marked a renewed acceleration phase in the crypto industry, according to CoinGecko’s newly released 2025 Q3 Crypto Industry Report. The market fully entered its second recovery cycle, with total crypto market capitalization surpassing the $4 trillion threshold the highest level seen since late 2021. This surge was driven by accelerating institutional inflows, rising liquidity, and strong rebounds in both spot and derivatives trading volumes.

Total Crypto Market Cap Rises +16.4% to Hit $4 Trillion

In Q3 2025, the crypto market gained strong momentum. Total market cap increased by $563.6 billion, reaching $4 trillion. This confirms that the capital inflows that started earlier in the year have intensified.

The increase in liquidity directly boosted trading activity. Average daily trading volume rose to $155 billion, a +43.8% increase from Q2 reversing the weakness seen in Q1 and Q2. This jump highlights a clear rise in interest from both professional traders and institutional participants.

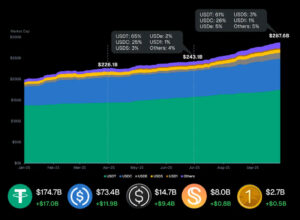

Stablecoin Market Hits a New All-Time High: $287.6 Billion

Q3 was a historic quarter for stablecoins. The combined market cap of the top 20 stablecoins grew by $44.5 billion to reach a record $287.6 billion.

Key highlights:

- Ethena’s USDe led percentage growth with +177.8%, adding $9.4 billion and increasing its market share from 2% to 5%.

- Tether (USDT) remains the largest stablecoin with a $17 billion increase, although its market share fell from 65% to 61% due to rising competition.

Surging stablecoin demand is tied to stronger DeFi revenue models and rising institutional funding activity.

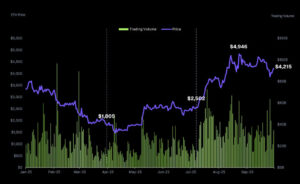

Ethereum Breaks Records in Q3 2025: Rallies to $4,946

Ethereum delivered exceptional performance in Q3:

- Start of quarter: $2,502

- New ATH: $4,946

- End of quarter: $4,215

This represents a +68.5% quarterly gain.

ETH trading volume showed similar strength — rising from $19.5B daily in Q2 to $33.4B in Q3. Institutional accumulation by Bitmine Immersion, SharpLink, and major funds played a key role, while strong inflows into U.S. spot ETH ETFs accelerated the rally.

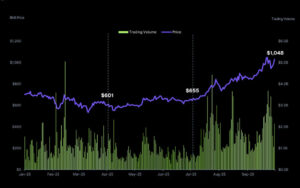

BNB Hits a New ATH: +57.3% in Q3

BNB delivered one of the strongest performances of 2025:

- New ATH: $1,048

- Quartile close: $1,030

Its trading volume doubled to $1.7B. Aster’s incentives for BNB perpetual pairs and PancakeSwap’s Binance Alpha integration significantly boosted liquidity across the BNB ecosystem.

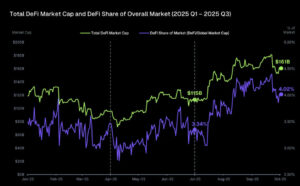

DeFi Ecosystem Grows +40.2%, Regains Market Share

DeFi staged a powerful comeback in Q3 2025. Total Value Locked (TVL):

- July: $115B

- September: $161B

- Growth: +40.2%

The ETH rally and stablecoin expansion directly fueled DeFi growth. Projects like Avantis (AVNT), Aster (ASTER), and several next-gen DEX platforms contributed to the renewed momentum. DeFi’s market share climbed from 3.3% in Q2 to 4.0% in Q3.

Centralized Exchange Spot Volume Soars to $5.1 Trillion

CEX activity picked up sharply:

- Q3 total spot volume: $5.1 trillion

- QoQ increase: +31.6%

Binance raised its market share to 40%, while Bybit grew +38.4% to become the third-largest exchange globally. Upbit saw the fastest growth at +40.5%. Despite being the largest U.S. exchange, Coinbase ranked only 10th globally.

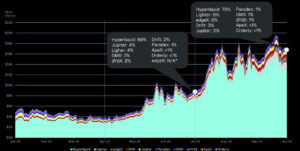

DEXes Deliver Their Strongest Performance of the Year: $1.8T in Perp Volume

Perpetual DEX trading volume surged +87% from the previous quarter, reaching $1.81 trillion.

Key insights:

- Hyperliquid maintained dominance with 6% market share.

- Aster, Lighter, and edgeX intensified competition through aggressive incentive campaigns.

- Aster’s daily trading volume hit $84.8B in September.

- In Open Interest, Hyperliquid retained unmatched dominance with 75% market share.

Conclusion

Q3 2025 wasn’t just a recovery period it signaled the beginning of a new growth cycle for the crypto industry. The return of institutional capital, record expansion in stablecoins, resurgence in DeFi, and unprecedented volume across both CEX and DEX platforms all confirm that the sector remains vibrant and primed for further expansion.

With Ethereum and BNB reaching new ATHs, investor interest in major assets remains strong. Meanwhile, the rapid growth of DeFi and stablecoins proves the core infrastructure of the crypto economy is healthier than ever. Overall, the report shows that the crypto market is entering the remainder of 2025 with deeper liquidity, greater maturity, and a significantly larger user base.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.