The cryptocurrency market continues to surprise investors with its volatile nature. On April 1, 2025, movements were observed in Bitcoin (BTC) and Ethereum (ETH) spot ETFs. Bitcoin ETFs saw a net outflow of $157.80 million, while Ethereum (ETH) ETFs experienced a net outflow of $3.60 million.

Bitcoin ETFs Continue to See Negative Movement: Large Outflows Stand Out

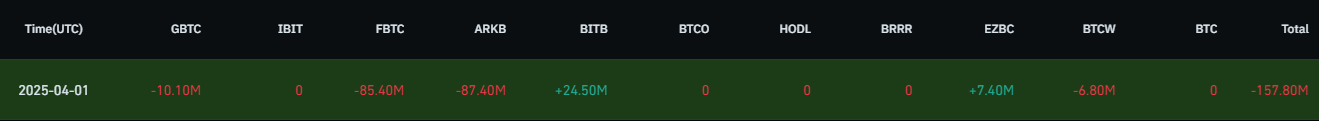

The selling pressure in Bitcoin ETFs continues unabated. According to the latest data, a total of $157.80 million in net outflows was observed from ETFs. The majority of this outflow came from FBTC. FBTC saw an outflow of $85.40 million, while no outflows were recorded in other major ETFs (GBTC, IBIT, ARKB, BITB, BTCO, HODL, BRRR, EZBC, BTCW).

Outflow data for the relevant ETFs is as follows:

-

GBTC: -$10.10 million

-

FBTC: -$85.40 million

-

ARKB: -$87.40 million

-

BITB: +$24.50 million

-

EZBC: +$7.40 million

-

BTCW: -$6.80 million

In total, there was a $157.80 million outflow. This highlights the significant selling pressure in Bitcoin ETFs and reflects investors’ tendencies to avoid risk. The large outflows from FBTC reflect investors’ fears stemming from market uncertainty.

Limited Inflows to Ethereum ETFs: $3.60 Million Movement

Ethereum ETFs have experienced a $3.60 million net outflow according to the latest data. However, the majority of this outflow came from ETH. ETH saw an outflow of $2.70 million, while no outflows were recorded in other major Ethereum ETFs (ETHE, ETHA, ETHW, FETH, ETHV, EZET, CETH, QETH).

Outflow data for the relevant ETFs is as follows:

-

ETH: -$2.70 million

-

ETHW: -$2.60 million

-

CETH: +$1.70 million

In total, there was a $3.60 million outflow. This shows the significant selling pressure in Ethereum ETFs, with investors tending to avoid risk due to general market uncertainty. The large outflows from ETH and ETHW indicate a decline in investor confidence in Ethereum.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.