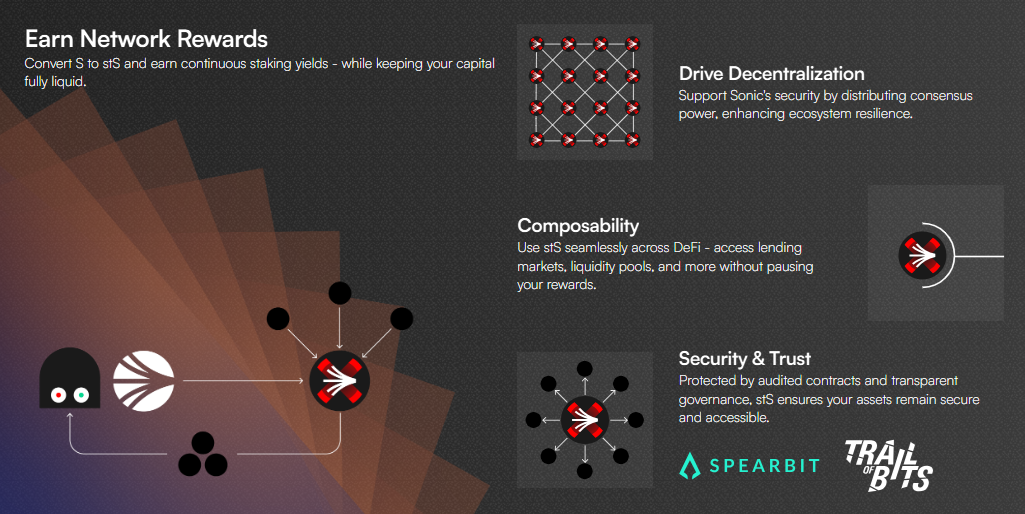

Beets is positioned as the hub for liquid staking and automated market maker (AMM) innovations built on the Sonic blockchain. Beets, a global community embracing the vision of developing open-source and decentralized financial software, aims to preserve and grow capital by offering user-friendly and accessible tools.

What is Beets (BEETS)? What Is It Used For?

Beets is the governance token of the BeethovenX protocol. Operating on chains such as Optimism, Base, and Fantom, BeethovenX is a decentralized DeFi platform that provides liquidity provision, automated portfolio management, and incentive systems.

BEETS token holders can vote on key protocol decisions, stake their voting power (maBEETS) to earn liquidity incentives, or delegate their power to governance actors like Music Directors.

In addition, BEETS is used to earn a share of protocol revenue, guide strategic incentives, and play an active role in the BeethovenX ecosystem.

Beets DEX and Balancer Infrastructure

At the heart of Beets is its decentralized exchange (DEX), powered by Balancer technology. This enables flexible trading between different assets while implementing customizable pool structures and advanced liquidity management strategies. The architecture, composed of Router, Vault, and Pool components, offers a highly flexible environment for developers.

Pool Types on Beets DEX

StablePools: Low Slippage Stable Asset Swaps

StablePools operate with the StableSwap algorithm, enabling low slippage in high-volume transactions between stablecoins. Thanks to Rate Provider integration, yield-bearing tokens can also be swapped with fair and up-to-date rates, optimizing returns for LPs.

Weighted Pools: The Next Generation of On-Chain Indexes

Instead of being fixed at 50/50, these pools bring together up to 8 different assets with customizable ratios. The 80/20 model, in particular, allows governance tokens to remain in liquidity while simultaneously granting voting power.

E-CLPs: Elliptically Concentrated Liquidity Pools

Developed by Gyroscope, this pool type concentrates liquidity within specific price ranges and allows asymmetric distribution. It offers capital efficiency similar to Uni V3, while remaining passive and simple for users.

Boosted Pools: Combine Passive Yield with Swap Income

Boosted pools redirect all liquidity to external yield-generating platforms while keeping it usable for AMM operations. This enables users to earn both swap fees and yield rewards simultaneously.

Yield Models for Liquidity Providers

Beets rewards liquidity providers (LPs) through three main revenue streams:

-

Swap Fees – Collected from trades and automatically added to LPs’ share in the pool.

-

Yield-Bearing Tokens – As these tokens appreciate in value, LP shares also increase.

-

Staking Incentives – Certain pools offer additional incentives (typically in BEETS). LP tokens must be staked to benefit.

Gauge Voting: Steering BEETS Emissions

maBEETS holders determine which liquidity pools will receive BEETS emissions via gauge voting held every two weeks. Protocols may add bounty rewards to these votes, encouraging users to support their pools.

Who Are BeethovenX Music Directors (MDs), and What Do They Do?

Music Directors (MDs) are selected members who play a critical role in the sustainability and growth of the BeethovenX protocol.

Duties and Responsibilities:

-

Liquidity Pool Management: Play an active role in strategic decisions such as pool design, swap fee adjustments, and amplification factor changes.

-

Emissions: Decide whether new pools will receive incentives and can shut down gauges to prevent malicious usage.

-

Voting Incentives: Direct incentives to revenue-generating pools and share decisions with the community via Discord.

-

Treasury Management: Can allocate up to $200,000 USD per month and use incentive/farm revenues within limits without a vote.

-

Oversight and Transparency: All actions (e.g., fund transfers) must be publicly disclosed.

Delegation and Voting:

maBEETS holders can delegate their voting power to MDs. This is only used in gauge voting: 80% is focused on incentive rewards, and 20% is freely used in favor of the protocol.

Structure and Membership:

-

The committee consists of 3 to 7 members.

-

Members are promoted from Guide Tone or selected directly as Composers.

-

MDs earn 6,000 BEETS per month, plus an additional 6,000 BEETS if they’re in the multisig.

Community Participation:

Those wishing to become an MD must share a candidacy post in the forum and engage with the community.

This structure ensures decentralization while managing protocol stability and growth effectively.

BEETS Tokenomics

The BEETS token lies at the center of the Beets ecosystem, governing components such as the DEX, LST protocol, and validator set. BEETS holders participate in governance, shape protocol development, and share in the revenue generated by the ecosystem. They can also vote on which DEX liquidity pools receive BEETS incentives, affecting liquidity distribution and earning rewards in the process.

Initial Supply and Tokenomics

The maximum supply of BEETS is set at 250 million. Of this, 22% (55 million) was minted at launch, with the remaining 195 million to be distributed via the MasterChef contract.

Quarterly Budget System

Instead of a fixed emission schedule, Beets emissions are managed via a flexible quarterly budget system, approved by the Beets DAO. This allows adjustments based on market conditions.

How Does It Work?

The Music Director Committee prepares a proposal detailing the number of BEETS to mint and its distribution for each quarter. The DAO votes on this proposal.

2025 Q1 Budget

Total BEETS: 5 million minted.

Breakdown:

-

2.5 million BEETS – DEX pair incentives

-

1 million BEETS – maBEETS pool

-

1.5 million BEETS – Voting-based incentives

-

2.5 million BEETS – At MDs’ discretion; used for DEX launch, key pool incentives, and Sonic LST adoption

The initial budget focused entirely on ecosystem growth, not treasury expansion.

Protocol Revenue Distribution

BEETS generates revenue through swap fees, yield fees, and flash loans. Distribution varies by network:

-

Sonic DEX: 70% to maBEETS holders (via BEETS buyback), 30% to DAO treasury

-

Optimism: 65% to Optimism bounties, 17.5% to DAO, 17.5% to Balancer

-

Stakes S: 40% to DAO, 40% to buyback, 20% to stS Seasons

-

Other Revenue: 50% to DAO, 50% to buyback

Advantages

-

Emissions are flexible and responsive to market conditions.

-

Incentives are strategically directed.

-

Revenue distribution is optimized to support growth.

-

Decisions are made by the community, ensuring transparency.

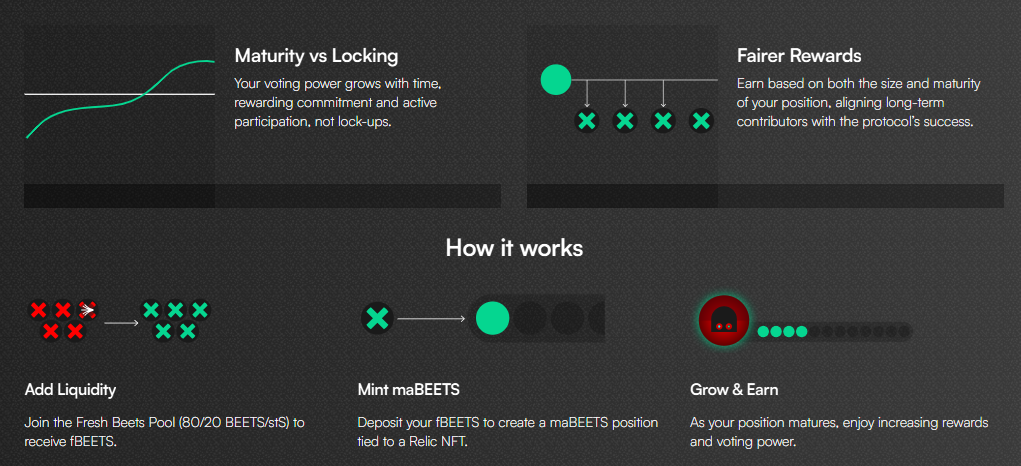

What is maBEETS?

maBEETS is a staking model that provides governance power and rewards without locking. Users can exit at any time, but doing so resets the accumulated “maturity.”

Key Features:

-

Maturity-Based Power: Reaches maximum after 11 weeks. Users must manually “level up” maturity.

-

80/20 Tokenomics: maBEETS is formed via an LP token containing 80% BEETS + 20% stS. This structure increases liquidity and governance strength.

-

NFT Ticket System: Each maBEETS position is represented by an NFT. These NFTs are transferable, divisible, tradable, and evolve based on maturity.

Beets Partnerships

Beets is in an official partnership with @Balancer on Optimism, creating a strategic alignment in liquidity solutions and incentive mechanisms. This collaboration supports Beets’ mission of sustainable DeFi growth across multiple networks.

Official Links

- Whitepaper: Beets Whitepaper

- Discord: Beets Discord

- X (Twitter): Beets Network X

You can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.