MYX.Finance is a decentralized derivatives exchange offering up to 50x leverage perpetual futures on-chain. Let’s explore what MYX is in detail.

What is MYX.Finance (MYX)? What Does It Do?

MYX provides zero slippage and high capital efficiency by directly matching investors through its unique Matching Pool Mechanism (MPM). Users can open long or short positions with USDC collateral, with prices sourced from the Pyth oracle. MYX aims to combine the centralized exchange experience with a decentralized structure, enabling secure, fast, and cost-effective derivatives trading.

Product Features

- Settlement: Conducted in USDC

- Expiration: Perpetual (no expiry date)

- Margin Modes: Isolated Margin

- Maximum Leverage: 50x

- Funding Rate: Funding fees are collected every hour; the side with more open positions pays the other.

Trading Experience

- Instant Order Execution: Liquidity providers act as counterparties, enabling instant trades without a matching engine.

- Fair Index Prices: All trades are based on real-time index prices from Pyth Oracle, minimizing the impact of sudden price swings or manipulations.

- High Leverage: Offers up to 50x amplified returns.

- Non-Custodial Exchange: No registration required. You retain full control of your funds.

- Low Costs: Competitive trading fees and carrying costs for on-chain derivatives trading.

How It Works

Order Types

- Buy-to-Open: Purchase an index token to open a long position → Increases long open position.

- Sell-to-Close: Sell an index token to close an existing long position → Reduces long open position.

- Sell-to-Open: Sell an index token to open a short position → Increases short open position.

- Buy-to-Close: Purchase an index token to close an existing short position → Reduces short open position.

How Liquidity Pools Facilitate Trades

Due to MYX’s order-book-free structure, there is a structural imbalance between long and short open positions. Liquidity pools act as counterparties for traders and later match positions between long and short investors with a delay.

- Liquidity Pool Takes Passive Positions: The pool passively takes positions to provide instant trading opportunities, holding collateral in reserve to cover potential losses.

Example 1:

If person opens a 1 BTC long position, the Liquidity Pool takes a 1 BTC short position and reserves 1 BTC as collateral.

Example 2:

If person shorts 1 BTC at $30,000, the Liquidity Pool takes a long position and reserves 30,000 USDC as collateral.

Position Closing and Matching:

If a trade reduces market imbalance, the LP closes its existing positions, and traders become each other’s counterparties.

Example:

The market has a 10 BTC long imbalance. If Alice opens a 1 BTC short position, the LP closes 1 BTC of its short position and transfers it to Alice. The LP may profit or lose in this process.

Funding Fees, Balanced Market, and Capital Efficiency

- Funding fees are paid hourly from the side with more open positions to the other.

- When managed correctly, market makers (MMs) can profit from funding fees.

- Statistically, funding and market-making activities bring the long-short ratio closer to a 50:50 balance.

- In a balanced market, LPs take less risk and can handle higher trading volumes.

Hedging for Liquidity Providers (LPs)

Sometimes, funding rates may be insufficient, and the market remains imbalanced. In such cases, LPs can hedge their positions in external markets like centralized exchanges. Since LP pools only contain two tokens, risk management is simpler.

Automatic Deleveraging (ADL)

When trading volume increases and the market is balanced, open positions can significantly exceed the liquidity pool’s capacity. This boosts LP returns but creates challenges. When the pool’s capacity is reached, new opening orders are rejected, while closing orders and liquidations continue.

In such cases, MYX activates the Automatic Deleveraging (ADL) system. It forcibly closes the most profitable opposing positions, reducing long and short open positions equally without requiring new capital.

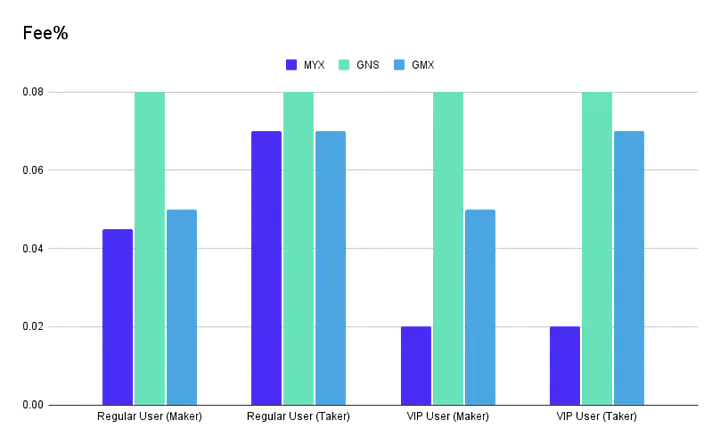

Trading Costs

MYX aims to maximize LP capital efficiency by achieving a long-short balance. Trading fees are part of this goal.

- Taker: Traders who disrupt the long-short balance

Example: Opening a long position when long positions dominate

Taker Fee: 0.06% - Maker: Traders who improve the long-short balance

Example: Opening a short position when long positions dominate

Maker Fee: 0.04%

Price Slippage Protection

All trades are executed at PYTH oracle prices, eliminating price impact or slippage. However, the oracle price may change between order submission and execution.

Reasons:

- Trades occur in two stages: Orders are first added to the transaction pool, then executed by the network’s “keepers.” This can take two blocks.

- Network congestion and high gas fees may delay order execution.

Note:

- Market orders guarantee execution but not price.

- Limit orders guarantee price but not execution.

- Users can set price slippage tolerance to limit this risk.

LP Pools

Each trading pair has a separate LP pool.

- Pools consist only of the index token and quote token.

- LPs receive MLP tokens when providing liquidity.

- MLP token value increases with 40% of trading fees, a portion of funding fees, and profits/losses from position closings.

MYX.Finance (MYX) Tokenomics

The tokenomics of MYX.Finance (MYX) is designed to promote long-term growth and community engagement. The MYX token distribution is as follows:

- Total Supply: 1,000,000,000 (1 billion) MYX

- Team and Advisors (20%): Locked for 1 year, then unlocked monthly over 2 years.

Total: 200,000,000 MYX - Institutional Investors (20%): Locked for 6 months, then unlocked monthly over 18 months.

Total: 200,000,000 MYX - Community Rewards (45%): Distributed based on product features.

Total: 450,000,000 MYX - Initial Liquidity (10%): Fully unlocked at launch.

Total: 100,000,000 MYX - Future Reserve (5%): Usage subject to voting.

Total: 50,000,000 MYX - Total Supply: 1,000,000,000 MYX (100%)

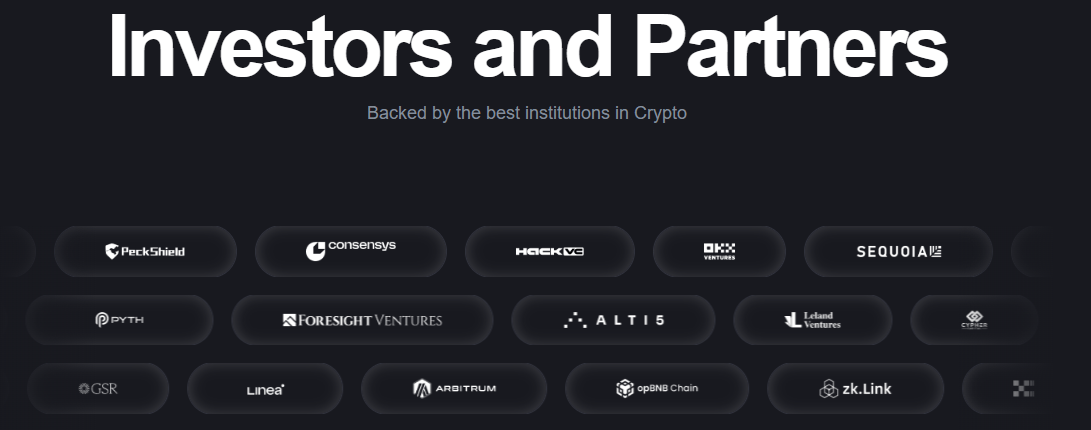

MYX.Finance (MYX) Partners and Investors

MYX.Finance has established strategic partnerships with key industry players, including Arbitrum and opbnb Chain, known for blockchain projects, Pyth as a financial data provider, zk.link for decentralized finance solutions, and investor-backed Foresight Ventures. Additionally, it collaborates with major investors like HashKey and OKX Ventures. These partnerships aim to strengthen MYX.Finance’s ecosystem and support platform growth.

MYX.Finance (MYX) Team

Mark Zhang is the founder and CEO of MYX.Finance. Previously, he worked at the cryptocurrency exchange HTX. Through MYX, he aims to deliver innovative solutions in the decentralized finance (DeFi) space.

Official Links

Whitepaper: MYX.Finance Whitepaper

Discord: MYX.Finance Discord

X (Twitter): MYX.Finance

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.