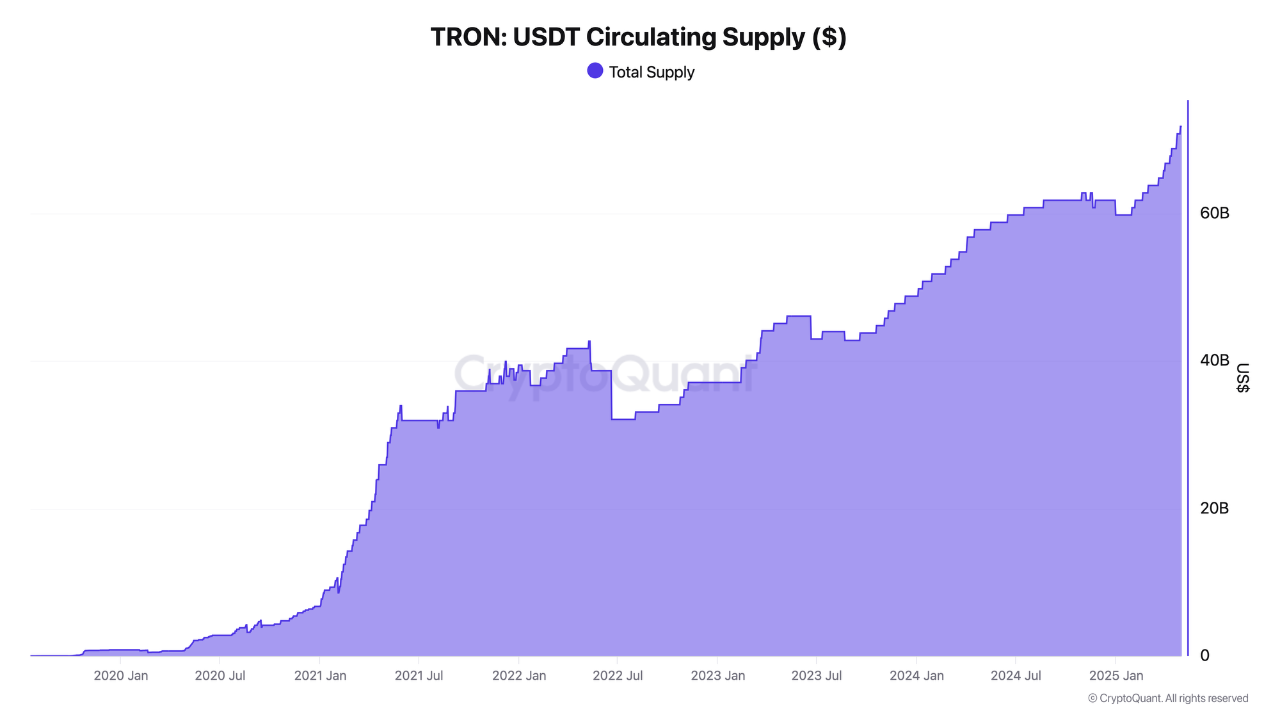

As of 2025, the TRON network continues to strengthen its influence in the world of cryptocurrencies. According to recent data, the supply of USDT (Tether) on the TRON blockchain has reached an all-time high. As of today, the amount of USDT circulating on the network has exceeded $71 billion.

This development is seen as a strong reflection of TRON’s steady growth and widespread adoption over recent years. Thanks to its low transaction fees, users and investors increasingly prefer TRON for USDT transactions, positioning the network as a strong alternative to giants like Ethereum in the realm of stablecoin transfers.

Currently, Ethereum holds the lead with around $75 billion worth of USDT, but TRON is rapidly closing the gap. With just a few billion dollars of difference remaining, some analysts suggest that TRON could surpass Ethereum in the coming months.

Reaching this record level further solidifies TRON’s position in the DeFi ecosystem. It also signals a significant achievement in terms of the network’s ability to attract liquidity and instill investor confidence.

According to analyst Darkfost, these developments highlight not only TRON’s technical advantages but also its increasing appeal to a global user base.

TRON Price Faces Weak Demand Despite Bullish Momentum

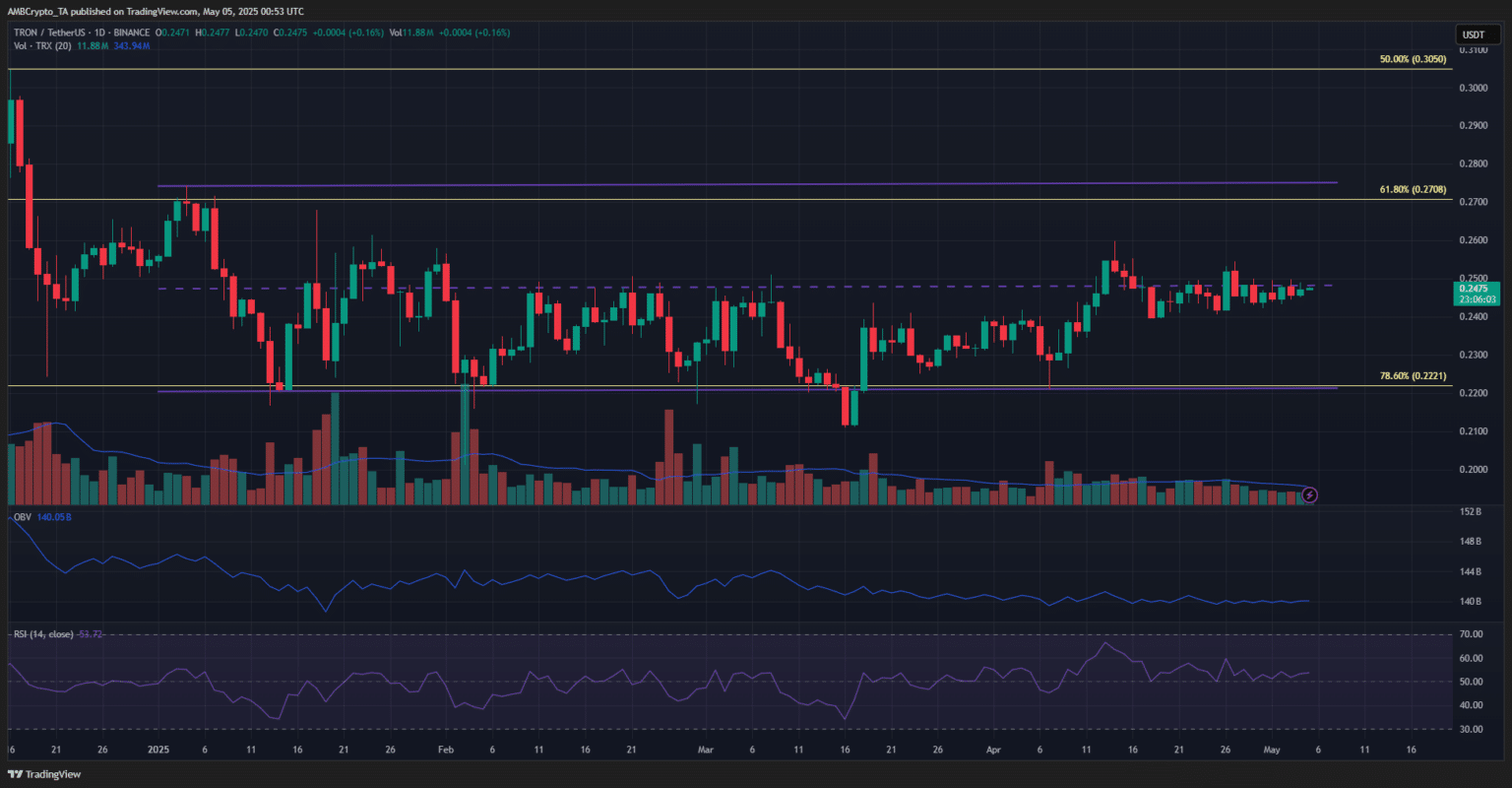

On the technical side, TRON (TRX) has maintained a bullish structure in recent weeks, but weak demand has prevented the price from gaining upward momentum. The $0.248 level has stood as a critical resistance for the past three weeks. If bulls manage to flip this level into support, a 10% rally could be triggered. However, current market data suggests this outcome is still uncertain.

According to the Fibonacci retracement levels, the $0.222 level acts as both a strong support zone and the lower boundary of the range within which TRX has traded throughout 2025. Although the price is currently above this point, increased selling pressure could push it back down.

A downward trend in the OBV (On-Balance Volume) indicator highlights the decline in buying power. Since mid-April, sellers have remained dominant in the TRX market, as shown by decreasing trading volumes and weakening momentum.

The liquidation map also raises red flags. High leveraged positions are concentrated in the $0.236–$0.238 range, while the $0.256–$0.258 zone remains a key short-term resistance. Analysts interpret this as a sign that TRON’s price may be heading toward a southbound correction.

Therefore, traders should also monitor Bitcoin’s (BTC) price movements. If BTC continues its downward trend, TRON may test the $0.236 level — a zone that could offer short-term buying opportunities, albeit with high risk.