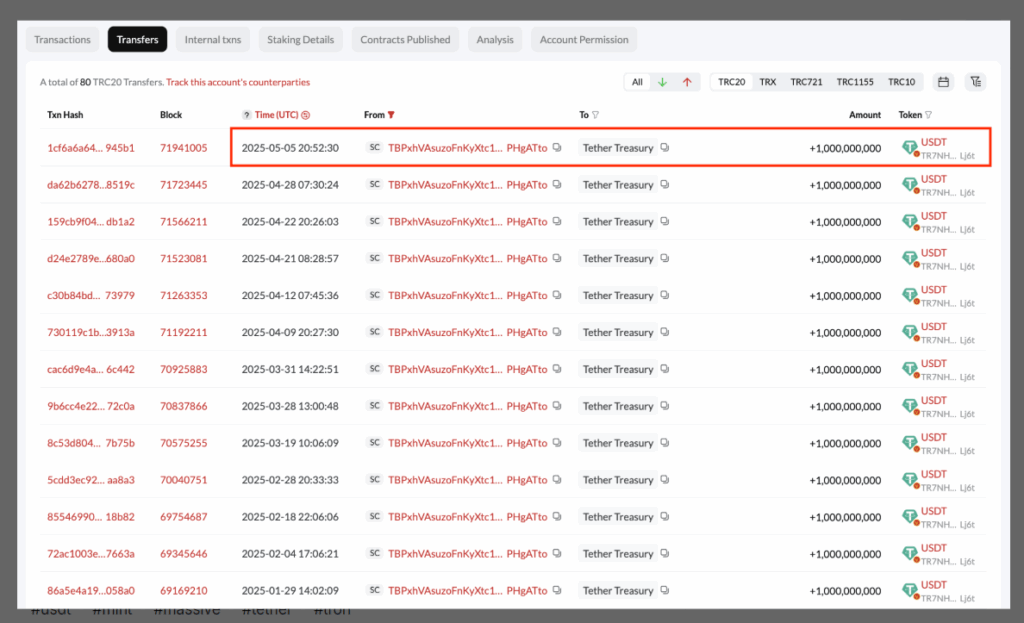

Tether minted 8 billion USDT in a short period. The total USDT circulation reached $149.4 billion, marking an all-time high.

According to Spot On Chain’s report, this amount was produced on the Ethereum and Tron networks within 8 days. 6 billion USDT was transferred to exchanges like Kraken, Binance, and Coinbase. This movement coincided with Bitcoin breaking the $93,000 mark, setting a new record.

Tether’s move injects significant liquidity into the crypto market. Historically, USDT minting has often signaled price surges for Bitcoin and other cryptocurrencies. For instance, in 2024, Tether’s minting of 31 billion USDT played a key role in Bitcoin’s jump from $27,000 to $73,000. The current minting strengthens expectations of a new market rally.

Bitcoin approached $95,000 following Tether’s liquidity increase, hitting an all-time high. Analysts suggest this movement could create a positive wave for altcoins as well. Notably, Solana previously saw an 810% surge forecast after USDT mints. However, some experts urge caution due to market volatility.

Tether’s Strategic Plans

CEO Paolo Ardoino announced a focus on “hyper-efficiency” for 2025. The company plans to solidify its market leadership with innovations like USDT integration on the Aptos network and a new stablecoin pegged to the UAE dirham. These steps reflect Tether’s response to growing global demand. Tether also plans to launch a U.S.-based stablecoin this year, though the launch date depends on regulatory approval.

Tether’s minting of 8 billion USDT could signal a new rally in the crypto market. The activity in Bitcoin and altcoins is drawing investor attention. However, market risks should not be overlooked.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.