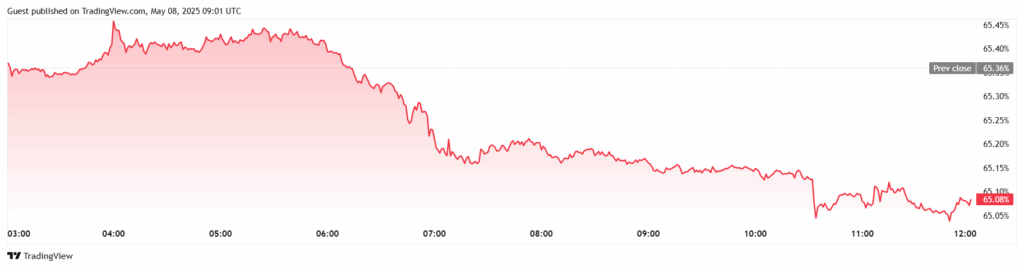

Bitcoin Dominance (BTC.D) has encountered strong resistance at the 64.7% level. Rising for the past three years, BTC.D has been a focal point in the crypto market. Analyst Gert van Lagen identified bearish signals in the charts. The rising wedge pattern resembles the 2021 cycle. This pattern has historically appeared at peaks. Analysts expect a turning point in the market.

Bearish Signals and RSI Divergence

RSI shows a bearish divergence in Bitcoin Dominance. While BTC.D rises, RSI loses momentum. A similar situation occurred in 2021. RSI divergence predicted BTC.D’s collapse, triggering an altcoin season. Analysts suggest that if the trend breaks, capital could flow into altcoins. History indicates the market is ready for a shift. Ethereum’s market dominance has fallen from a 2022 peak of 22.27% to 7.5%.

Most altcoins have lost significant value from their 2024 highs. For example, Ripple (XRP) is down 37%, Cardano (ADA) 50%, Solana (SOL) 51%, and Tron (TRX) 45%.

Analysts’ Altcoin Season Prediction

Ijaz Awan noted that BTC.D is approaching the 71.38%-73.06% resistance zone. This zone marked peaks in 2017, 2019, and 2021. Karman Asghar sees a double-top formation in 2025. Additionally, Asghar demonstrated similarities between the 2021 and 2025 charts. This strengthens expectations for an altcoin season. High BTC.D indicates Bitcoin’s market dominance, while low BTC.D signals altcoin rallies. Furthermore, the total altcoin market cap (Total2) and other coins’ dominance (Others.D) charts show positive RSI divergence and trend reversal signals, reinforcing the likelihood of an altcoin recovery.

New Opportunities in the Market

BTC.D’s peak could create opportunities for altcoins. Meanwhile, analysts await a trend break. If capital shifts to altcoins, 2025 could be eventful. BTC.D’s movements will shape the path for altcoins.

***NOT INVESTMENT ADVICE***

The crypto market carries high risk; please conduct your own research before investing.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.