The world of decentralized finance (DeFi) revolves around stablecoins. However, existing solutions, from centralized giants like USDT and USDC to projects requiring over-collateralization like DAI, are plagued by chronic issues such as centralization, capital inefficiency, and dependence on fiat currencies. This is where Resolv steps onto the scene with a different solution. As the world’s first delta-neutral stablecoin protocol backed entirely by on-chain assets like Ethereum (ETH) and Bitcoin (BTC), Resolv aims to usher in a new era in DeFi. At its core, Resolv is a holistic DeFi ecosystem composed of two main components: the Resolv Protocol and the RESOLV Token. Distinguishing between these two is critical to understanding the genius of the project.

Resolv Protocol: This is the entire ecosystem. Its main function is to produce and maintain the USR stablecoin, which is pegged to the US dollar, using a delta-neutral strategy. The protocol includes complex mechanisms such as collateral management, futures hedging, and the RLP insurance pool. RESOLV Token: This is the native governance and utility token of the protocol. It grants holders a say in the future of the protocol, offers staking rewards, and allows them to share in the ecosystem’s growth.

What Key Problems Does Resolv Solve?

The project was developed to target four main weaknesses of existing stablecoin models:

1. Centralization and Fiat Dependence: USDC and USDT rely on fiat reserves held by centralized companies. This creates censorship and regulatory risks. Resolv completely eliminates this dependence by being backed solely by on-chain ETH and BTC. 2. Capital Inefficiency: Crypto-backed stablecoins like DAI require $1.5-$2 worth of collateral (over-collateralization) to mint $1 of assets, to guard against price volatility. This makes the locked capital inefficient. Resolv offers 1:1 capital efficiency through its delta-neutral hedge, meaning 1 USR can be minted with $1 worth of collateral. 3. Lack of Native Yield: Most stablecoins do not offer their holders a native yield. Resolv, however, generates a sustainable and native yield from ETH staking rewards and funding rates in the futures markets, which it shares with its users. 4. Governance Focused on Short-Term Speculation: In many DeFi projects, governance tokens are concentrated in the hands of short-term speculators. Resolv encourages long-term investors with a time-weighted staking (stRESOLV) system, granting them more voting power and rewards.

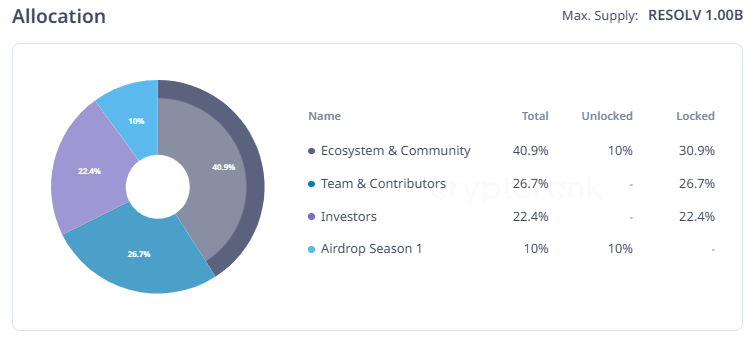

RESOLV Tokenomics and Distribution

The project’s economic model is built on long-term sustainability and value stability. Accordingly, the total supply of RESOLV tokens is fixed at 1 billion.

The largest share of the total supply, 40.9%, is allocated to the Ecosystem and Community. These funds will be used to support the future development of the protocol, finance community-driven initiatives, and grow the ecosystem through incentive programs. 26.7% of the supply is allocated to the Team and Contributors behind the project. To reinforce their commitment to the project, these tokens will be released linearly over 30 months following a one-year full lock-up period. Similarly, 22.4% of the supply is allocated to Investors who provided early-stage capital. This share is also subject to a 24-month gradual distribution schedule following a one-year lock-up period. These lock-up mechanisms aim to prevent potential sell-off pressure in the market during the project’s initial phase.

Finally, to reward the protocol’s early supporters and active users, 10% of the total supply has been allocated for the Season 1 Airdrop campaign.

The Project’s Investors

The project has received support from prominent investors in the crypto world. Its investors include: Arrington XRP Capital, Coinbase Ventures, gumi Cryptos Capital, Animoca Brands, Robot Ventures, Maven 11 Capital, No Limit Holdings, and SCB Limited. These investors demonstrated their confidence in the project by participating in Resolv’s seed round financing.

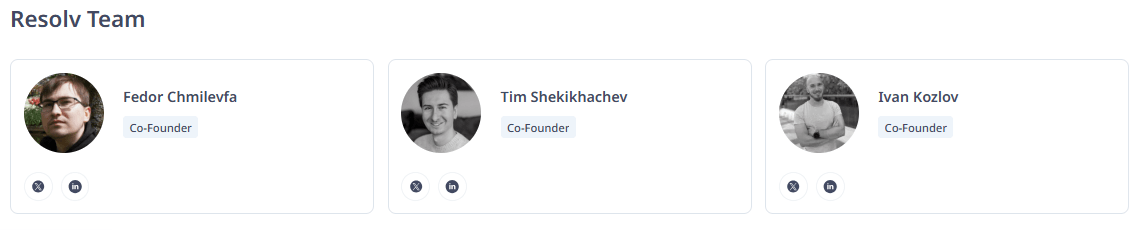

The Resolv Founding Team

Behind Resolv is an experienced team in the fields of blockchain and financial technologies. The project has three co-founders:

- Fedor Chmilevfa – Co-Founder

- Tim Shekikhachev – Co-Founder

- Ivan Kozlov – Co-Founder

These individuals are known for their technical and strategic expertise, having been involved in pioneering projects in the development of decentralized finance (DeFi) and the crypto-economy.