Velo Protocol (VELO) is an innovative cryptocurrency and financial infrastructure project aiming to make global financial transactions faster, more secure, and cost-effective through the transformative power of blockchain technology. As an alternative to the slow and outdated infrastructure of traditional financial systems, Velo offers a reliable, decentralized, and transparent ecosystem with its Web3+ architecture. In this article, we will explore what Velo Protocol is, how it works, the use cases of the VELO token, and the project’s standout features in detail.

What is Velo Protocol (VELO)? What Does It Aim For?

Velo Protocol aims to create a reliable bridge for financial transactions by integrating existing banking infrastructure and fiat currencies with a blockchain-based payment system. The goal is to establish a connection between traditional finance (TradFi) and decentralized finance (DeFi), developing a platform that ensures both regulatory compliance and user privacy. Velo’s Web3+ approach combines Web 2.0 and Web 3.0 technologies, facilitating the transition of existing economic activities to the blockchain world.

Velo addresses the shortcomings of slow and costly traditional systems, particularly in areas like cross-border transactions and remittances. Built on the Stellar Consensus Protocol, Velo processes transactions quickly and transparently using smart contracts. This provides a reliable financial infrastructure for users and businesses.

Velo Ecosystem and Features

Velo’s ecosystem is built around the VELO token and operates on the EVM (Ethereum Virtual Machine)-compatible Nova Chain. Nova Chain simplifies user interaction with decentralized applications (dApps) and uses NOVA tokens for gas fees. These tokens have no monetary value, and users can request NOVA through a faucet when their balance falls below a certain threshold. This makes the transition to the blockchain world easier, especially for new users.

Velo’s standout features include:

- Bridge Between TradFi and DeFi: Velo brings together traditional financial players like SEBA Bank, Asia Digital Bank, VISA, and iRemit with blockchain firms like Kyber Network and Finclusive. This enables the integration of both traditional and next-generation financial services.

- Low-Cost Transactions: Nova Chain’s low gas fees reduce user costs, making blockchain technology accessible to a wider audience.

- Decentralized Governance (DAO): Velo adopts a DAO system to strengthen community governance. VELO token holders can vote on matters such as project approvals or revenue sharing. For example, partnerships with Bybit support this governance model.

- Security and Compliance: Velo works with leading security firms like Inspect, PeckShield, and SlowMist to continuously test its infrastructure. Additionally, KYC/KYB (Know Your Customer/Know Your Business) and anonymous transaction chains balance regulatory compliance and user privacy.

- Revenue Sharing and Staking: VELO token holders can share in the revenue generated by ecosystem partners and earn additional rewards by staking their tokens.

Use Cases of the VELO Token

The VELO token is the cornerstone of the Velo ecosystem and serves various functions:

- Use as Collateral: VELO is used as collateral for digital credits, ensuring the security of transactions within the network.

- Ecosystem Access: VELO tokens are an entry requirement for users to benefit from Velo’s financial products and services.

- Value Transfer: VELO supports fast and low-cost value transfers within the network.

- Smart Contracts: Smart contracts supported by the Stellar Consensus Protocol ensure secure and transparent transaction processing.

Velo Identity Framework: Balancing KYC/KYB and Anonymity

One of Velo’s most notable features is the Velo Identity Framework, which combines KYC/KYB and anonymous transaction chains. This system offers a two-tiered structure:

- KYC/KYB Chain: Businesses and individuals join the network by verifying their identity and business information. This is ideal for financial institutions to quickly verify new customers.

- Anonymous Chain: Users can transact while preserving their privacy. For example, on an e-commerce platform, buyers can verify sellers’ KYC/KYB information while keeping their own identities confidential.

This structure ensures compliance with regulatory requirements while protecting user privacy and reducing fraud risk.

Storing Velo Tokens

There are several options for securely storing VELO tokens:

- Atomic Wallet: A wallet supporting over 1,000 cryptocurrencies, requiring no KYC.

- Hardware Wallets: Cold storage devices like Ledger or Trezor can store VELO offline, with integration possible via Stellar Term.

- Universe Wallet: Velo Labs’ own wallet, available on iOS and Android, connects with popular wallets like MetaMask without requiring KYC.

- Stellar Term: Another secure platform for managing VELO tokens.

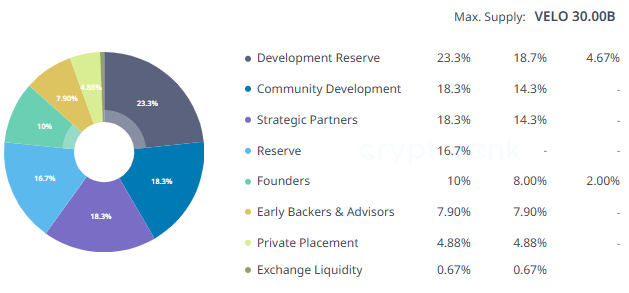

VELO Tokenomics

- Development Reserve: Total Supply: 23.3%

- Community Development: Total Supply: 18.3%

- Strategic Partners: Total Supply: 18.3%

- Reserve: Total Supply: 16.7%

- Founders: Total Supply: 10%

- Early Backers and Advisors: Total Supply: 7.9%

- Private Placement: Total Supply: 4.88%

- Exchange Liquidity: Total Supply: 0.67%

Velo Strategic Partners and Investors

Velo is supported by strong strategic partnerships and investors. Partners include Cactus Custody, Copper, Inception, KogoPAY, Lightnet, SEBA, Stellar Development Foundation, and VISA.

Investors include prestigious firms such as C.P. Group, Du Capital, Everest Ventures Group, Hanwha, HashKey Capital, Signum Capital, Uni-President, UOB and LDA Capital.

Velo Team and Leadership

Velo’s leadership team consists of experienced names in finance and blockchain:

- Mike Kennedy (CEO): With over 25 years of experience in financial services and payment innovations, he previously served as CEO of Interstellar and North American President of OFX.

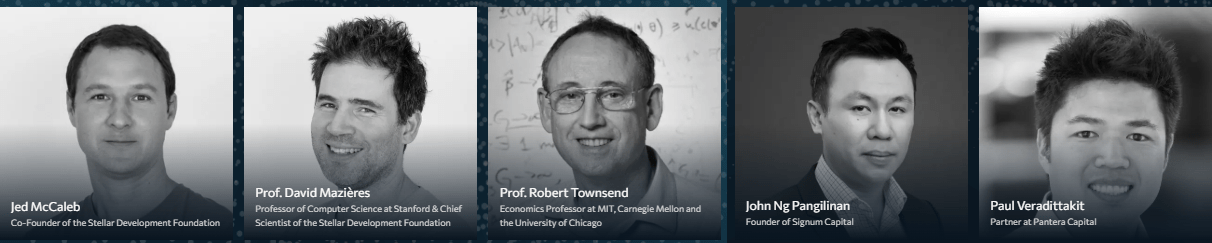

VELO Advisors

- Jed McCaleb: Co-Founder of the Stellar Development Foundation.

- Prof. David Mazières: Professor of Computer Science at Stanford University and Chief Scientist of the Stellar Development Foundation.

- Prof. Robert Townsend: Economics Professor at MIT, Carnegie Mellon, and the University of Chicago.

- John Ng Pangilinan: Founder of Signum Capital.

- Paul Veradittakit: Partner at Pantera Capital.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.