Powell’s speech will start today at 2:30pm at. Following the FOMC meeting, the interest rate is expected to remain in the 4.25%–4.50% range.

This expectation led to a 1.2% loss in Bitcoin and the overall crypto market. The total crypto market cap dropped approximately 1.23% to $3.29 trillion. Although the Consumer Price Index (CPI) and Producer Price Index (PPI) announced in May were below expectations, the Fed maintains a cautious stance. For example, Ether fell 2.8% to $2,506.90, XRP declined 2.7% to $2.13. Cardano and Solana dropped 3–4%, Polygon decreased by 2.3%. Among meme tokens, Dogecoin lost over 3%, and $TRUMP declined more than 4%.

Geopolitical factors also increase volatility. The Israel–Iran tension pushed oil prices up. This situation brings inflation expectations back on the agenda, pressuring risk assets.

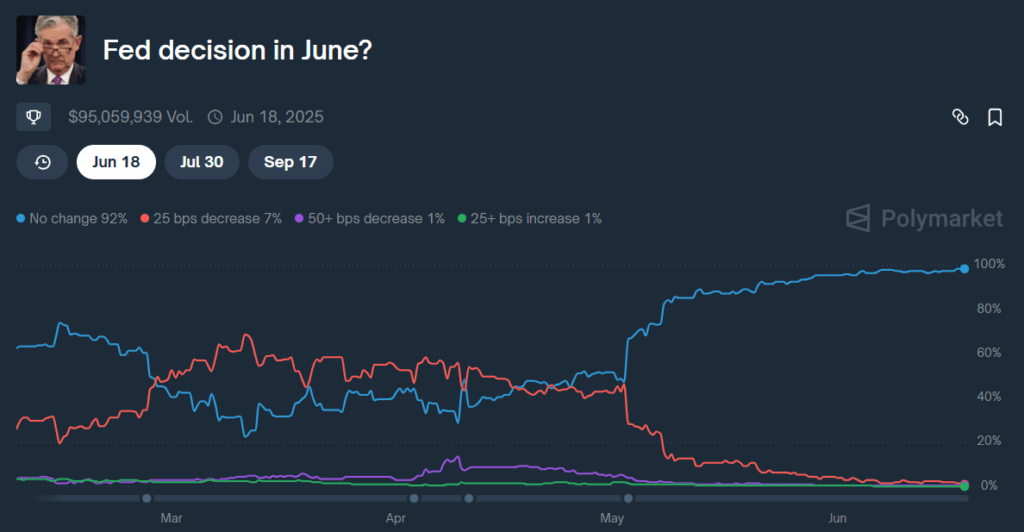

In Bitcoin, downside supports stand at $108,000 and critical resistance is at $112,000. Analysts, especially based on CME FedWatch data, do not expect any change in interest rates.

Jerome Powell to Speak Today

Despite political pressure from Donald Trump, the FOMC meeting will most likely conclude without an interest rate change. Inflation rose slightly from 2.3% to 2.4% in May. This limited increase, combined with a strong labor market, strengthens the likelihood that the Fed will continue its “wait and see” policy. On the other hand, rising oil prices and Israel–Iran tension indicate that inflationary pressures may increase. Jerome Powell is expected to highlight these global risks in his speech.

Additionally, stablecoin regulation was approved in the US Senate; however, its impact has not yet eased the market in the short term. The market remains in a waiting pattern.

Bitcoin miners are also noteworthy during this period. While coping with drought and energy costs, they are known to be preparing for new demand. The US-China trade war and Trump tariffs are causing structural changes in the mining hardware supply chain. However, detailed data has not yet been updated. Institutions are closely monitoring a possible increase in the M2 money supply.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.