Bitcoin price has been trading sideways below the $112,000 level since May 23. BTC has been consolidating within a narrow $10,000 range for the past five weeks, pausing its upward trend. A strong resistance has formed at $106,000.

This resistance continues to block Bitcoin’s attempts to climb back to $112,000. This stagnant movement is mainly due to investors remaining cautious amid geopolitical and macroeconomic uncertainties. Particularly, rising tensions in the Middle East, conflicts between Israel and Iran, and cyberattacks are undermining investor confidence.

Iran-based cryptocurrency exchange Nobitex was attacked by a pro-Israel hacker group, resulting in a $81 million loss. This incident exposed the vulnerability of crypto assets during geopolitical cyber conflicts. Bitcoin is often promoted as “digital gold,” but during times of crisis, it underperforms compared to traditional safe-haven assets like gold and U.S. Treasury bonds. While gold approached all-time highs this week, BTC lost 3.6% in value just last week.

Fed Decision and Inflation Concerns Weigh on Bitcoin

The U.S. Federal Reserve kept its policy interest rate steady at 4.25–4.50% during its June 18 meeting. However, its ongoing hawkish stance against inflation increased pressure on risk assets. Due to a core PCE inflation rate of 2.8% and potential trade policies from Trump, the Fed reduced expectations for rate cuts.

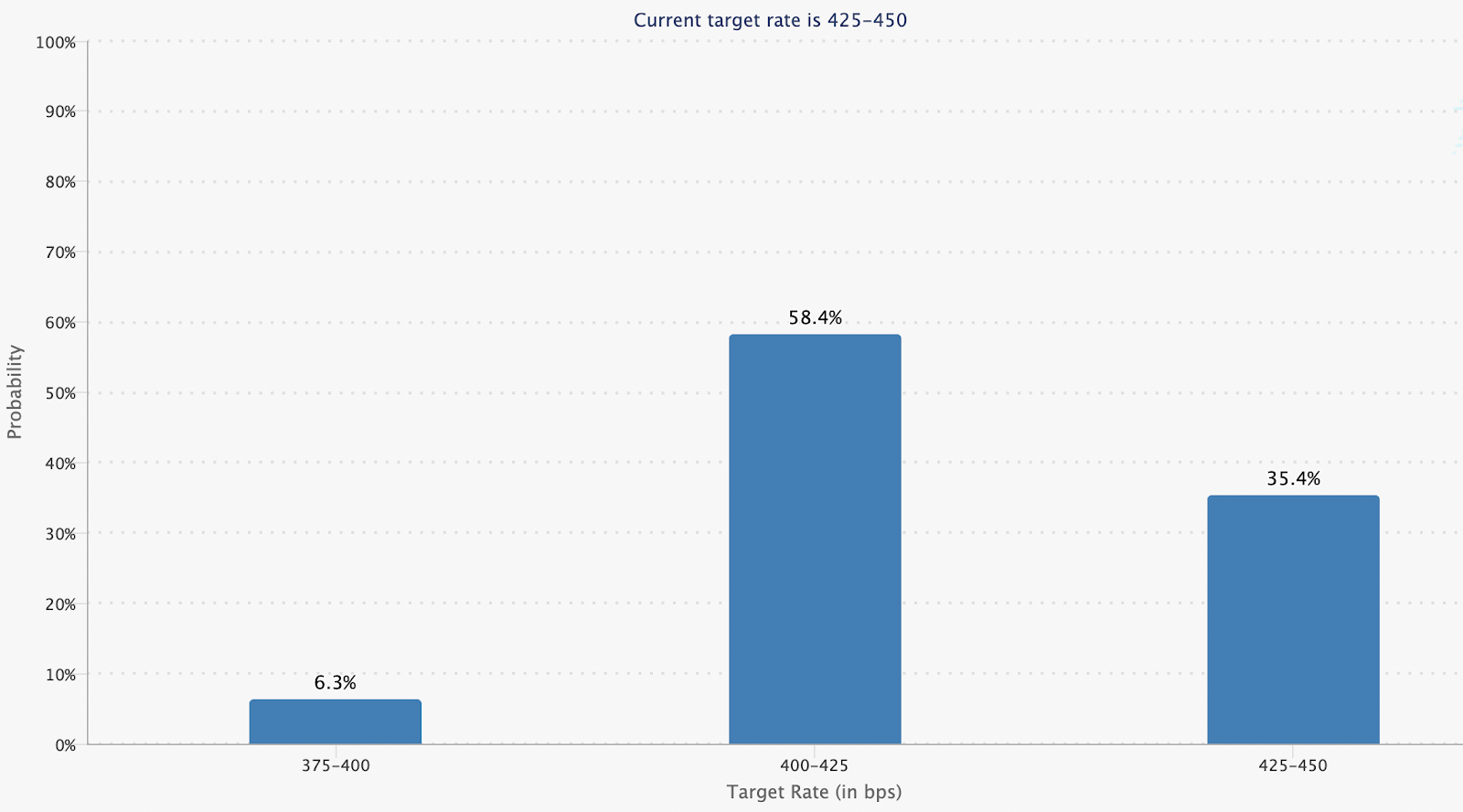

According to the CME Group’s FedWatch Tool, the FOMC now projects only two 25-basis-point rate cuts in 2025, down from four previously. Markets are currently pricing in just a 58.4% chance of a rate cut in September.

This scenario strengthens the U.S. dollar while putting further pressure on risk assets like Bitcoin. Diminishing liquidity expectations reduce demand for digital assets. According to QCP Capital’s June 18 report, the Fed is likely to make only one rate cut, limiting Bitcoin’s upward momentum.

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.