As institutional investors continue to expand their footprint in the crypto market, BlackRock—the world’s largest asset manager—has reached a major milestone. Its spot Bitcoin ETF, the iShares Bitcoin Trust (IBIT), has now surpassed $69.7 billion in assets under management, representing more than 3.25% of the total BTC supply.

IBIT Dominates the U.S. Spot Bitcoin ETF Market

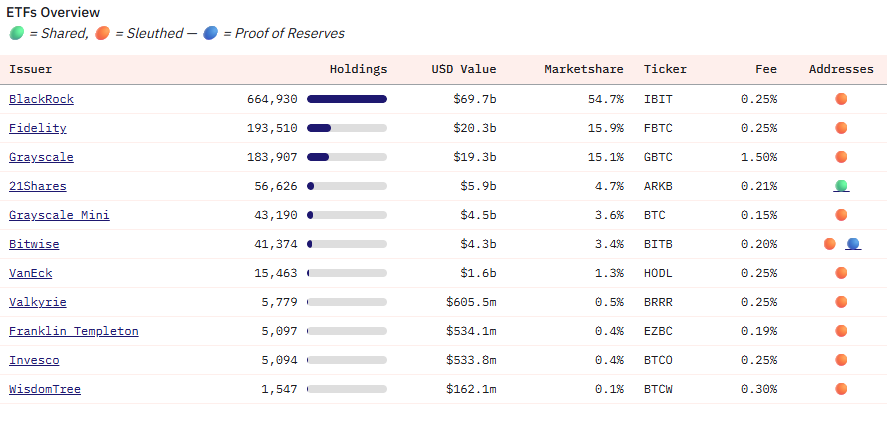

According to recent data, BlackRock’s IBIT currently holds a commanding 54.7% market share among all spot Bitcoin ETFs listed in the United States. Altogether, these ETFs control approximately 6.12% of the total circulating Bitcoin, meaning nearly one in every 16 BTC is held within U.S. ETF structures.

This rapid growth has occurred in less than 18 months since spot Bitcoin ETFs began trading on January 11, 2024. IBIT has also climbed the global ranks, entering the list of the top 25 largest ETFs by assets, across both traditional and crypto markets.

Institutions Are Accumulating, Retail Momentum Slows

Despite the rising institutional demand, retail investor participation appears to be slowing. Data from CryptoQuant shows that the total BTC held by short-term holders has dropped by 800,000 BTC since May 27, now sitting at just 4.5 million BTC. This trend points to a decline in fresh capital entering the market from new participants.

Meanwhile, long-term holders and institutional treasuries continue to accumulate. Selling pressure from miners and profit-taking is largely being absorbed by these larger market players.

Network Activity Now Dominated by Large Transfers

On-chain analysis reveals that high-value transactions have become the dominant force on the Bitcoin network. According to Glassnode, transfers above $100,000 now make up over 89% of total network activity, with the average transaction size hovering around $36,200.

This shift underscores the growing influence of whales and large entities, as they take center stage in a market where smaller retail trades are declining.

What’s the Next Support Level for BTC?

If buying momentum continues to weaken, analysts point to the $92,000 level as the next potential on-chain support zone. According to CryptoQuant, this level aligns with the realized price metric used during previous bull markets to define key support levels.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.