ETH Gaining Technical Strength

Ethereum price has reached $2,438, preparing to test the $2,500 level. ETH is currently trading within the $2,450 – $2,405 resistance band. Breaking through this zone could push the price toward the $2,550 level. This upward breakout, supported by technical indicators and liquidity structure, could pave the way for a strong rally.

However, if this resistance zone fails to break, the first major support lies around $2,200. This area has historically attracted strong buying interest and served as a rebound zone. Therefore, in the event of a pullback, this level will be critical for investors to monitor closely.

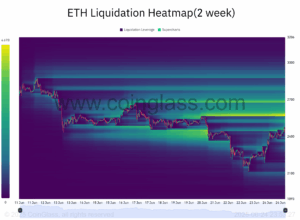

The liquidation map shows that the price is forming higher lows and heading toward liquidity-rich zones. Liquidity pockets above $2,500 could trigger stop orders, pushing the price higher. Market makers taking positions in these areas and short squeeze scenarios may further accelerate the uptrend. Meanwhile, the increasing trading volume since May resembles the bear market of July–August 2022, indicating renewed interest from both retail and institutional investors.

Institutional Capital Flowing Into Ethereum

On-chain data also supports bullish expectations. On Monday, investors withdrew 61,000 ETH from Binance. This move suggests a shift toward a long-term holding strategy instead of short-term trading.

According to Swissblock analysis, 90% of Bitcoin supply is in profit, while Ethereum is below 80%. This discrepancy indicates that ETH may enter a “catch-up” phase, as seen in previous cycles. The ETH/BTC ratio is near multi-year lows, suggesting Ethereum is undervalued.

In June, inflows into spot Ethereum ETFs rose by 68.4% to $950 million. In contrast, spot Bitcoin ETF inflows dropped by 49.5% to $2.64 billion. This clearly shows a capital shift from BTC to ETH, highlighting the growing institutional focus on Ethereum.

THIS IS NOT INVESTMENT ADVICE

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.