The crypto market is once again on the rise as news of a ceasefire between Iran and Israel boosts global risk sentiment. The wave of optimism is not limited to equities digital assets like Bitcoin are also experiencing a notable lift.

Bitcoin Surges to $108,000

The standout move of the day comes from Bitcoin, which has climbed 1.82% in the past 24 hours, pushing past the $108,000 mark.

However, analysts warn that this rally may be short-lived. Susannah Streeter, head of money markets at Hargreaves Lansdown, noted: “While the ceasefire has lifted market mood, uncertainty remains over how long this fragile peace will last.”

Leaked U.S. intelligence reports suggest that recent American strikes failed to significantly damage Tehran’s nuclear infrastructure — a factor that could reignite geopolitical tensions.

Powell’s Cautious Tone Provides Additional Relief

It’s not just the ceasefire that’s driving investor appetite. Federal Reserve Chair Jerome Powell, in his testimony before Congress, emphasized a patient approach toward potential rate cuts. He acknowledged that inflation remains elevated and could face further pressure from rising tariffs in the coming months.

According to analysts at Bitunix, Powell’s “wait-and-see” message brings clarity amid policy uncertainty. While not signaling immediate action, it reassures markets that risk assets still have breathing room. Investors are now closely watching upcoming inflation reports and trade developments.

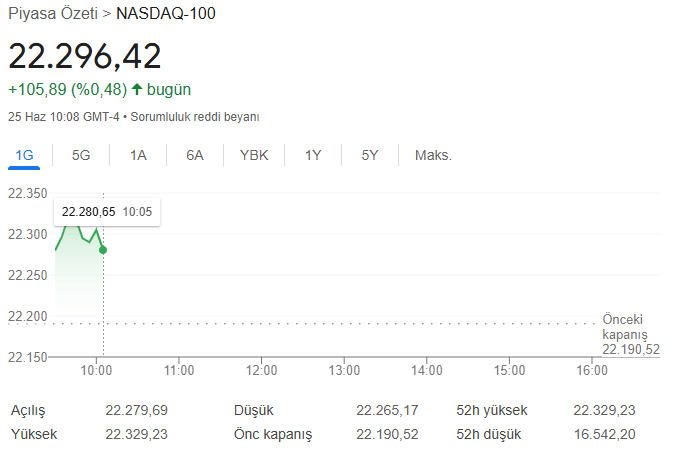

On the other hand, the Nasdaq 100 index rose by 0.48%, reaching an all-time high of 22,296.53 points.

Data Increases Odds of July Rate Cut

Soft U.S. consumer confidence data pushed two-year Treasury yields down to a six-week low of 3.78%. Based on CME’s FedWatch tool, the probability of a rate cut in July has climbed to 20%, up from just 13% a week ago. On Polymarket, traders currently price an 18% chance of a cut.

Later today, Powell is scheduled to appear before the Senate, in a hearing that could shape short-term market sentiment. Meanwhile, President Donald Trump has intensified pressure on the Fed, publicly stating that interest rates should be “at least two to three points lower.”

Options Market: Calm Yet Cautious

Crypto derivatives desks remain neutral ahead of the June 27 expiry. Jake O, an OTC trader at Wintermute, reported that traders are positioning with straddles and short puts around the $105,000 and $100,000 levels, suggesting expectations of limited short-term movement.

Still, the purchase of call options targeting $108,000 and $112,000 for July and September reveals an underlying bullish bias, indicating some confidence in further upside.

You can share your opinions in the comments about the topic. Also, follow us on Telegram, Twitter, and YouTube for more content like this.