In Europe, crypto cards are gaining momentum over traditional banks, especially for micro-payments. According to CEX.IO’s 2025 report, 45% of crypto-linked card transactions are under €10 (roughly $12), a segment long dominated by cash.

The report highlights that crypto cardholders exhibit spending behavior similar to traditional bank card users but adopt online payments at a significantly faster rate. While the European Central Bank reports that only 21% of card payments in the eurozone are made online, CEX.IO users already conduct 40% of their transactions digitally.

Everyday Use of Crypto Cards on the Rise

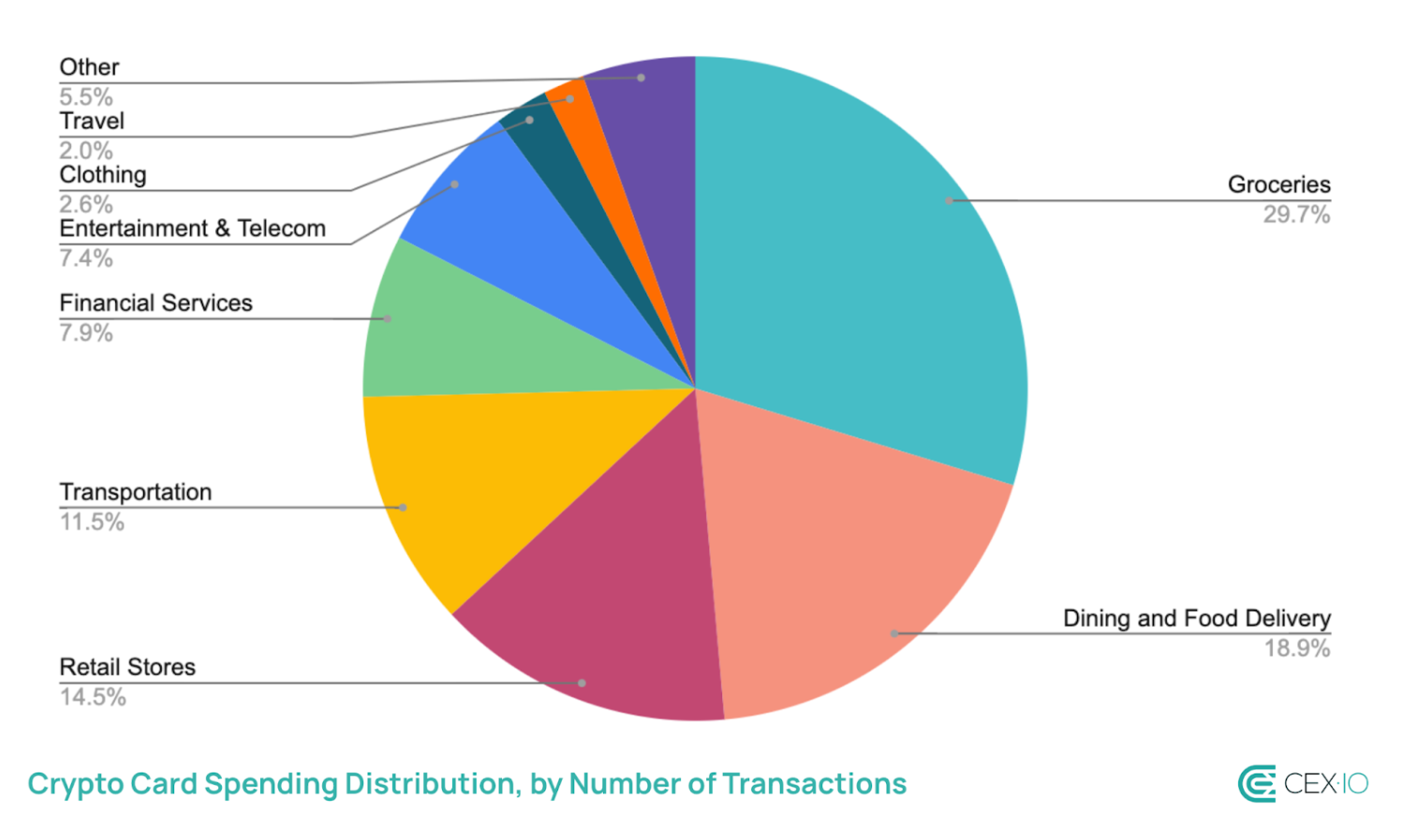

CEX.IO data reveals that 59% of crypto card spending goes to groceries, and 19% is spent on restaurants and bars — both figures surpassing ECB benchmarks. The average transaction value for crypto cards stands at €23.7, compared to €33.6 for bank cards, indicating crypto cards are preferred for small, day-to-day purchases.

Alexandr Kerya, Vice President of Product Management at CEX.IO, commented: “Crypto users in Europe are not just experimenting with new tech — they’re showing us what a cashless future could actually look like.”

Stablecoins account for 73% of crypto card transactions, with the rest split between major cryptocurrencies like Bitcoin, Ethereum, Litecoin, and Solana — used across groceries, dining, and transport.

Similar Trends on Other Platforms

Other companies, including Oobit and Crypto.com, have also reported strong demand in Europe for crypto cards used for everyday essentials and online shopping.

Barclays Bans Credit Card Crypto Purchases

Despite growing adoption, Barclays recently announced a ban on crypto purchases via its Barclaycard credit cards, citing concerns over volatility and lack of consumer protections.

The bank emphasized that crypto transactions offer no recourse through the Financial Ombudsman Service or Compensation Schemes, leaving customers exposed to potential risks.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.