In the first half of 2025, crypto ETP products saw total inflows of $17.8 billion — a modest 2.7% decline compared to the same period in 2024. Despite this dip, investor appetite for digital asset funds remains strong.

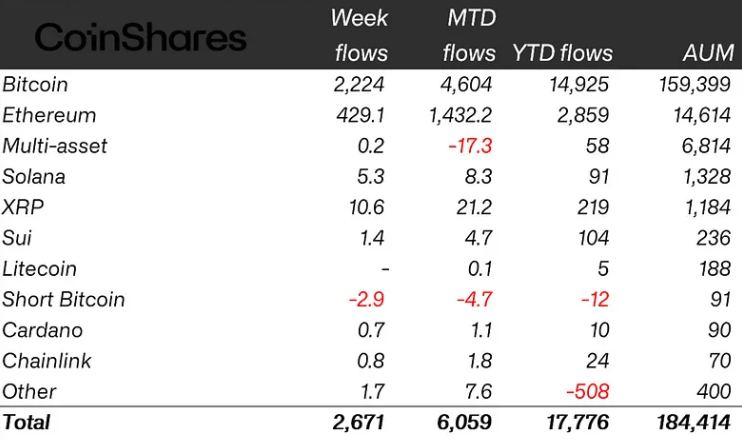

Global cryptocurrency investment products maintained 11 consecutive weeks of positive inflows, with $2.7 billion added in the most recent week. This brings the total year-to-date inflow to $17.8 billion, with a remarkable $16.9 billion flowing in over just the last 11 weeks. That accounts for nearly 95% of all inflows recorded since January.

Bitcoin Dominates with 84% of Total Inflows

Bitcoin-linked investment products continued to lead the market, attracting $14.9 billion in inflows during H1 2025. This represents nearly 84% of all crypto ETP gains in the period.

Last week followed the same trend, with Bitcoin ETPs bringing in $2.2 billion — roughly 83% of the weekly total. Ethereum (ETH) products came next, securing $429 million in inflows for the week and $2.9 billion overall in the first six months, accounting for 16.3% of the total.

XRP ranked third in both weekly and year-to-date inflows, adding $10.6 million last week and reaching $219 million for the year. This performance is notable as the U.S. continues to await regulatory approval for spot XRP ETFs, while Canada launched its own on June 18.

BlackRock Captures 96% of Crypto ETF Inflows

Just as Bitcoin dominates the asset class, BlackRock stands out among ETF issuers. The firm saw over $17 billion in inflows across its crypto products in H1 2025, representing 96% of the market share.

ProShares followed with $526 million and Fidelity with $246 million in inflows. Meanwhile, major competitor Grayscale recorded nearly $1.7 billion in net outflows during the same period.

These inflow statistics came as Bitcoin experienced a mild pullback below $108,000 earlier in the week. Last week, BTC surged from around $101,000 to a high of $107,800, demonstrating continued bullish momentum.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.