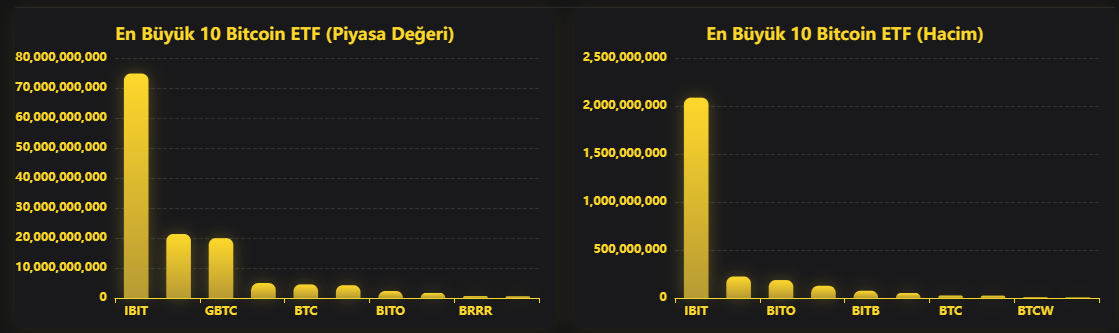

One of the clearest signs of institutional interest in the crypto market continues to be observed in Bitcoin and Ethereum ETF products. On June 30, 2025, Bitcoin ETFs recorded a net inflow of $102.1 million, while Ethereum ETFs saw $31.8 million in net inflows.

Leader Among Bitcoin ETFs: IBIT

Looking specifically at spot Bitcoin ETFs, the majority of the investment flow came through IBIT, which alone recorded +$112.3 million in inflows. On the other hand, the ARKB fund saw an outflow of -$10.2 million. The rest of the funds showed no movement.

-

IBIT: +$112.30 million

-

ARKB: -$10.20 million

-

GBTC, FBTC, BITB, BTCO, HODL, BRRR, EZBC, BTCW, BTC: 0

- Total Net Inflow: $102.10 million

This data shows that the IBIT fund continues to earn the trust of investors and stands out in portfolio diversification.

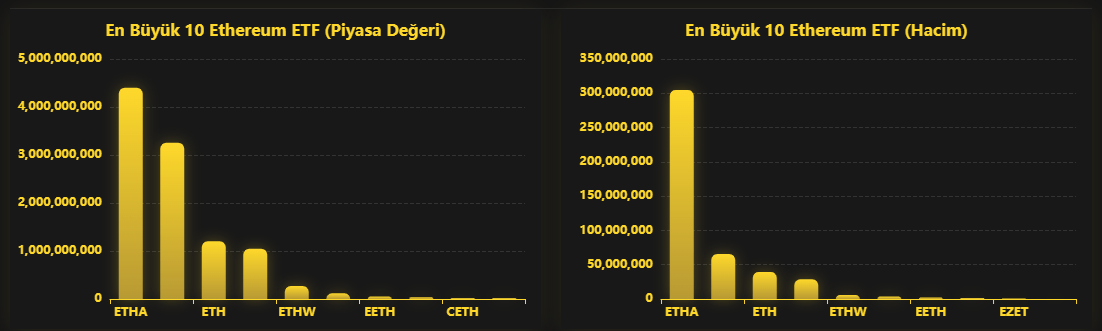

Ethereum ETFs More Limited but Stable

On June 30, Ethereum ETFs also showed a positive picture. The ETHA fund recorded +$6.1 million, while FETH saw +$25.7 million in inflows. There were no changes in the other funds.

-

FETH: +$25.70 million

-

ETHA: +$6.10 million

-

ETHE, ETH, ETHW, ETHV, EZET, QETH: 0

Total Net Inflow: $31.80 million

Although interest in Ethereum ETFs seems more cautious, the flow into FETH reflects investors’ continued long-term confidence in ETH.

Institutional Confidence Grows Each Day

The inflows recorded on the last day of June clearly demonstrate that institutional confidence in both Bitcoin and Ethereum remains high. The continuation of such inflows even during periods of increased volatility indicates that the crypto market is becoming increasingly mature.

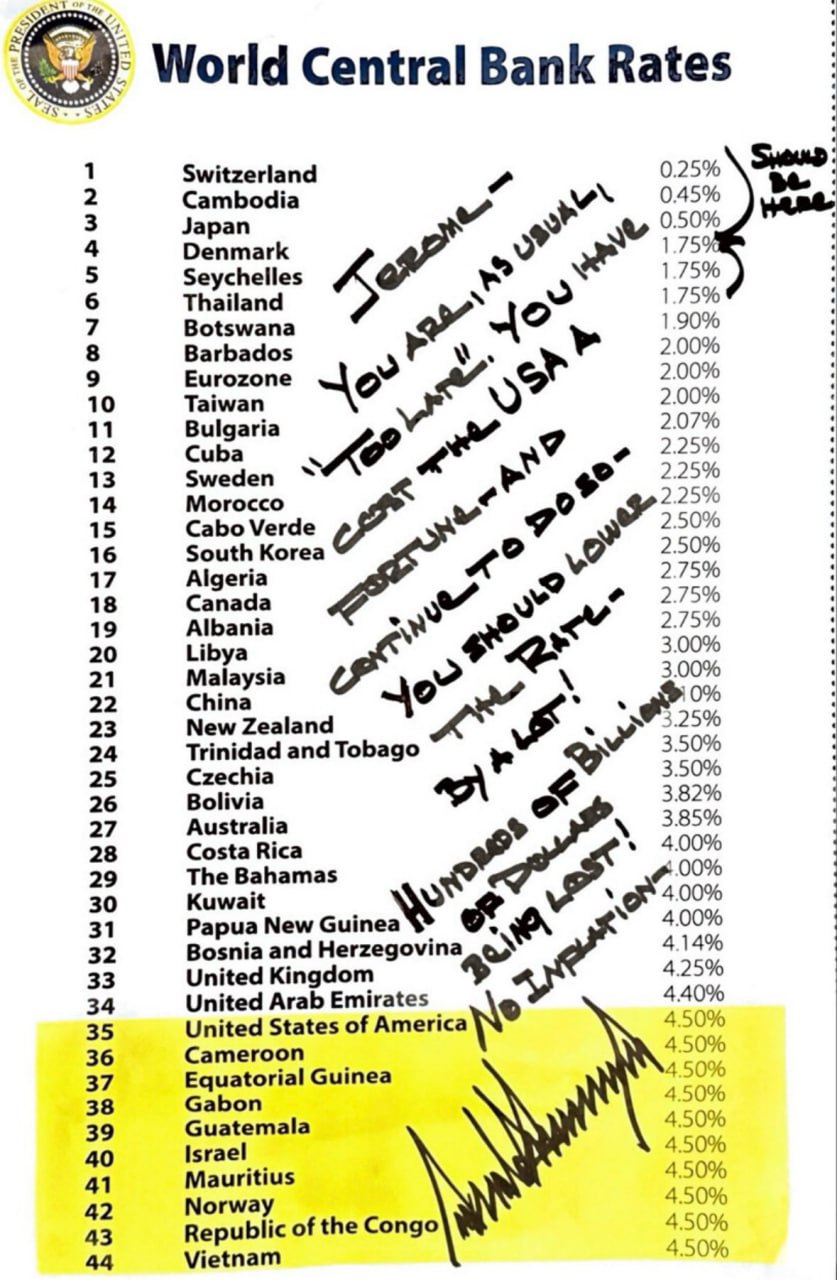

Investors Await a Rate Cut!

Meanwhile, White House sources have brought rate cut expectations back into focus. President Trump reportedly sent a handwritten note to Fed Chairman Powell, demanding lower interest rates. It was also noted that Trump believes Powell acted “too late.”

White House officials emphasized that high interest rates remain a serious issue. These statements have increased the probability of a rate cut in September. July is still seen as a weak possibility. However, institutional inflows into ETFs may further increase in the coming weeks, driven by growing expectations of monetary easing.

This content does not constitute investment advice. Markets carry high risk, and it is important to conduct your own research before making any investment decisions.

You can present your thoughts as comments about the topic. Moreover, you can follow us on Telegram, Twitter, and YouTube channels for the kind of news