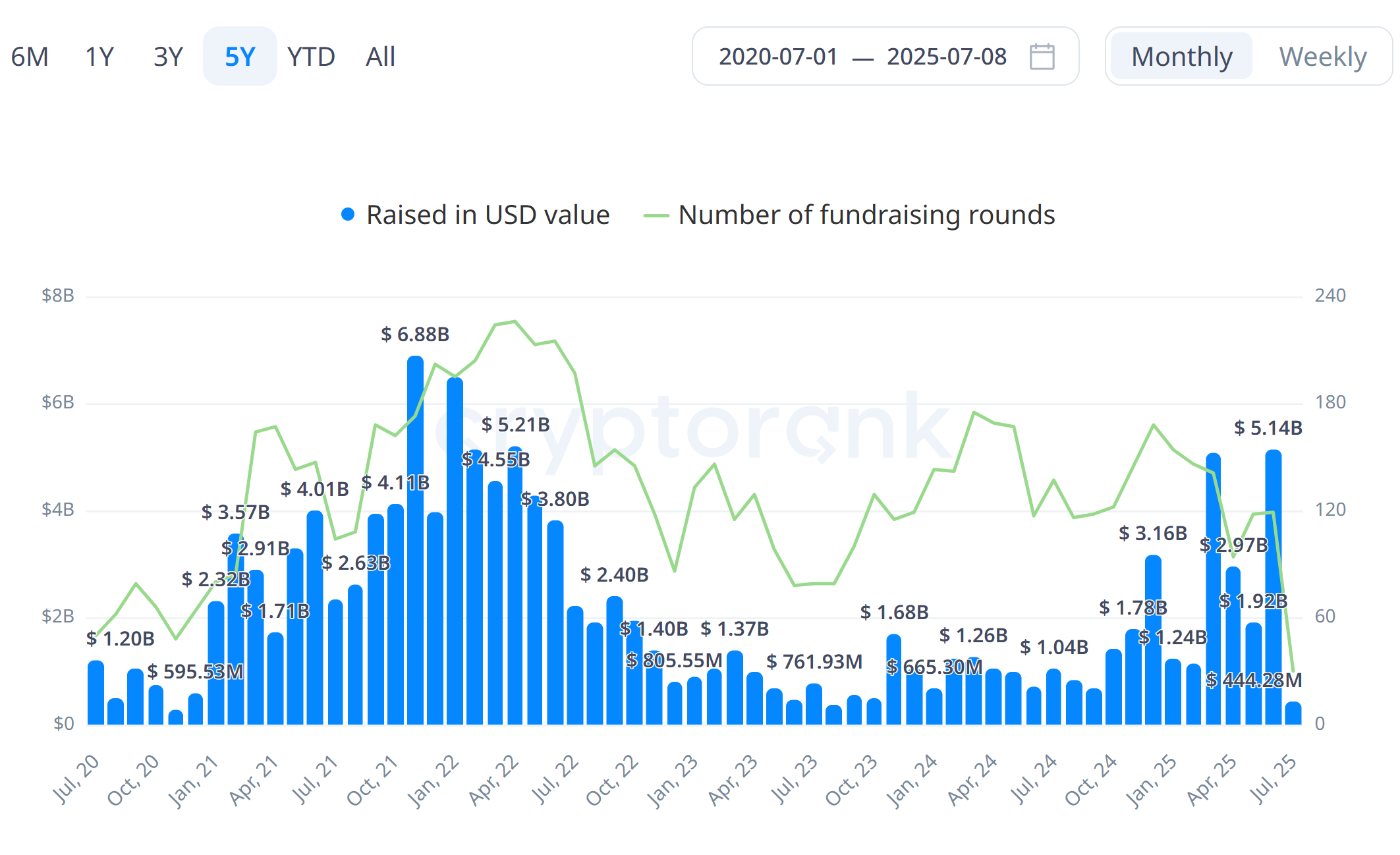

The crypto industry has witnessed a powerful resurgence in investment activity during the second quarter of 2025. According to recent data, crypto startups raised an impressive $10.03 billion in Q2, making it the strongest fundraising quarter since Q1 2022. Even more notably, June alone accounted for $5.14 billion, marking the highest single-month total since January 2022.

Strive Funds Leads the Quarter

This resurgence indicates a renewed appetite from investors, especially after a relatively quiet period in the crypto space. Topping the list of recipients this quarter was Strive Funds, founded by American entrepreneur and politician Vivek Ramaswamy. The firm raised a massive $750 million in May to support Bitcoin-focused alpha-generating strategies.

Following closely behind, TwentyOneCapital secured $585 million in April, ranking as the second-largest raise of the quarter. Other major recipients included Securitize ($400 million), Kalshi ($185 million), Auradine ($153 million), ZenMEV ($140 million) and Digital Asset ($135 million) — all contributing to the sector’s strong momentum.

Coinbase Ventures Tops Q2 Activity

On the investment side, Coinbase Ventures emerged as the most active investor in Q2 2025, participating in 25 deals between April and June. Close behind were Animoca Brands, Andreessen Horowitz (a16z) and Pantera Capital, continuing their strong support of the blockchain ecosystem.

In June alone, Coinbase Ventures led with 10 investments, followed by Pantera Capital (8), Galaxy (5), and Paradigm, which made 4 strategic deals. Other notable participants included Cyber Fund and GSR, showcasing a healthy mix of venture activity across different stages and sectors.

Key Focus Areas: Blockchain Infrastructure & DeFi

Funding was distributed across various sectors, but blockchain infrastructure and decentralized finance (DeFi) captured the majority of attention. While CeFi, NFTs, and GameFi continued to receive moderate levels of support, memecoins saw limited traction, with occasional spikes in activity.

Early-Stage Rounds Dominate Fundraising

Out of the 1,673 deals tracked over the past year, seed-stage rounds accounted for the largest share at 19.43%. This was followed by strategic rounds at 14.23%, reflecting continued interest in ecosystem-building and long-term plays. Pre-seed (9.26%) and M&A deals (9.44%) also played notable roles in shaping the capital landscape.

Series A rounds made up 6.34% of the total, while incubation deals remained less frequent at 3.35%, according to CryptoRank data.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram ,YouTube and Twitter channels for the latest news and updates.