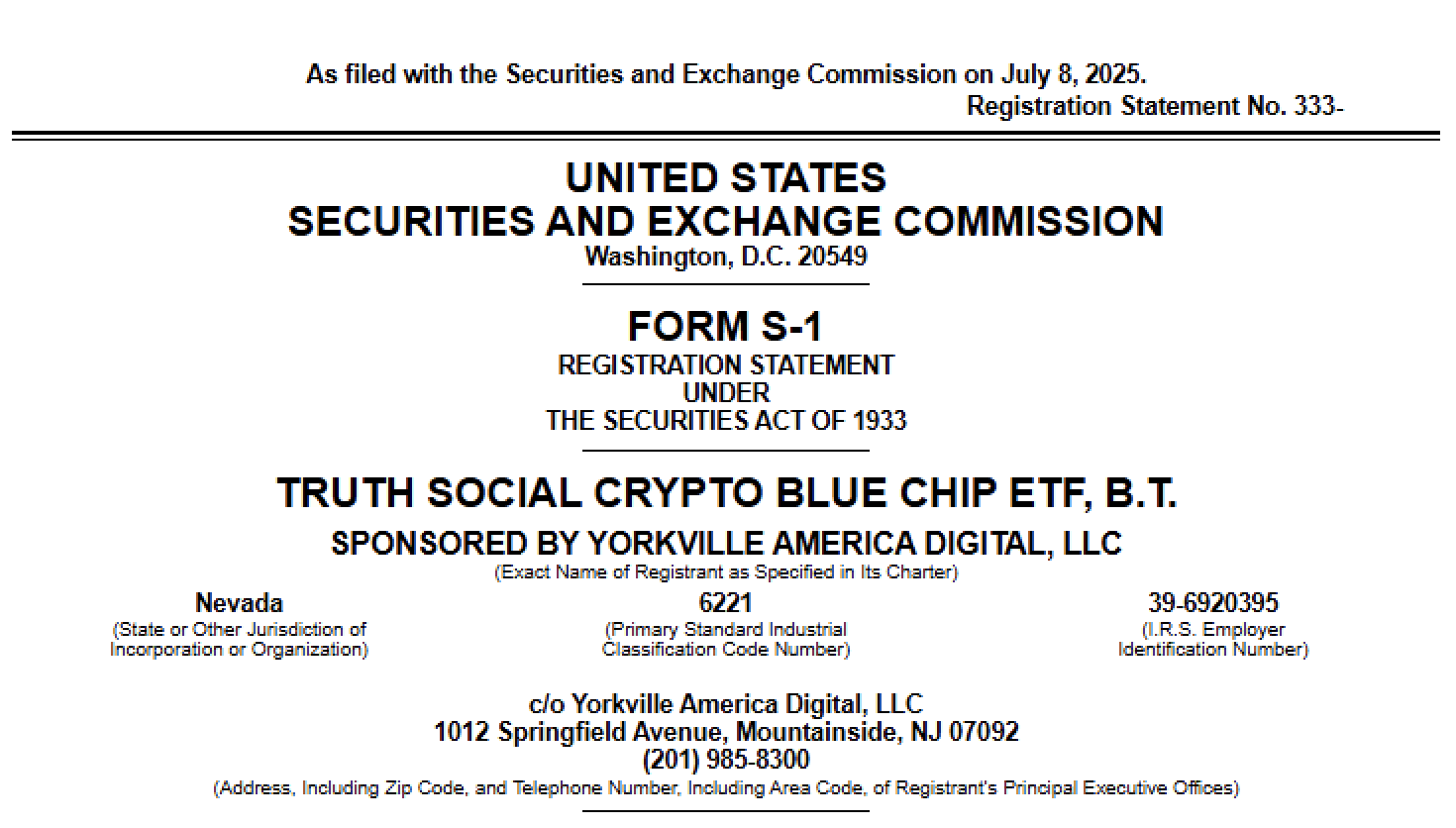

In a bold move to expand its presence beyond social media, Truth Social, the platform backed by current U.S. President Donald Trump, has officially filed an S-1 registration statement with the SEC to launch a crypto-focused exchange-traded fund (ETF).

Introducing the BT – Trust: A Passive Bet on Top Cryptos

The ETF, titled Truth Social Crypto Blue Chip ETF (BT – Trust), aims to track the performance of leading digital assets in a passive investment structure. The trust will hold a diversified portfolio of five major cryptocurrencies, designed to reflect their market movements proportionally.

Initial allocation breakdown includes:

-

70% Bitcoin (BTC)

-

15% Ethereum (ETH)

-

8% Solana (SOL)

-

5% Cronos (CRO)

-

2% Ripple (XRP)

The allocation ratio may change over time, subject to regulatory approval, and any amendments will be disclosed via prospectus updates and filings in accordance with U.S. securities law.

Structure and Oversight

Although BT – Trust functions as an investment vehicle, it is not registered under the U.S. Investment Company Act of 1940. Additionally, the sponsor of the trust is not SEC-registered as an investment adviser. This setup allows for greater operational flexibility and potentially lower costs for investors.

Yorkville America Digital LLC will sponsor the trust. Foris DAX Trust Company is appointed as the digital asset custodian, while a separate firm will manage the trust’s cash reserves.

A New Contender in the ETF Race

Truth Social’s entry into the ETF space underscores the growing competition in crypto investment products. Notably, the inclusion of Solana, XRP, and Cronos sets this ETF apart from many of its peers that focus solely on Bitcoin and Ethereum.

If approved, the fund will offer investors broad exposure to multiple high-cap digital assets through a single product—catering especially to institutional investors seeking compliant and efficient crypto access.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.