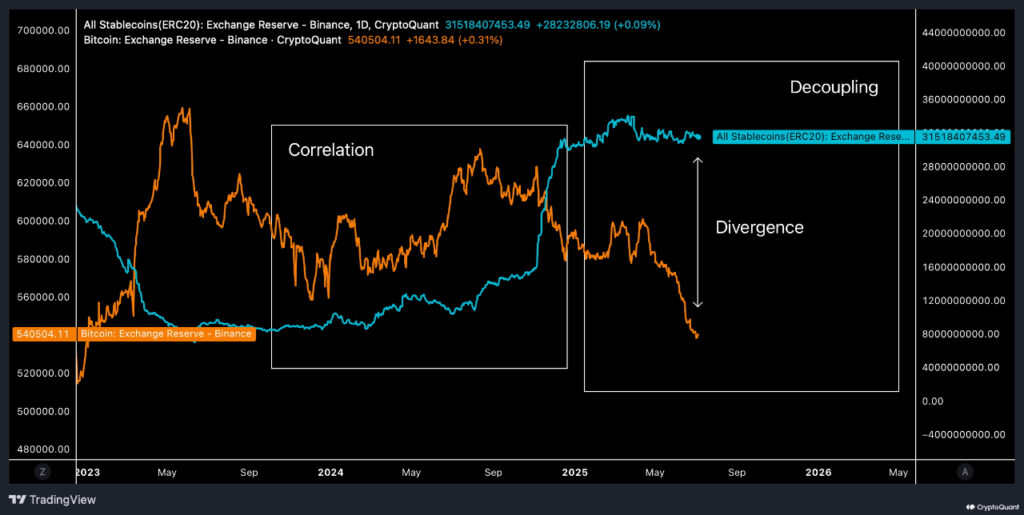

USDT and USDC balances on Binance surged to a record $31 billion as of June 2025, indicating a strong increase in reserves. This signals that investors are holding stablecoins while awaiting potential altcoin opportunities.

Crypto analyst Timo Oinonen described this as a “brewing liquidity explosion.” According to him, investors are sitting on USDT and USDC—low-volatility assets—while waiting for clearer market signals.

Between 2023 and the end of 2024, Bitcoin and stablecoin reserves were strongly correlated. However, this relationship reversed in early 2025. While Bitcoin flows out of exchanges, stablecoin inflows have accelerated, showing increased capital availability on trading platforms.

Meanwhile, the global stablecoin market cap has exceeded $254 billion. USDT leads with $159 billion, followed by USDC at $62 billion. This growing volume forms a solid foundation for a potential altcoin rally.

Bitcoin Dominance Declines, TOTAL2 Chart Looks Promising

Bitcoin’s market dominance has been steadily declining over the past 90 days. This indicates capital is starting to shift toward altcoins.

Joao Wedson, CEO of Alpharactal, highlighted that the Altcoin Season Index is sending positive signals. He noted that Bitcoin has outperformed altcoins in recent months, making this an opportune time to accumulate undervalued tokens.

With rising stablecoin reserves on Binance and price action compressing near critical resistance levels, a strong altcoin season could ignite rapidly—if the right catalyst appears.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.