The cryptocurrency market is highly sensitive to macroeconomic shifts, and few events create as much turbulence as interest rate cuts. These policy changes ripple through financial markets, impacting liquidity, investor sentiment, and asset prices, including Bitcoin and other digital currencies. So, how exactly do interest rate cuts affect the crypto market, both in the short term and the long term? In this article, we’ll deeply explore the dynamics of rate cuts, their effects on Bitcoin and other cryptocurrencies, and the other factors driving price movements in this volatile market.

The Relationship Between Interest Rate Cuts and Cryptocurrencies

When the Federal Reserve announces an interest rate cut, the crypto market typically experiences a surge in volatility. For instance, the Fed’s 25 basis point cut on December 18, 2024, triggered a sharp sell-off across major cryptocurrencies. Bitcoin dropped over 5% within 24 hours to $100,700, while XRP fell 9.8% to $2.32. The reasons for this short-term turbulence include:

-

Speculative Trading: Short-term traders react quickly to market sentiment, buying or selling, which amplifies price swings.

-

Portfolio Rebalancing: Long-term investors may reposition their holdings, either capitalizing on dips or exiting riskier assets due to expectations of economic uncertainty.

-

Risk-Off Sentiment: Rate cuts can signal economic weakness, sparking recession fears and driving investors toward safer assets like bonds.

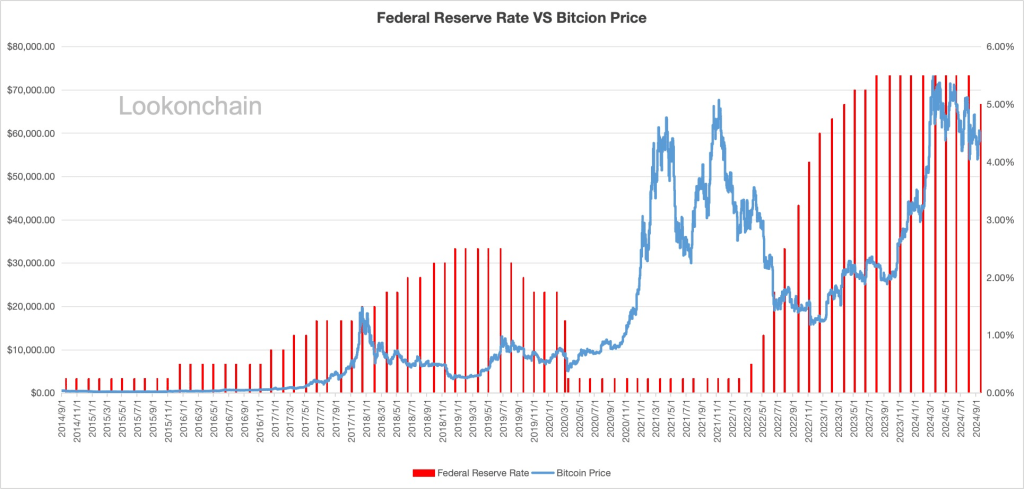

Historically, rate cuts haven’t always led to immediate price surges. For example, after the significant rate cut in March 2020, Bitcoin crashed by approximately 39% that month but saw a strong recovery by year-end. Similarly, in 2019, Bitcoin surged from $4,000 to $13,000 in anticipation of rate cuts starting in April, but it dropped 30% after the actual cut in July. This suggests that crypto prices may rise in anticipation or with a delay rather than immediately following a cut.

Long-Term Effects of Interest Rate Cuts

While short-term reactions are often erratic, interest rate cuts generally create a favorable environment for cryptocurrencies in the long term. Here’s how this happens:

-

Increased Liquidity: Lower interest rates reduce borrowing costs, injecting capital into markets. This liquidity flows toward high-risk, high-reward assets like Bitcoin and altcoins.

-

Heightened Risk Appetite: When government bond yields are low, investors turn to speculative assets in search of higher returns.

-

Ecosystem Development: Low-rate environments encourage investment in crypto startups. For example, in April 2020, Andreessen Horowitz launched a $515 million crypto fund, fueling innovation in blockchain projects.

-

Weaker U.S. Dollar: Rate cuts can devalue the dollar, enhancing Bitcoin’s appeal as “digital gold” due to its fixed supply and scarcity.

Bitcoin’s capped supply of 21 million coins and periodic halving events, which reduce new coin issuance, make it particularly attractive during inflationary periods. Historical data shows that Bitcoin typically rises after each halving, reinforcing its resistance to inflation.

Other Factors Influencing Crypto Prices

While rate cuts play a significant role, they don’t act in isolation. Other factors shaping the crypto market’s response include:

-

Magnitude of the Cut: Larger cuts, like those in 2020, have a more pronounced impact compared to the recent 25 basis point reduction.

-

Economic Conditions: Recession fears or weak economic growth can dampen risk appetite, even with lower rates.

-

Regulatory Developments: Changes in crypto regulations, such as clearer guidelines or restrictions, can influence market sentiment.

-

Geopolitical Events: Global uncertainties, like trade tensions or conflicts, can either bolster crypto as a hedge or heighten risk aversion.

-

Market Sentiment: The crypto market is heavily driven by sentiment, amplified by hype or fear on social media platforms like Twitter (X).

Do Interest Rate Cuts Always Trigger a Crypto Bull Market?

The idea that rate cuts automatically boost Bitcoin’s price is overly simplistic. Historical trends show mixed results:

-

2019: Bitcoin rallied before the Fed’s July cut but fell afterward, only to recover later.

-

2020: Bitcoin didn’t surge immediately after the March cut; the main uptrend began at year-end.

Following the September 2024 cut, the current market resembles 2019. Rate hikes in 2022-2023 led to a bear market, but anticipation of cuts sparked rallies in Q4 2023 and Q1 2024. However, Bitcoin’s price dropped from over $70,000 to below $60,000 in Q2 and Q3 of 2024, suggesting the market may have already priced in the recent cut. A single cut may not ignite a bull market without significant economic shifts or larger rate reductions.

Potential for a Bitcoin Bull Market

If a bull market emerges, how high could Bitcoin climb? Historical bull markets offer clues:

-

Early cycles saw multi-fold gains, but as Bitcoin’s market cap grows, returns have diminished.

-

A 50% to 200% increase remains plausible, though massive surges require substantial new capital inflows.

Key factors to monitor include the pace of rate cuts, the Fed’s response to inflation or recession risks, and regulatory changes. Bitcoin’s on-chain fundamentals, such as adoption and transaction volume, also play a critical role.

This content does not constitute investment advice. Markets carry high risks, and it is important to conduct your own research before making any investment decisions.

In the comment section, you can freely share your comments about the topic. Additionally, don’ t forget to follow us on Telegram, YouTube, and Twitter for the latest news and updates.