World Liberty Financial (WLF) has become a notable name in the crypto space following Donald Trump and his family’s entry into the digital finance world. Founded in 2024, this US-based decentralized finance (DeFi) platform aims to give users full control over their funds, differing from traditional banking systems. The platform’s main goal is to strengthen the global position of the US Dollar and make DeFi accessible to everyday Americans.

Brief About the Project

World Liberty Financial positions itself as a US-based DeFi project aiming to reinforce the global dominance of the US Dollar and promote financial freedom. Unlike traditional financial systems with centralized authorities, WLF is community-driven, promising users more control over their assets.

Team

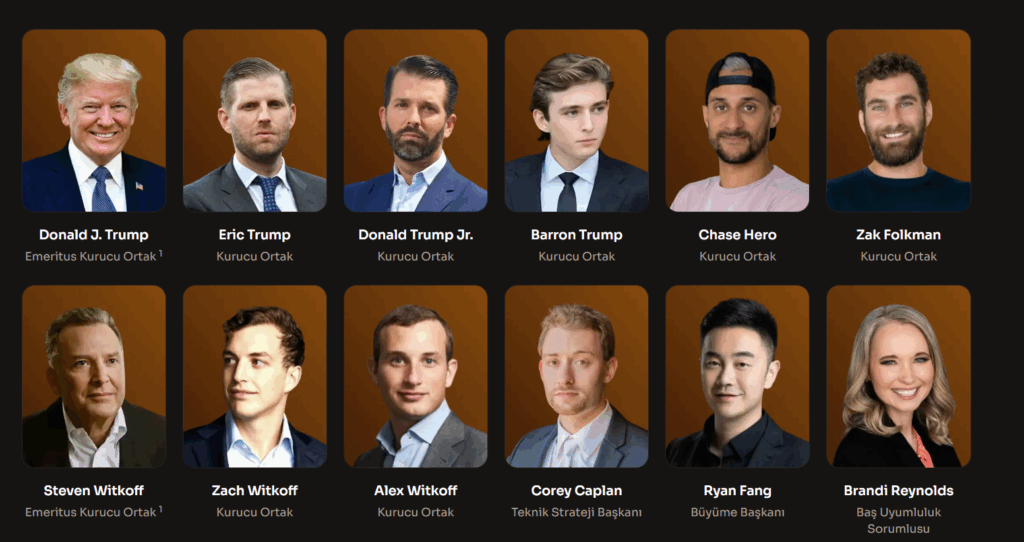

The team behind World Liberty Financial combines the Trump family’s political and brand power with experienced crypto entrepreneurs’ technical expertise:

- Donald J. Trump – Chief Crypto Representative: Leading the vision to make America the “Crypto Capital of the World.”

- Eric Trump – Web3 Ambassador: Active in daily management and platform promotion.

- Donald Trump Jr. – Web3 Ambassador: Collaborates in platform management and community engagement.

- Barron Trump – DeFi Visionary: Listed as the decentralized finance visionary adding fresh perspectives.

- Chase Herro: Co-founder of WLF and partner at Axiom Management Group (AMG), leading the technical team.

The Trump family owns 50% of World Liberty Financial and receives 50% of all revenue from token sales. Initially, they received 22.5 billion WLFI tokens as supporters.

Investors and Key Partners

World Liberty Financial has attracted notable investors:

- MGX (Abu Dhabi): Received significant support of $2 billion from MGX, a company based in Abu Dhabi.

- Zak Folkman and Chase Herro: Co-founders with previous experience at Dough Finance.

- Steve Witkoff: A real estate mogul who facilitated the Trump family’s involvement in the project.

- Aqua1 Foundation: A UAE-based fund that made the largest public WLFI investment ($100 million).

- Justin Sun: Founder of Tron, who invested over $75 million in WLFI.

- DWF Labs: Contributed $25 million and helped support WLFI’s liquidity.

- Sui and Chainlink: WLFI integrates with Sui assets and uses Chainlink oracles on Ethereum for price data.

Project Idea

World Liberty Financial’s core idea is to strengthen the US Dollar digitally and bring decentralized finance (DeFi) to mainstream users. Unlike traditional banking, WLF eliminates intermediaries to offer users direct control over their assets. The project emphasizes American ideals like “Freedom, privacy, and financial liberty.”

How Does It Work?

World Liberty Financial operates through the WLF Protocol, with a community-based governance model centered around the $WLFI token.

WLFI Token ($WLFI)

The $WLFI token functions as a governance token with features such as:

- Equal Voting Rights: Each WLFI token gives one vote, but no single person can hold more than 5% of total votes to ensure fairness.

- Proposal Creation: Token holders can propose various platform changes.

- Network: Built on Ethereum blockchain.

- Non-Transferable: Tokens cannot be sold or transferred, making them solely for governance participation without profit motives.

- Purpose: Used only for governance voting, not financial returns.

USD1 Stablecoin

Launched in March 2025, USD1 is a stablecoin pegged 1:1 to the US Dollar and a vital part of WLF’s mission to empower the US Dollar. By April 2025, it reached a circulation volume of $2.1 billion, becoming one of the fastest-growing stablecoins.

Management Model

WLF’s governance is democratic and community-focused:

- Proposal Submission: Any WLFI token holder can submit proposals.

- Community Review: Discussions happen on official forums.

- Voting: Token holders vote via Snapshot, usually lasting one week.

- Implementation: Approved proposals are executed by the technical team.

- This system prevents a single entity or group from controlling the platform’s future.

Investment Requirements

- US Participants: Must qualify as accredited investors.

- International Participants: Must be outside the US.

- KYC Compliance: Mandatory for all users.

- How It Works and Why It Matters

- USD1’s value is backed 1:1 by real US Dollars or equivalent high-liquid assets (e.g., US Treasury bonds). This peg makes USD1 a safe haven against crypto volatility.

Key benefits of USD1:

- Protection from Volatility: Keeps asset value stable amidst price swings.

- Fast and Low-Cost Transfers: Enables cheaper, quicker cross-border payments.

- DeFi Integration: Used for lending, borrowing, and yield farming within WLF and broader DeFi.

- Strengthens the US Dollar’s digital role supporting Trump’s vision to make it the “Crypto Capital of the World.”

WLFI Token Distribution

- 35%: Reserved for token sales.

- 32.5%: For community growth and incentives.

- 30%: Allocated to early supporters (including Trump family’s initial 22.5 billion tokens).

- 2.5%: For team members and advisors.

WLFI Token Supply:

- Total Supply: 10 Peta (10P) WLFI

- Circulating Supply: 10P WLFI (all tokens are non-transferable and used for governance)

USD1 Stablecoin Supply (Latest):

- Total Supply: 2.2 Billion USD1

- Circulating Supply: 2.2 Billion USD1

Roadmap

Though there is no detailed roadmap, the project was founded in 2024 and launched USD1 in March 2025. By April 2025, USD1 reached a $2.1 billion circulation, highlighting rapid growth. Future updates and partnerships will be community-voted.

Ecosystem

WLF aims to increase financial freedom and strengthen the US Dollar digitally. Core elements include:

WLFI Token for governance

- USD1 Stablecoin as the main digital dollar asset

- WLF Protocol as the tech backbone

- Community voting and discussions

- Blockchain analytics via platforms like Arkham Intelligence

Features

WLF offers:

- Democratic decision-making with voting limits

- Supports USD-backed stablecoins

- Easy access to DeFi services

- Strong security audits

- Beginner-friendly UI

- Educational resources

- American values focus

- Risks and Considerations

WLFI tokens are non-transferable and do not yield profits, which may deter some investors.

- Political ties to the Trump family introduce regulatory and political risks.

- Accredited investor requirements limit US user base.

- Trump family’s 50% ownership raises questions about decentralization.

- Being a new 2024 project, long-term sustainability is unproven.

Social Media and Communities

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.