Taker Protocol (TAKER) is a groundbreaking incentive protocol designed to transform the Bitcoin ecosystem by empowering retail investors and expanding the community by 100x. Built on Web3 technology, Taker encourages millions of users to adopt, hold, and leverage Bitcoin and its derivatives through innovative reward systems. Curious about what makes Taker Protocol so exciting? Let’s explore this game-changing project in detail!

What is Taker Protocol?

Taker Protocol is the first and largest Bitcoin incentive layer, focused on maximizing returns for individual Bitcoin holders. Unlike traditional Layer 2 solutions or purely financial protocols, Taker acts as a growth engine, driving user adoption through its EVM-compatible Taker Chain. By supporting Bitcoin derivatives and liquid staking derivatives (LSDs) like wBTC, cbBTC, and SolvBTC, Taker makes it easy for users to join and benefit from the ecosystem.

Key Features:

-

Retail-Focused: Tailored for small-scale Bitcoin holders to optimize their gains.

-

EVM Compatibility: Seamlessly integrates with Ethereum-based dApps and tools.

-

Economic Flywheel: Boosts user traffic to create a self-sustaining growth loop.

-

Bitcoin Derivatives Support: Includes popular assets like wBTC, cbBTC, and SolvBTC.

Taker is a blockchain project that prioritizes user growth, aiming to expand the Bitcoin community while delivering real yield opportunities.

Taker Chain: The Technological Foundation

The backbone of Taker Protocol, Taker Chain, is a high-performance, secure, and decentralized blockchain network. Its EVM compatibility ensures easy integration with existing Ethereum tools, and it stands out with the following technical features:

Nominated Proof of Liquidity (NPoL)

Taker Chain introduces NPoL (Nominated Proof of Liquidity), a novel consensus mechanism built on NPoS (Nominated Proof of Stake). By incentivizing liquidity contributions, NPoL enhances network security and participation. It consists of:

-

NPoS Layer: Token holders (nominators) select validators to secure the network.

-

POL Layer: Validators stake liquidity tokens (e.g., $TAKER) to ensure stability and earn rewards.

This system boosts security, scalability, and fair reward distribution.

Dual Finality Mechanism

-

Probabilistic Finality (BABE): Ensures continuous block production for network progress.

-

Provable Finality (GRANDPA): Guarantees irreversible blocks, enhancing network reliability.

Secure and Proportional Elections

Taker Chain employs a fair and proportional validator election system, maintaining decentralization and network integrity.

High Performance

With fast finality and high transaction throughput (TPS), Taker Chain delivers a smooth user experience.

Taker Sowing: The User Growth Engine

Taker Sowing is Taker’s user acquisition powerhouse, already attracting over 5 million users. This zero-barrier, task-based incentive system guides users into the Bitcoin ecosystem. Key features include:

-

Zero-Barrier Tasks: On-chain and off-chain tasks help users learn about Bitcoin projects and interact with them.

-

Taker Diamonds: Users earn Taker Diamonds upon task completion, granting access to future $TAKER airdrops.

-

Laser Medal NFT: A special NFT that symbolizes user loyalty and contribution.

Sowing bridges education, incentives, and asset integration, driving mass Bitcoin adoption.

Lite Mining Node: Accessible Participation

Lite Mining Node is a lightweight, task-based system designed for broad user engagement without technical barriers. Users earn Taker Points (TP) through simple on-chain tasks. Features include:

-

User-Friendly: Appeals to both Web2 and Web3 users, lowering entry barriers.

-

Rewards: TP accumulation unlocks airdrops and ecosystem benefits.

-

NFT Integration: Future tasks may require specific NFTs, enhancing user loyalty.

Lite Mining fosters daily engagement, boosting ecosystem activity and user value.

Taker Swap: DEX for Bitcoin LSDs

Taker Swap is a low-slippage decentralized exchange (DEX) built for Bitcoin LSD assets. Key features include:

-

Liquidity Aggregation: AMM pools ensure efficient matching with minimal slippage.

-

Smart Routing: Automatically finds the best swap paths for optimal pricing.

-

Taker Lend Integration: Swapped assets can be deposited into lending pools for additional yield.

Taker Swap offers community-driven liquidity optimized for Bitcoin derivatives.

Taker Lend: Decentralized Lending Platform

Taker Lend is a decentralized lending protocol that allows users to borrow stablecoins using Bitcoin LSD assets like wBTC, cbBTC, and SolvBTC as collateral. Features include:

-

Flexible Interest Rates: Dynamic rates adjust based on market supply and demand.

-

Risk Management: Liquidation mechanisms and collateral ratios ensure safety.

-

Use Cases: Unlocks liquidity, supports leverage strategies, and optimizes DeFi yields.

Taker Lend enables Bitcoin holders to access liquidity without selling their assets.

Security and Audits

Taker Chain prioritizes security through a partnership with Scalebit, a leading blockchain auditing firm with expertise in Bitcoin ecosystem projects like Unisat and Merlin Chain. Built on Parity Technologies’ robust Substrate framework, Taker Chain ensures reliability. All audit reports are publicly available for transparency:

-

Taker Controller Audit Report

-

Taker Chain Audit Report

-

Taker Swap Audit Report

Taker Laser Cat NFT: Your Ecosystem Pass

The Taker Laser Cat NFT is a key component of the ecosystem, offering early supporters exclusive benefits. Features include:

-

$TAKER Token Allocation: Each NFT includes a fixed $TAKER token allocation.

-

Ecosystem Perks: Access to airdrops, priority in tasks, and community identity.

2025 Roadmap

-

Q1 2025: Launch of Lite Mining Node and Taker Swap development.

-

Q2 2025: Taker Sowing rollout, Taker Lend development, and Laser Cat NFT sale.

-

Q3 2025: $TAKER token listing, Taker Lend, and Taker Swap launch.

-

Q4 2025: Ecosystem partnerships, DeFi integrations, and TradFi bridge.

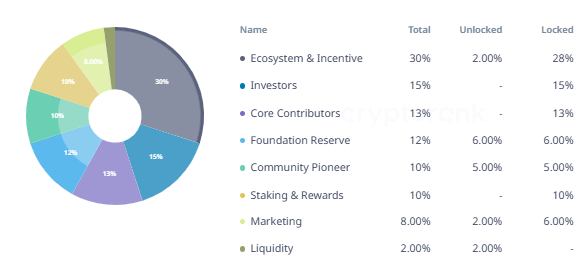

Token Distribution

$TAKER is the native token of Taker Chain, with a total supply of 1,000,000,000.

-

Ecosystem & Incentives (30%): 6.67% unlocked at TGE, remainder vested linearly over 5 years.

-

Core Contributors (13%): 1-year cliff post-TGE, then quarterly vesting over 4 years.

-

Foundation Reserve (12%): 50% unlocked at TGE, remainder vested quarterly over 4 years.

-

Investors (15%): 6-month cliff post-TGE, then quarterly vesting over 18 months.

-

Staking & Rewards (10%): Linear vesting over 5 years.

-

Marketing (8%): 25% unlocked at TGE, remainder vested linearly over 4 years.

-

Liquidity (2%): Fully unlocked at TGE.

-

Community Pioneers (10%): 50% unlocked at TGE, remainder vested monthly over 9 months.

$veTAKER is a non-transferable token used for network security and governance, with rewards distributed in this format.

Taker Protocol Investors

Taker Protocol has secured strong backing from leading investors, including The Spartan Group and DragonFly Capital. Other prominent supporters include Electric Capital, Digital Currency Group (DCG), Shima Capital, Sfermion, The LAO, Bitscale Capital, Ascensive Assets, Morningstar Ventures, Jets Capital, 071labs, and GTS Ventures, reflecting confidence in Taker’s potential to drive Bitcoin ecosystem growth.

Taker Protocol Team

-

Mike Jin: Co-founder, shaping Taker’s vision and strategy.

-

Charles Jia: Co-founder, leading technical and strategic development.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.