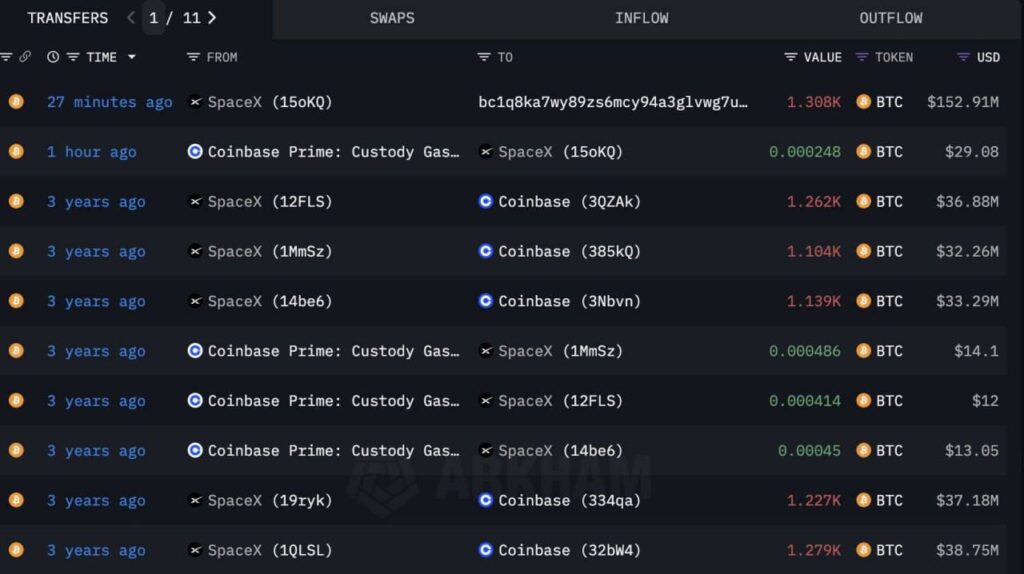

Elon Musk company SpaceX has made a large-scale Bitcoin (BTC) transfer for the first time in nearly 3 years. According to on-chain analytics platform Arkham Intelligence, 1,308 BTC were sent from a wallet controlled by the company to another address. This amount is valued at approximately $152.91 million at current prices.

This transfer is the first significant high-volume movement recorded for SpaceX since transactions made in 2021. The transaction comes amid a renewed rise in Bitcoin prices.

However, the recipient wallet address does not yet have a known institutional identity. The address starting with bc1q8ka…vwg7u leaves the strategy behind the transaction unclear.

Similarities with Past Bitcoin Transactions

In 2021, SpaceX transferred a total of 4.7K BTC to various wallets via Coinbase Prime. These moves had offered key insights into the company’s crypto strategy. Most of those transfers at that time were directed to the Coinbase exchange.

On the other hand, a notable detail after this new transfer is the transaction route. The transferred BTC was sent not to known exchange wallets but to a “passive” address with no prior transaction history. This suggests the funds might have been moved for restructuring or custody purposes rather than for sale.

According to Arkham Intelligence reports, SpaceX currently holds approximately 8,285 BTC. This gives the company a digital asset portfolio worth about $560 million. Arkham Intelligence identified these wallets as belonging to SpaceX through previous transactions, Coinbase Prime links, and on-chain patterns.

Meanwhile, the same reports show Tesla still holds 11,509 BTC. Combined, the two companies hold a total of 19,794 BTC.

Elon Musk’s Crypto Asset Strategy Back in Focus

The timing of the transfer has not gone unnoticed by market observers. Moreover, the large amount signals confidence in potential BTC movements between institutions. High-volume transactions by corporate firms indicate renewed interest in the market and boost confidence in the sector. SpaceX’s transfer has brought Elon Musk’s crypto asset strategy back into the spotlight.

Especially as Fed and SEC’s statements on crypto regulations remain topical, such transactions gain even more significance.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram ,YouTube and Twitter channels for the latest news and updates.