What is Curve DAO Token (CRV)?

Curve DAO Token (CRV) is the native governance and incentive token of Curve Finance, a leading decentralized exchange (DEX) in the decentralized finance (DeFi) ecosystem. Curve Finance is an Ethereum-based Automated Market Maker (AMM) protocol launched in January 2020. It is optimized to enable efficient swaps between similarly priced assets, such as stablecoins (USDT, USDC, DAI) and tokenized Bitcoin assets (WBTC, renBTC), with very low slippage and minimal fees.

The CRV token allows users to participate in governance votes. It is also a core part of the incentive mechanism for liquidity providers. By locking CRV into veCRV, users gain long-term governance power and boosted rewards.

How Did the Curve Project Start? (Founding Team)

Curve Finance was founded in January 2020 by Russian scientist and entrepreneur Michael Egorov. Egorov, who also co-founded and served as CTO of NuCypher, has extensive experience in cryptography and software engineering. Curve quickly rose to prominence in DeFi by specializing in stablecoin swaps and integrating with other projects like Aave, Yearn, and Convex.

The CRV token was launched in August 2020 to enable decentralized governance of the protocol, marking the start of Curve’s transition from a simple trading platform to a community-driven ecosystem.

Curve DAO and Governance

- DAO Framework: Curve DAO is a decentralized organization built on Aragon infrastructure.

- Voting and Proposals: CRV holders vote on protocol changes such as pool parameters, incentive policies, and new pool additions.

- veCRV Model: CRV tokens are locked to gain governance power. Tokens can be locked for up to 4 years, with longer locks granting more voting power and incentives.

- Incentive for Long-Term Participation: This system encourages long-term commitment and powers the “Curve Wars,” where other protocols compete for veCRV control.

- Voting Cycles: Proposals typically have a 7-day voting period and cover gauge allocations, protocol upgrades, and more.

- Emergency DAO: A 9-member Emergency DAO can disable pools to prevent fund loss, with a 24-hour proposal window for swift response.

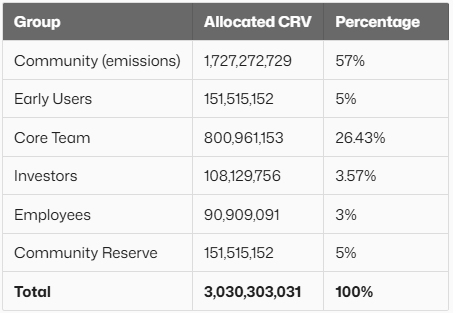

CRV Tokenomics and Vesting

- The total CRV supply is capped at 3.03 billion tokens, protecting it from long-term inflation.

- Locked CRV tokens (veCRV) cannot be transferred or delegated.

- Convex Finance offers an alternative to locking by allowing users to gain voting and reward boosts without directly locking CRV.

Token Allocation:

- Liquidity Provider Incentives: 57% (~1.72 billion CRV)

- Core Team: 26.5% (~800.96 million CRV)

- Community Reserve: 5% (~151.52 million CRV)

- Investors: 3.6% (~108.13 million CRV)

- Employees: 3% (~90.91 million CRV)

- Pre-Launch Liquidity Providers: 5% (~151.52 million CRV)

Vesting Details:

Core team and investor tokens are vested over 2 to 4 years. Employees have a 2-year schedule, and early liquidity providers are subject to a 1-year vesting. This linear process aims to reduce market shocks and support token stability.

Annual Emissions:

Annual CRV emissions declined from 274 million in 2020 to ~137–162.7 million in 2024, lowering inflation from 20% to around 6%, contributing to long-term sustainability.

Curve Ecosystem

- Curve is more than just a DEX—it’s a foundational liquidity layer for many DeFi applications. Its AMM supports various DeFi protocols:

- Convex Finance: Allows CRV staking and optimization. Offers CVXCRV, a liquid alternative to veCRV.

- Yearn Finance: Uses CRV yield farming strategies to optimize returns.

- Frax, Lido, Aave, StakeDAO: Use Curve pools for liquidity and yield generation.

- RenVM: Enables yield farming and efficient swaps between BTC and wBTC.

- Elixir: Partners with Curve to bring BlackRock’s on-chain fund BUIDL into DeFi, allowing users to mint deUSD and trade on Curve.

- TON (The Open Network): Integrates Curve’s CFMM to improve stablecoin swaps on TON.

- veCRV dynamics continue to support liquidity depth and active governance by rewarding long-term user participation.

![]()

CRV Roadmap

Though not structured like a traditional corporate roadmap, Curve’s development is driven by community governance and strategic integrations.

Key Milestones:

- 2019: StableSwap whitepaper (Nov 2019)

- 2020: Platform launch (Jan), CRV announcement (May), CRV launch (Aug)

- 2021: Curve v2 whitepaper (June), multi-chain factory pools (Sep)

- 2022: v2 factory pools official launch (Jan), crvUSD whitepaper (Oct)

- 2023: crvUSD contracts deployed on Ethereum mainnet (May)

Future Outlook:

- Cross-Chain Expansion: Deployed on Ethereum, zkSync, Arbitrum, Optimism, Polygon, Moonbeam (Polkadot), expanding user base and lowering fees.

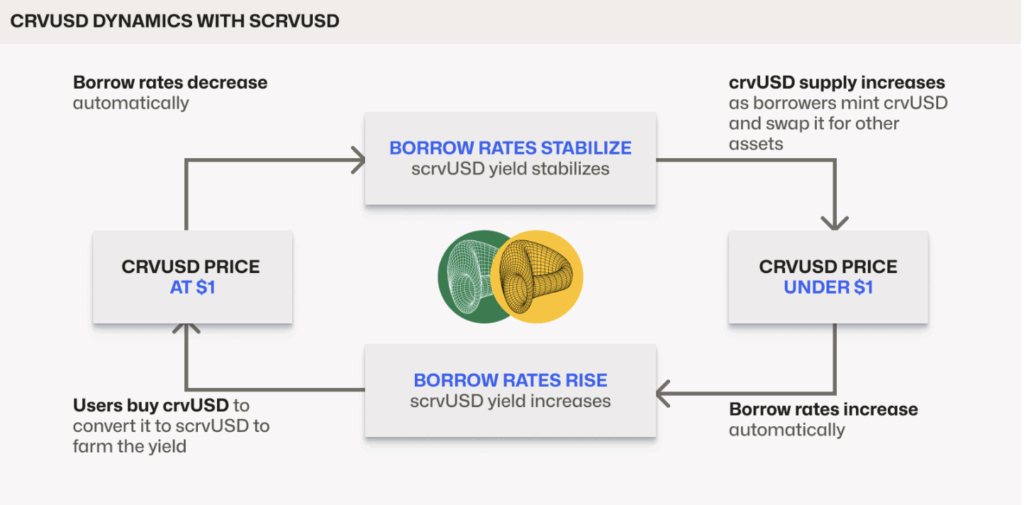

- Stablecoin Strategy: Launch of native crvUSD enhances ecosystem functionality.

- AMM Optimization: Algorithm updates will improve capital efficiency.

- Security Audits: Regular code reviews and security upgrades boost protocol resilience.

- Partnerships: Integration with leading DeFi and CeFi players continues to expand Curve’s reach.

Major Investors

Curve is backed by top DeFi investors such as Andreessen Horowitz (a16z Crypto), Polychain Capital, Paradigm, Dragonfly Capital, Placeholder, and Framework Ventures. The now-defunct Three Arrows Capital (3AC) was also among its early backers.

Social Media and Community