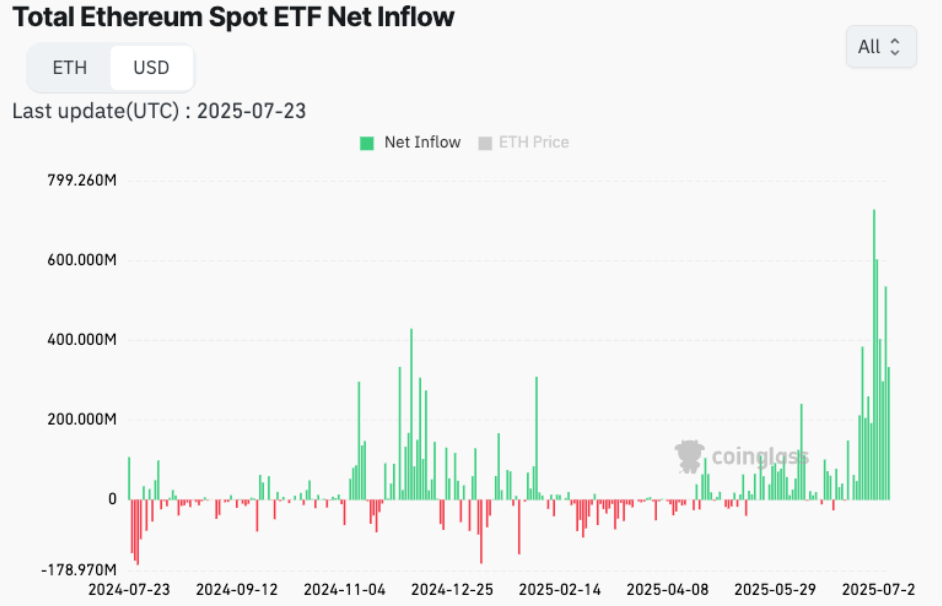

Spot Ethereum ETFs have completed their first year in the U.S. markets. Over the past 12 months, they have recorded a total net inflow of $8.69 billion. During the same period, the total assets under management (AUM) of these funds reached $16.57 billion.

The funds began trading on July 23, 2024. Major institutions including BlackRock, Fidelity, 21Shares, Bitwise, Franklin Templeton, VanEck, Invesco, and Grayscale entered the Ethereum ETF space. Notably, nearly half of the total inflows occurred in the last three weeks. In just the past 14 trading days, $3.9 billion flowed into the funds.

Ethereum (ETH) displayed volatile price action during this time. The price reached $4,000 in December but dropped to $1,500 in April. Still, ETH gained over 8% in value over the last 12 months.

On the ETF’s first anniversary—July 23, 2025—investors added $332.2 million in new inflows. This marked the seventh-strongest daily inflow since launch.

Spot eth ETFs celebrate 1yr anniversary w/ $330mil inflows…

7th best day since launch.

6 of top 7 inflow days have come in past *2 weeks*.

Now 13-day inflow streak altogether.

$4.4bil new $$$.

— Nate Geraci (@NateGeraci) July 24, 2025

BlackRock Takes the Lead, Grayscale Falls Behind

The highest inflows were recorded by BlackRock’s iShares Ethereum Trust ETF (ETHA), which alone attracted $8.9 billion in net flows. This helped offset the $4.3 billion in outflows from Grayscale’s converted fund, ETHE, which lost investors due to its high fees and market discount.

Nate Geraci, President of NovaDius Wealth Management, highlighted that six of the seven highest daily inflows into Ethereum ETFs occurred in the past two weeks. On July 16, ETFs experienced their strongest single day ever with $726.6 million in inflows. Geraci noted that nearly 1,000 new ETFs launched during this period, with BlackRock’s ETH fund ranking first in inflows.

Staking Phase Begins: A New Chapter for Ether ETFs

As investor interest grows, staking support is becoming a hot topic for Ether ETFs. Fund managers plan to integrate Ethereum’s staking mechanism—which supports the network and rewards investors—into their ETF structures.

Earlier this month, REX Shares and Osprey Funds launched the first Solana ETF with staking support. This move has paved the way for a similar model with Ethereum. Expectations that the SEC will approve staking-enabled ETFs are further boosting institutional interest. Experts suggest this could mark the beginning of a new era for Ether ETFs.

Additionally, on July 23, 2025, while Bitcoin ETFs saw $83 million in outflows, Ethereum ETFs attracted $332.2 million in inflows. And this trend may just be the beginning. Investors are now viewing Ether ETFs not only for price exposure but also for their potential to generate passive income.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.