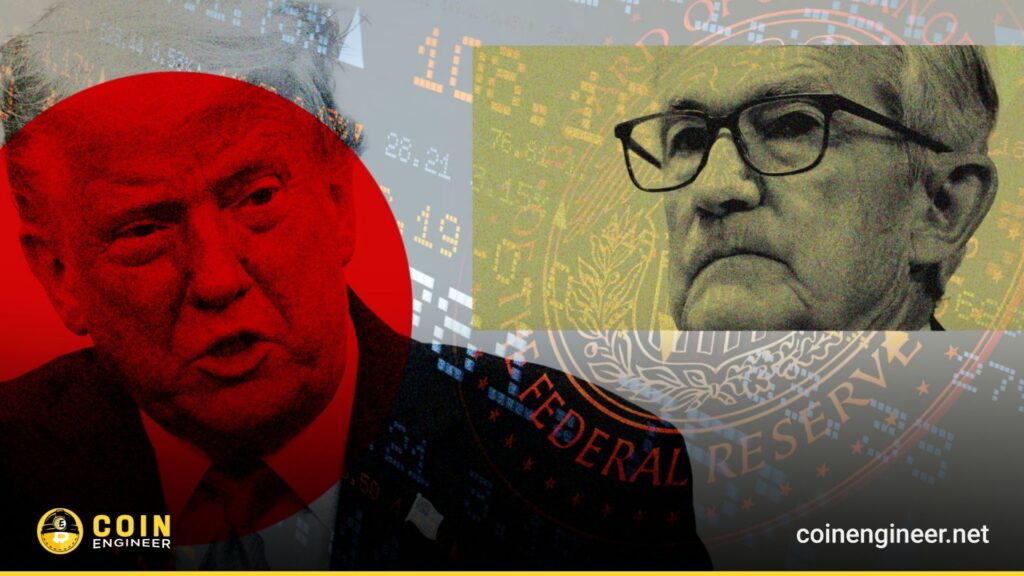

A sudden announcement from the White House has put financial markets on high alert: U.S. President Donald Trump is set to visit the Federal Reserve building tonight at 4 p.m. ET. While details remain undisclosed, the financial world is abuzz with speculation about a potential private meeting between Trump and Fed Chair Jerome Powell.

Tensions Rise Between Trump and Powell

Trump’s relationship with Powell has long been strained. Over the years, Trump has publicly criticized the Fed Chair, calling him “incompetent” and blaming him for major economic setbacks. Just days ago, Trump remarked, “He should cut rates by 3%. He’s on his way out anyway.” Such remarks have fueled rumors that Trump may be preparing to replace Powell as soon as his term ends.

This mounting pressure from the White House has begun to echo across global markets. Within just four hours of the announcement, over $305 million was liquidated in the crypto market. Bitcoin dipped sharply to $117,950, reflecting a 1.68% decline as investors reacted to the uncertainty.

Treasury Secretary Speaks on Interest Rate Cuts

Meanwhile, Treasury Secretary Scott Bessent added to the volatility with his latest comments. Speaking on Fox News, Bessent stated that 1 or 2 rate cuts could be on the table later this year. He also confirmed that discussions around Powell’s successor are already underway, with new Fed chair candidates likely to be revealed by December or January. Rumors suggest Trump has already begun interviewing potential replacements behind closed doors.

Altcoins Under Pressure, Fear Index on the Rise

As political pressure on the Federal Reserve intensifies, the ripple effects are being felt across both traditional and digital asset markets. Traders have increasingly shifted to short positions, anticipating further price drops. The altcoin sector has been particularly hard hit, with widespread pullbacks contributing to a rising fear index among investors.

If the standoff between Trump and the Fed continues, it could signal a major turning point for global monetary policy — and a critical moment for both Wall Street and crypto investors.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram ,YouTube and Twitter channels for the latest news and updates.