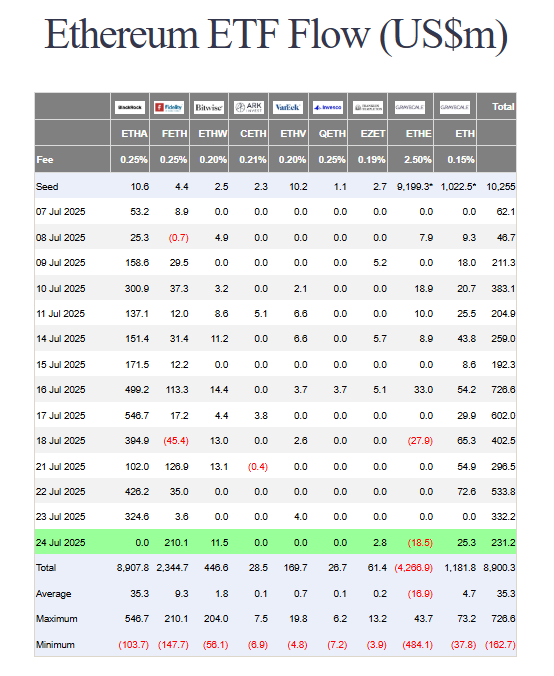

U.S.-based spot Ethereum ETFs recorded $2.4 billion in net inflows over the last six trading days. During the same period, Bitcoin ETFs attracted just $827 million—highlighting Ethereum’s growing institutional appeal. This sharp contrast highlights a growing institutional interest in Ethereum.

BlackRock’s iShares Ethereum ETF (ETHA) led the pack, attracting $1.79 billion—accounting for approximately 75% of total ETH ETF inflows in that period.

ETHA also became the third-fastest ETF ever to reach $10 billion in assets under management, hitting the milestone in just 251 trading days. This achievement signals rising confidence and expectations around Ethereum. Fidelity’s Ethereum Fund (FETH) had its best-performing day on Thursday, July 25, recording $210 million in net inflows—4% higher than its previous record set on December 10, 2024.

Institutions Are Accumulating ETH

Interest in Ethereum isn’t limited to ETFs. BitMine Immersion Technologies purchased $2 billion worth of ETH in the past 16 days, making it the largest institutional ETH holder. Total ETH held by public companies now stands at 2.31 million, representing 1.91% of Ethereum’s circulating supply. This figure continues to rise and has the potential to put upward pressure on market supply.

Galaxy Digital CEO Michael Novogratz predicted that Ethereum would outperform Bitcoin over the next six months and suggested ETH could reach $4,000. He also warned that large-scale purchases by firms like BitMine and SharpLink Gaming could trigger a supply shock in the market.

Cooling Signs for Bitcoin ETFs

Bitcoin ETFs ended their 12-day inflow streak on July 22, posting $131 million in net outflows. This came after they had attracted $6.6 billion during the previous 12-day run. Swissblock Research stated the trend may persist, noting, “ETH is positioning itself as the next cycle leader.” The strong performance of Ethereum ETFs supports this view.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.