Investor interest in Ethereum-based spot exchange-traded funds (ETFs) continues to climb. According to recent data, spot Ether ETFs recorded $452.72 million in net inflows on Friday, marking their 16th consecutive day of positive flows. This strong trend has pushed the total net assets of these funds to $20.66 billion.

BlackRock’s ETHA Dominates with Massive Inflow

BlackRock’s iShares Ethereum Trust (ETHA) led the way once again, pulling in $440.10 million in a single day. The fund’s assets under management have now reached $10.69 billion, securing its position as the largest Ethereum ETF in the U.S. market.

Bitwise’s ETHW followed with $9.95 million, while Fidelity’s FETH fund attracted $7.30 million. On the flip side, Grayscale’s ETHE product continued to lose investors, seeing an outflow of $23.49 million on Friday. Cumulatively, ETHE has now lost $4.29 billion, the largest net outflow among all Ether ETFs.

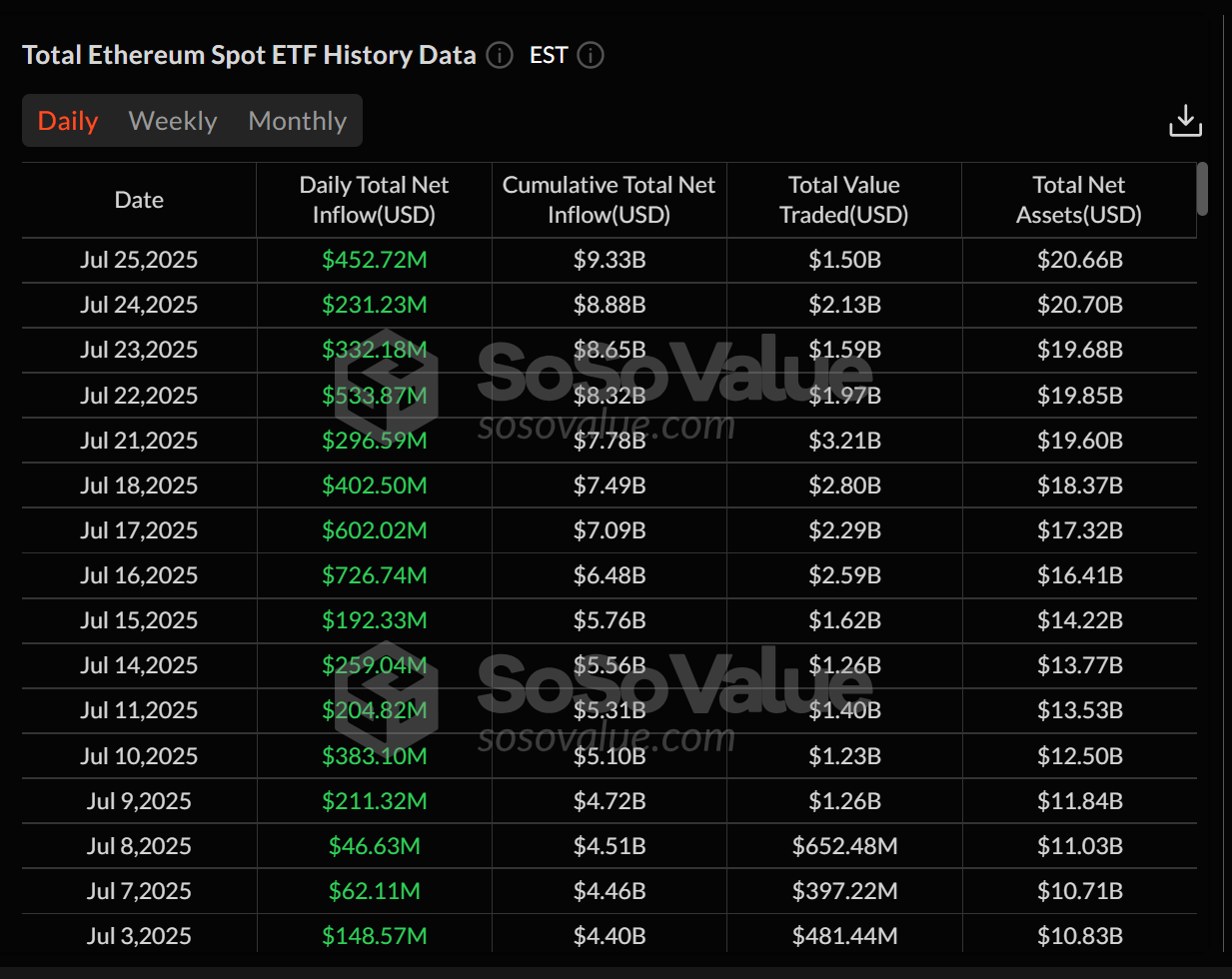

Total net inflows across all U.S. spot Ether ETFs have reached $9.33 billion since launch. These products now represent approximately 4.64% of Ethereum’s total market cap. On Thursday alone, total trading volume in Ether ETFs stood at $1.5 billion.

16-Day Momentum Shows No Signs of Slowing

The ongoing inflow streak began on July 2 and has continued without interruption for 16 trading days. The highest single-day inflow occurred on July 16, totaling $726.74 million. Several sessions during this run have recorded over $300 million in inflows. Since the beginning of the streak, total net inflows have more than doubled from $4.25 billion to $9.33 billion.

This surge in demand is largely driven by institutional investors, who are increasing exposure to ETH thanks to its expanding role in DeFi, staking, and smart contract infrastructure.

Matt Hougan, CIO at Bitwise, cited the growing interest in stablecoins and tokenization as key drivers for continued long-term inflows into Ethereum-based ETPs. According to Hougan, the combined demand from ETFs and institutional buyers could reach $20 billion over the next year — equivalent to roughly 5.33 million ETH at current prices. Meanwhile, Ethereum’s network is expected to issue only 800,000 ETH in that period, implying demand could exceed supply by a factor of seven.

Bitcoin ETFs Also See Renewed Activity

While Ethereum ETFs have stolen the spotlight, Bitcoin spot ETFs also showed renewed strength with $130.69 million in net inflows on Friday. This comes after a volatile mid-July period that saw outflows of $131.35 million on July 21, followed by additional losses of $67.93 million and $85.96 million on July 22 and 23.

These new inflows brought total net assets in Bitcoin ETFs to $151.45 billion, with total cumulative net inflows now standing at $54.82 billion.

Despite the recent turbulence, July has delivered some standout sessions for Bitcoin, including inflows of $1.18 billion on July 10 and $1.03 billion on July 11 — further signaling that institutional demand for crypto remains strong across both major assets.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.