Ethereum futures contracts traded on the Chicago Mercantile Exchange (CME) have reached an all-time high open interest (OI) of $7.85 billion. This development highlights institutional investors’ increasing confidence in ETH.

According to CryptoQuant analyst Maartunn, this growth is the result of a combination of risk-hedging and expectations of price appreciation. Fund managers are using derivative products to hedge their positions while continuing to seize upside opportunities.

Another indicator supporting this institutional movement is the rise of spot ETH ETFs. Data from SoSo Value reveals that spot Ethereum ETFs have seen uninterrupted inflows for the past 16 days, with total inflows exceeding $5 billion during this period.

ETF Inflows Accelerate, BlackRock Leads

Ethereum ETFs are currently experiencing the strongest streak of inflows since their launch. BlackRock’s ETH ETF is leading this trend and currently holds nearly 3 million ETH. According to ETF analyst Nate Geraci, net inflows into the funds reached $452.72 million on July 25 alone. This figure marks the fourth-largest single-day inflow in Ethereum ETF history.

Moreover, ETH ETFs have outperformed Bitcoin ETFs in terms of performance over the past 7 days. This indicates that investors are increasing their positions in favor of ETH and that new capital flows are shifting accordingly.

Whale Addresses Increase, Technical Indicators Support the Rally

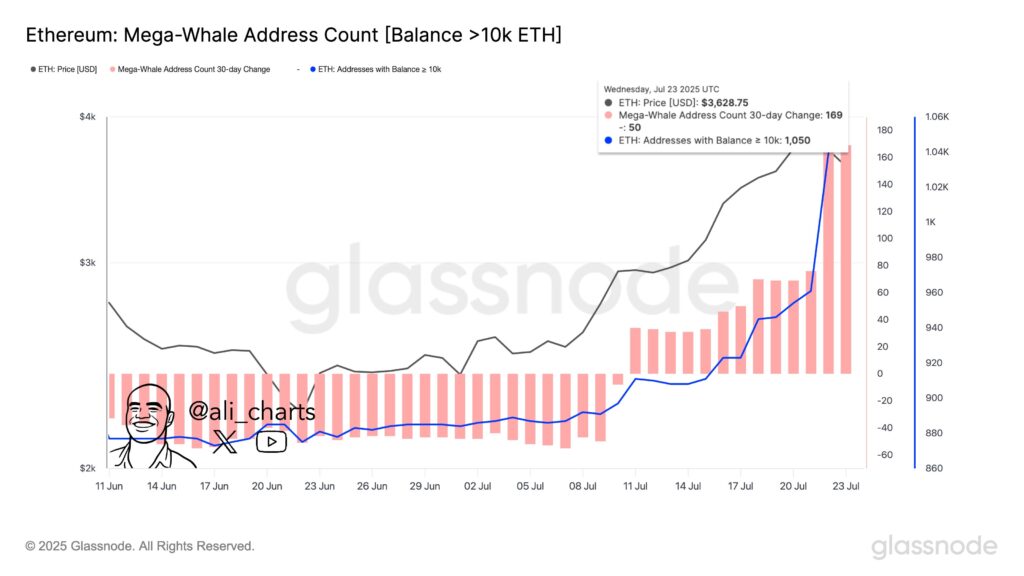

Institutional movement isn’t limited to ETFs. Data from Glassnode shows that 170 new addresses holding more than 10,000 ETH have been added to the network in the last 30 days. This increase has brought the total number of such mega whale wallets to 1,050. These types of wallets usually belong to custodial institutions and indicate a strong accumulation trend.

The price of ETH is currently trading at $3,771. It has risen by 2.41% in the past 24 hours, while daily trading volume has decreased by 40% to $25.38 billion. The total market capitalization has reached $452 billion.

On the technical side, analyst Merlijn The Trader noted using TradingView data that Ethereum is still moving within its long-term primary channel. This channel previously generated strong reversal signals in 2018 and 2021. Additionally, RSI data indicates that ETH is not currently in overbought territory, suggesting that the rally remains healthy.

The acceleration in institutional buying, the record open interest in futures, increased ETF inflows, and the rise in mega whale wallets may all create upward pressure on Ethereum’s price in the coming period. The direction of institutional capital appears to favor ETH.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.