Today 27 July 2025, at approximately 10:13 UTC+8, the address 0x17…a132, associated with Justin Sun, withdrew 60,000 ETH from the Lido protocol and immediately deposited the same amount into the Aave platform. The value of the transaction, based on the prevailing market prices at that time, was recorded as approximately $226 million.

Why Is This Move Significant?

-

Liquidity and DeFi Ecosystem Impact

This massive withdrawal of ETH from Lido has further extended the unstake (exit) queue on Lido, signaling potential strain on the protocol’s processing capacity. -

Spike in Aave Borrow Rates

As ETH flow into Aave surged, the platform’s borrowing rates climbed above 10%. Consequently, many derivative strategies—especially stETH–ETH looping setups—faced rising funding costs, resulting in losses or forced closures.

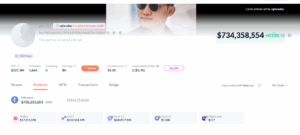

The total ETH and equivalents held in Justin Sun’s wallet are as follows:

- 197,xxx ETH (held in wallet)

- 109,326.xxx stETH (staked on Lido)

- 60,422.xxx WETH (deposited into Aave)

Following this move, the combined ETH holdings across Lido and Aave for this address reached approximately $630 million.

You might also find this article interesting: PUMP Token Soars: Pump.fun Rewards Plan Revealed!

What Is Justin Sun Trying to Achieve?

-

Liquidity Control and DeFi Fragility

-

A single entity moving such a large amount of ETH can destabilize protocol dynamics.

-

The exit queue on Lido lengthens; increased supply on Aave can cause borrowing rates to spike. DeFi remains vulnerable to these centralized pressures.

-

-

Strategic Risk or Opportunity?

-

Analysts view this move as a strategic attempt to avoid stETH–ETH volatility and deploy a more controlled, yield-bearing position in Aave.

-

-

Whale Influence on Market Psychology

-

Moves by large players like Justin Sun can induce short‑term swings in ETH price. Traders often adjust positions in response to such signals.

-

Today’s transaction isn’t just a move by an ICO investor—it stands out as a major event that directly impacts the borrowing, staking, platform risk, and behavioral psychology within the Ethereum ecosystem. It shows that even in decentralized systems, bold maneuvers by a single wallet can carry substantial influence beyond mere HODLing.

Visit Coinmuhendisi.com for all content and detailed news, and don’t forget to follow us on Google News!