Innovative projects in the cryptocurrency world continue to transform financial systems. Treehouse (TREE) is a protocol that brings a fresh perspective to the DeFi ecosystem by offering fixed-income financial products. Aiming to address the lack of reference rates in traditional finance, Treehouse stands out with innovative tools like tAssets and Decentralized Offered Rates (DOR). In this article, we will explore what Treehouse (TREE) is, how it works, its tokenomics structure, founders, and investors in detail.

What is Treehouse?

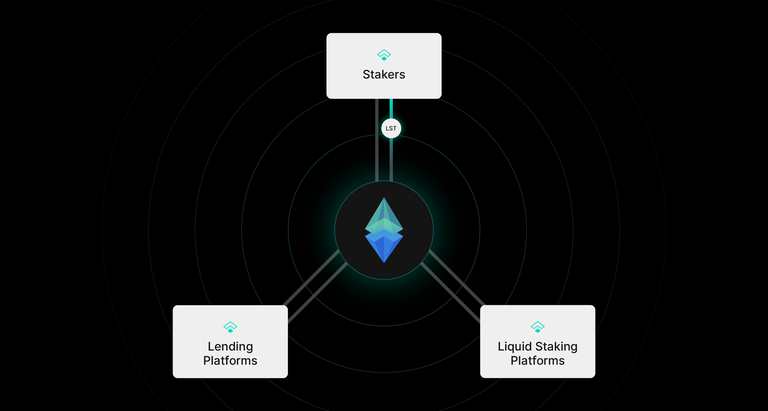

Treehouse is a decentralized application (dApp) that provides fixed-income financial products in the DeFi market. The protocol, particularly focused on Ethereum-based assets, offers fixed-income solutions, consolidating fragmented interest rates and creating a more reliable financial infrastructure. The core innovations of Treehouse are tAssets, which are liquid staking tokens, and the DOR (Decentralized Offered Rates) mechanism. Users deposit ETH or liquid staking tokens (LST) into the protocol to receive tETH, earning real yield through interest rate arbitrage.

Treehouse aims to solve the issue of interest rate fragmentation in DeFi, creating a more predictable and efficient ecosystem for both individual and institutional investors. Additionally, the DOR system establishes a consensus mechanism among stakeholders to provide accurate interest rate data.

The Story of Treehouse

Treehouse originated from a team that started as Treehouse Analytics during the 2020 DeFi summer, developing on-chain risk analytics tools. The 2022 market crash highlighted the lack of reliable reference rates in DeFi. Seeing this crisis as an opportunity, the team published a theoretical work titled “One Rate To Rule Them All” and developed the Treehouse Protocol. Combining traditional finance expertise with crypto knowledge, the team aims to accelerate the institutional adoption of DeFi.

How Does Treehouse Work?

Treehouse’s functionality is built on two core components: tAssets and DOR.

tAssets and tETH

tETH is Treehouse’s liquid staking token, offering real yields that exceed Ethereum’s risk-free rate. Users deposit ETH or other liquid staking tokens into the protocol to receive tETH. This token provides additional yield through interest rate arbitrage and can be used on DeFi platforms. The yield from tETH is generated as follows:

- Base Yield: tETH is based on the yield obtained from liquid staking tokens (LST).

- Enhanced Yield: The protocol uses LSTs as collateral to borrow ETH, which is then converted back into LSTs to earn additional Ethereum PoS rewards.

- Additional Rewards: tETH holders can also benefit from rewards such as points campaigns.

tETH also serves as a tool to enhance the security of the DOR system and helps converge fragmented ETH interest rates toward Ethereum’s risk-free rate.

Decentralized Offered Rate (DOR)

DOR is Treehouse’s interest rate determination consensus mechanism. Similar to reference rates like LIBOR or SOFR in traditional finance, DOR incentivizes stakeholders to provide accurate and transparent interest rate data. The system operates with the following roles:

- Operators: Initiate DOR feeds and maintain system integrity. Treehouse, as the first operator, creates the Treehouse Ethereum Staking Rate (TESR) curve.

- Panelists: Expert entities providing interest rate data or forecasts. Only rigorously vetted panelists can take on this role.

- Referencers: Entities that integrate DOR data into their financial products.

- Delegators: Users who delegate tAssets to panelists to participate in the DOR process.

DOR produces reference rates based on objective data, protecting against manipulation. For example, TESR measures the average daily yield of validators on the Ethereum network, serving as a reference point in the staking market.

What is the TREE Token?

TREE is the native utility and governance token of the Treehouse Protocol. Built on the ERC-20 standard, this token has a total supply of 1 billion. TREE is designed to support ecosystem growth, coordinate incentives among stakeholders, and strengthen governance processes.

Use Cases of the TREE Token

- Query Fees: Smart contracts or businesses using DOR data pay with TREE.

- Panelist Staking: Panelists stake TREE or tAssets to ensure accurate predictions.

- Consensus Payouts: Panelists and delegators who make accurate predictions receive TREE rewards.

- Governance: TREE holders have a say in determining protocol parameters.

- DAO Grants: The Treehouse DAO allocates TREE for strategic partnerships and ecosystem projects.

Treehouse’s Solutions

- Fragmented Interest Rates: The issue of varying interest rates for the same assets across different DeFi platforms is addressed by Treehouse’s tETH and DOR systems.

- Lack of Professional Financial Infrastructure: Reference rates, standard in traditional finance, are missing in DeFi. Treehouse bridges this gap with DOR.

- Limited Access to Yield Optimization: Arbitrage strategies accessible to institutional investors are made available to retail users through tETH.

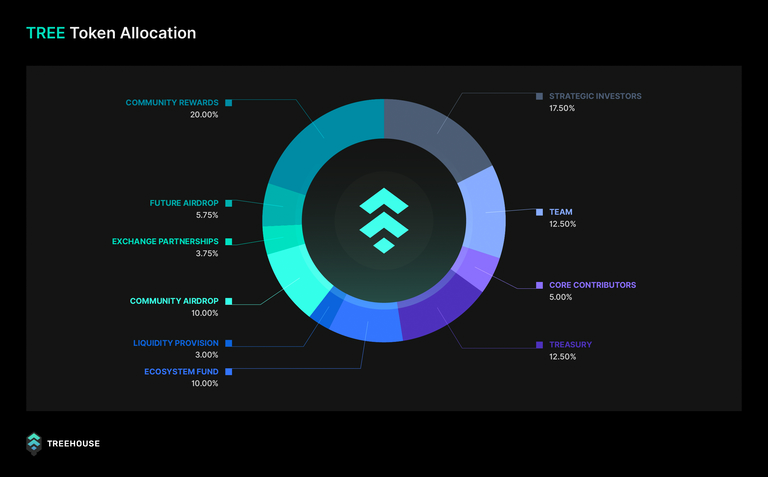

Treehouse (TREE) Tokenomics

The distribution of the TREE token is planned to ensure sustainable growth and stakeholder alignment. The breakdown of the total supply is as follows:

- Community Rewards (20%): Incentivizes user participation in staking, governance, and protocol activities.

- Strategic Investors (17.5%): Allocated to early supporters, subject to a vesting schedule.

- Team (12.5%): Reserved for the core team with vesting for long-term commitment.

- Treasury (12.5%): Managed by the DAO for future protocol needs.

- Community Airdrop (10%): Distributed to early contributors and testers.

- Ecosystem Fund (10%): Supports developers and DOR-based products.

- Core Contributors (5%): Allocated to those contributing to protocol design.

- Exchange Partnerships (3.75%): Reserved for exchanges to enhance liquidity and access.

- Future Airdrops (5.75%): Reserved for growth campaigns.

- Liquidity Provision (3%): Supports on-chain liquidity pools.

Supply and Unlock Schedule

TREE tokens are released gradually over a 48-month vesting schedule to prevent sudden supply increases and ensure long-term sustainability.

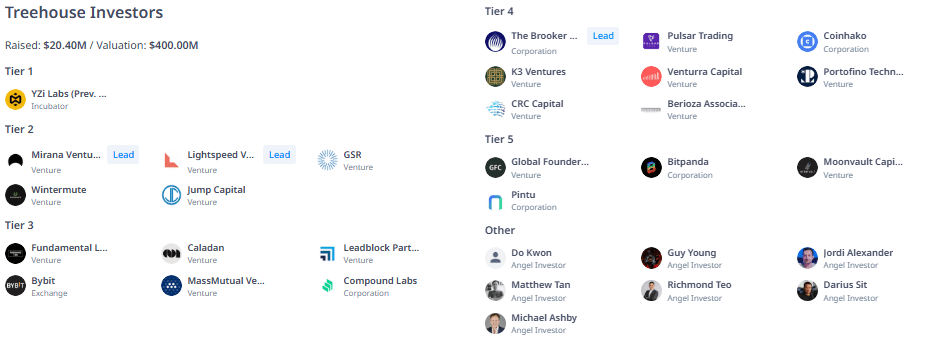

Treehouse Investors and Funding

Treehouse raised $20.4 million, reaching a $400 million valuation. Its investors include:

- Tier 1: YZi Labs (formerly Binance Labs)

- Tier 2: Mirana Ventures, Lightspeed Venture Partners, GSR, Wintermute, Jump Capital

- Tier 3: Fundamental Labs, Caladan, Leadblock Partners, Bybit, MassMutual Ventures, Compound Labs

- Tier 4: The Brooker Group, Pulsar Trading, Coinhako, K3 Ventures, Venturra Capital, Portofino Technologies, CRC Capital, Berioza Associates

- Tier 5: Global Founders Capital, Bitpanda, Moonvault Capital, Pintu

- Angel Investors: Do Kwon, Guy Young, Jordi Alexander, Matthew Tan, Richmond Teo, Darius Sit, Michael Ashby

Treehouse Founders

- Brandon Goh (CEO): The leader shaping Treehouse’s vision.

- Kang Loh (CSO): Co-founder responsible for strategic operations.

- Bryan Goh: Co-founder playing a key role in protocol development.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.