Inflows to spot Bitcoin and Ethereum ETFs on July 28 demonstrated that institutional investor interest remains strong. Notably, IBIT stood out with its remarkable performance at the top.

IBIT Leads Inflows in Spot Bitcoin ETFs

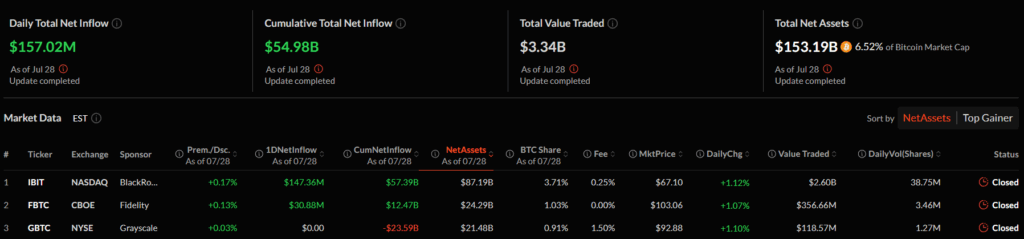

Spot Bitcoin ETFs recorded a total net inflow of $157 million on July 28. This marks the third consecutive day of positive net inflows. BlackRock’s IBIT ETF was the day’s leader with an inflow of $147 million, reflecting investors’ long-term confidence in Bitcoin.

Moreover, IBIT accounted for 93% of the total daily inflow, clearly showing it as the preferred product among institutional investors.

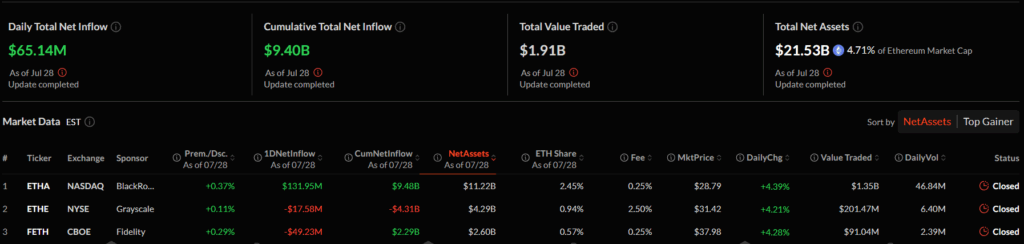

Momentum also continues in spot Ethereum ETFs. On the same day, spot ETH ETFs saw a net inflow of $65.14 million, marking the 17th consecutive day of positive net inflows. This indicates growing institutional interest in Ethereum as well. Ethereum ETFs recorded $1.59 billion in inflows last week, the second-largest weekly total in the asset’s history.

Last week, Bitwise CIO Matt Hougan noted increasing interest in DeFi, staking, and tokenization, predicting continued demand for Ethereum ETFs. Institutions and ETFs are expected to generate $20 billion in ETH demand next year, while only 800,000 ETH will be issued.

Other spot BTC ETFs contributed more modestly. However, the overall positive picture signals optimism for the sector. The consecutive inflows into US-based spot crypto ETFs indicate a sustained market recovery and renewed institutional confidence. Strong demand for large funds like IBIT reaffirms investors’ belief in Bitcoin’s long-term value.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.