On July 29, 2025, spot Ethereum and Bitcoin ETFs recorded a total net inflow of $298.61 million. Institutional investors’ interest in crypto assets continues to strengthen.

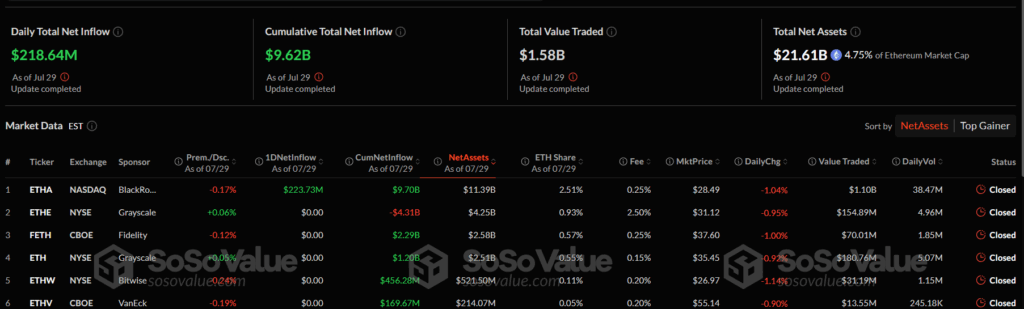

Ethereum ETFs saw an inflow of $218.64 million, marking the 18th consecutive day of positive net inflows. The largest contribution came from BlackRock’s ETHA ETF, which received $223.73 million in a single day. ETHA’s total assets under management rose to $11.39 billion.

Currently, total spot Ethereum ETFs have reached a net asset size of $21.61 billion. Daily trading volume stands at $1.58 billion.

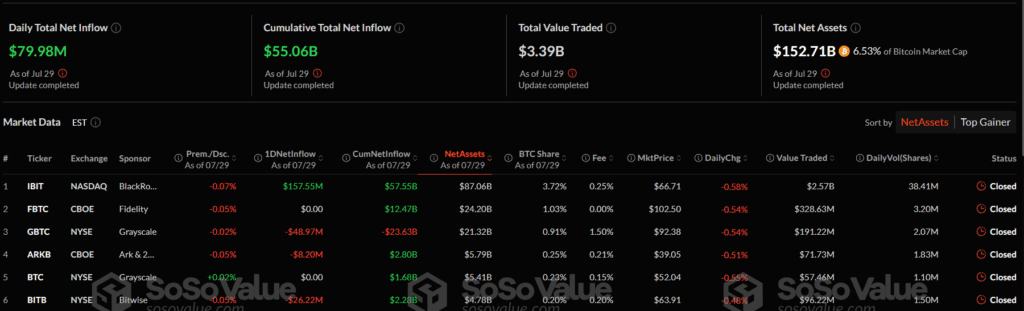

On the same day, spot Bitcoin ETFs also experienced a net inflow of $79.97 million, closing positive for the fourth consecutive day. BlackRock’s IBIT ETF was again the standout product of the day. Continued institutional inflows support price stability on the Bitcoin side as well.

During the same period, notable activity was observed in the Bitcoin spot ETF options market. As of July 28, the daily net open interest (delta) exceeded $215 million. Total nominal open interest reached $24.67 billion, while the call/put ratio remained at 1.96. Meanwhile, on July 29, total trading volume was $927 million, with BlackRock’s IBIT options dominating nearly the entire volume at $918 million. These figures reveal that institutional interest in Bitcoin ETFs is not limited to the spot market.

Supply-Demand Risk Increasing for Ethereum

Bitwise CIO Matt Hougan highlighted the growing interest in staking and tokenization use cases. According to him, this demand is boosting interest in Ethereum ETFs. Hougan predicts that next year, $20 billion worth of ETH demand could arise through ETFs and institutions.

However, Ethereum’s annual issuance is limited to only 800,000 ETH. This means demand could exceed supply by approximately seven times. The potential supply squeeze may exert upward pressure on Ethereum prices.

Institutional investor interest in both Ethereum and Bitcoin ETFs has surged rapidly in recent days. This trend could signal the start of a new institutional cycle in crypto assets.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.