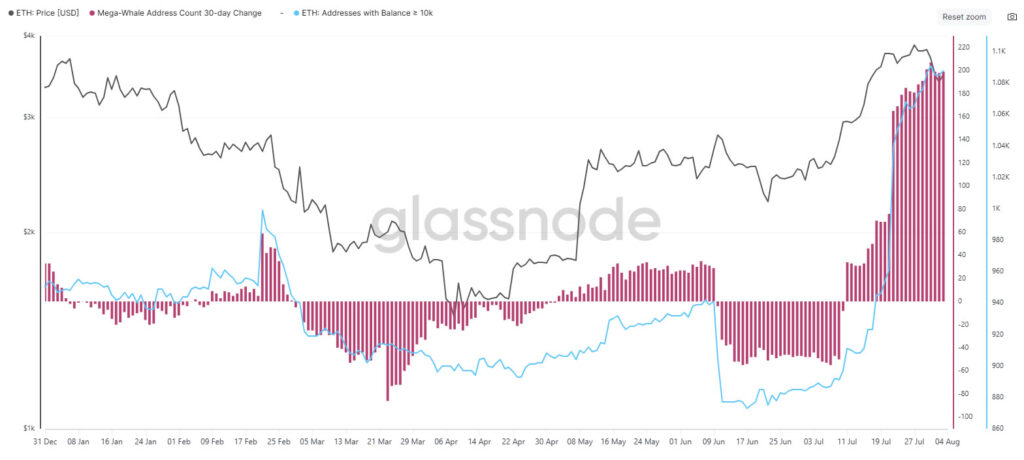

Over the weekend, Ethereum briefly dipped in price — yet onchain data revealed continued accumulation by large-scale investors. Especially among mega whale addresses, the pullback was viewed as a buying opportunity.

Blockchain analytics firm Arkham Intelligence reported Sunday that one unnamed address purchased approximately $300 million worth of Ether through OTC trades via Galaxy Digital. The address currently holds 79,461 ETH, valued at around $282.5 million.

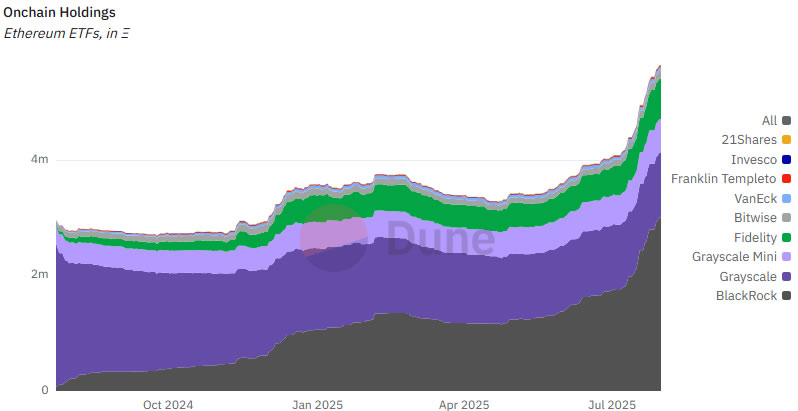

Meanwhile, institutional demand continued to rise. BlackRock’s iShares Ethereum Trust ETF saw a staggering $1.7 billion in inflows over the past 10 consecutive trading sessions.

Institutional Demand and ETF Inflows Drive Ethereum Accumulation

This rising interest is also reflected in Ethereum’s onchain ETF holdings. According to Dune Analytics, Ether held in ETFs surged by more than 40% over the past 30 days.

Glassnode data confirmed a sharp increase in the number of Ethereum “mega whale” addresses. Since early July, more than 200 new addresses holding over 10,000 ETH have been added to the network.

Many of these addresses belong to centralized exchanges, custodians, and ETF products—highlighting a strategic accumulation trend.

Dip Followed by Buying Frenzy: How the Market Reacted

Ethereum dropped below the $3,400 level over the weekend but rebounded on Monday, regaining the $3,560 mark.

Monika Mlodzianowska, Director of Strategic Partnerships at CoinW exchange, noted that a cooling labor market initially triggered investor caution. However, renewed expectations for monetary easing are likely to fuel liquidity and bolster crypto prices.

During the same period, Eric Trump — son of U.S. President Donald Trump — urged his followers on X to “buy the ETH dip.” Meanwhile, CNBC referred to Ethereum as “Wall Street’s invisible backbone” in a Saturday feature.

Historically, Ethereum’s August performance has been mixed. The asset posted double-digit losses in 2023 and 2024 but soared over 35% in August 2021 during the bull run. As a result, investors remain focused on both historical patterns and onchain signals.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.