INFINIT is an AI-powered DeFi Intelligence Platform aiming to make the decentralized finance (DeFi) space more intuitive, accessible, and efficient. The platform allows users to discover, analyze, and execute on-chain opportunities with a single click, using DeFi Agents. These agents assist users with yield discovery, social trend tracking, and strategy analysis.

Project Idea

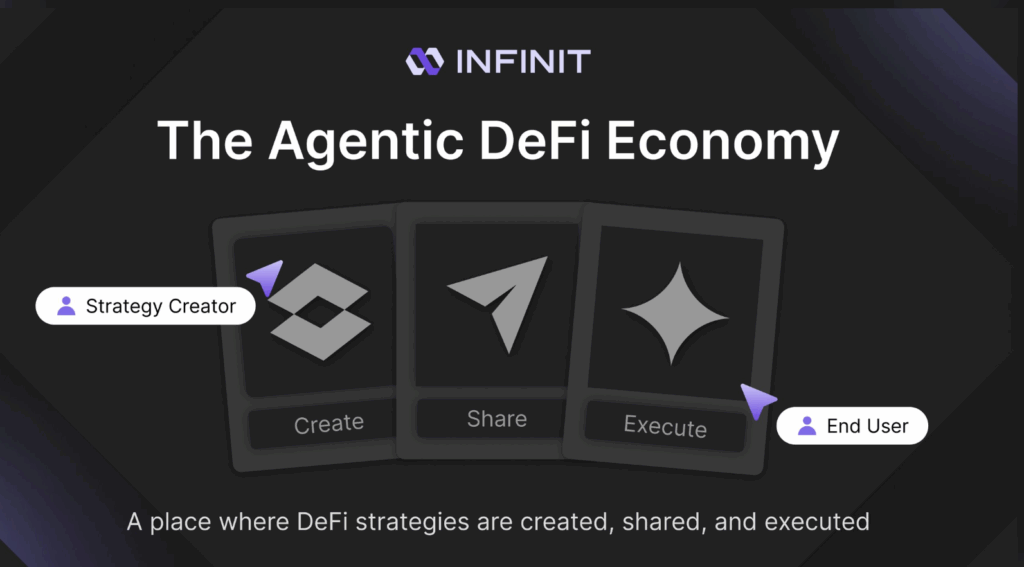

INFINIT was designed to reduce the complexity of DeFi. It enables strategy creators to turn their knowledge into income-generating strategies without dealing with technical details. Users can then apply these strategies with just one click, without needing deep understanding.

How It Works

- Users receive personalized strategy suggestions based on wallet history, asset structure, and risk profile.

- The AI-powered system translates natural language inputs into on-chain actions for seamless execution.

- Strategies combine multiple steps and protocols into a single transaction, simplifying complex multi-chain operations.

- Assets remain in the user’s wallet, and all operations are non-custodial.

What is the IN Token?

IN is the native governance and utility token of the INFINIT platform.

Use Cases:

- Protocol Fees: IN holders earn a share of execution fees from DeFi Agents and strategies.

- Advanced Product Access: By staking IN, users unlock benefits like fee discounts, early access to features, and higher daily usage limits.

- Protocol Governance: IN stakers vote on upgrades, fee structures, and integrations.

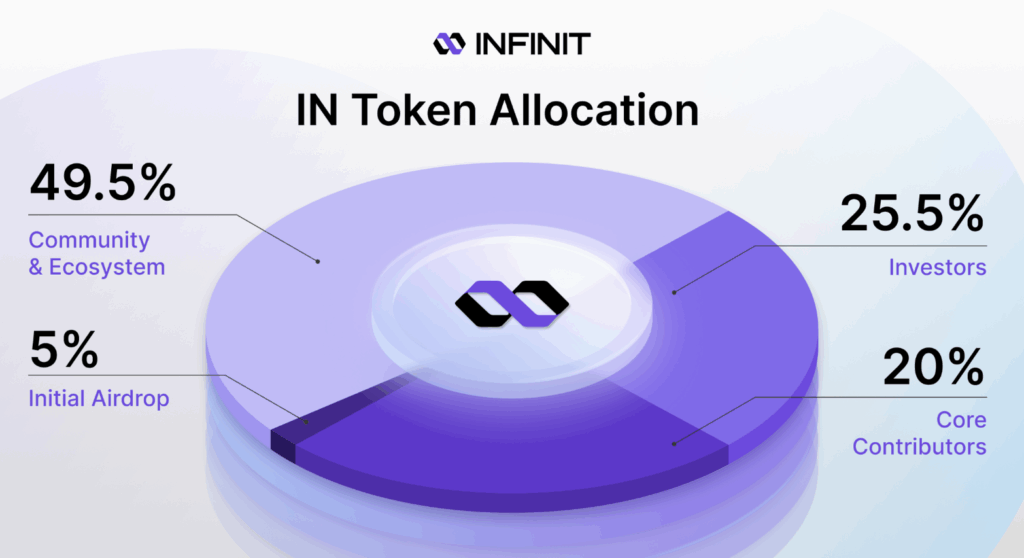

INFINIT (IN) Tokenomics

- Total Supply: 1,000,000,000 IN (fixed, no burn mechanism)

- Circulating Supply: 228,330,000 IN

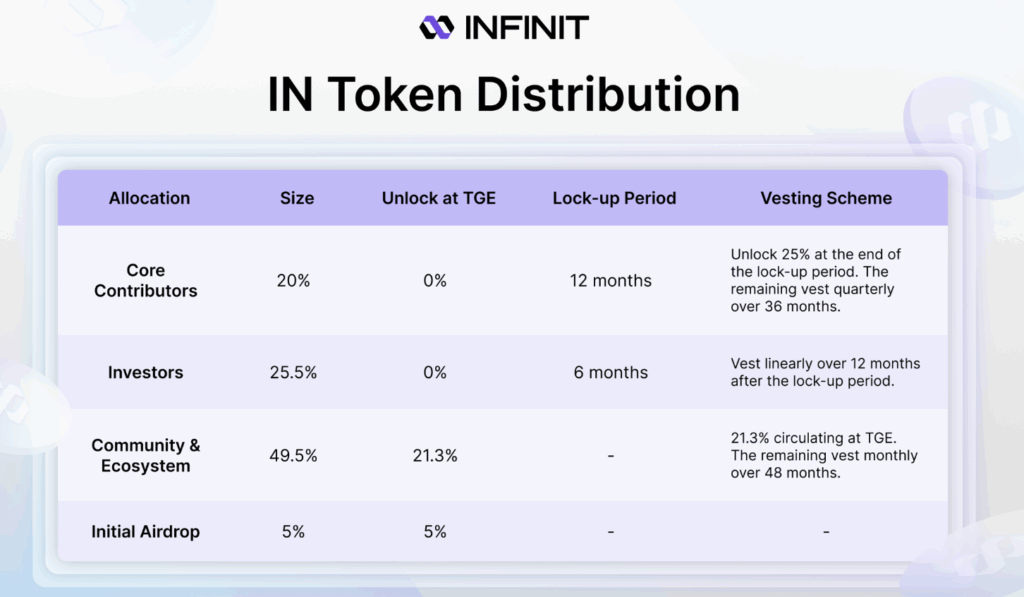

Token Allocation:

- 49.5% Community & Ecosystem: For growth, partnerships, strategy creator rewards, and user acquisition.

- 25.5% Investors: For early-stage growth support.

- 20% Core Contributors: For ongoing development by the core team.

- 5% Initial Airdrop: Rewarding early users and the community.

Distribution & Vesting

- 26.3% of total supply will be in circulation at TGE:

- 21.3% Community & Ecosystem

- 5% Airdrop

Vesting Schedules:

- Core Contributors (20%): 12-month lock-up, followed by 36-month vesting.

- Investors (25.5%): 6-month lock-up, followed by 12-month vesting.

- Community & Ecosystem (28.2%): Vesting over 48 months.

Investors and Partners

Although the full investor list has not been disclosed, early-stage investors are subject to a 1.5-year vesting period—indicating long-term commitment.

The integration of social media strategy and a monetization model supporting direct collaboration with KOLs (Key Opinion Leaders) opens new revenue streams for content creators and protocol developers.

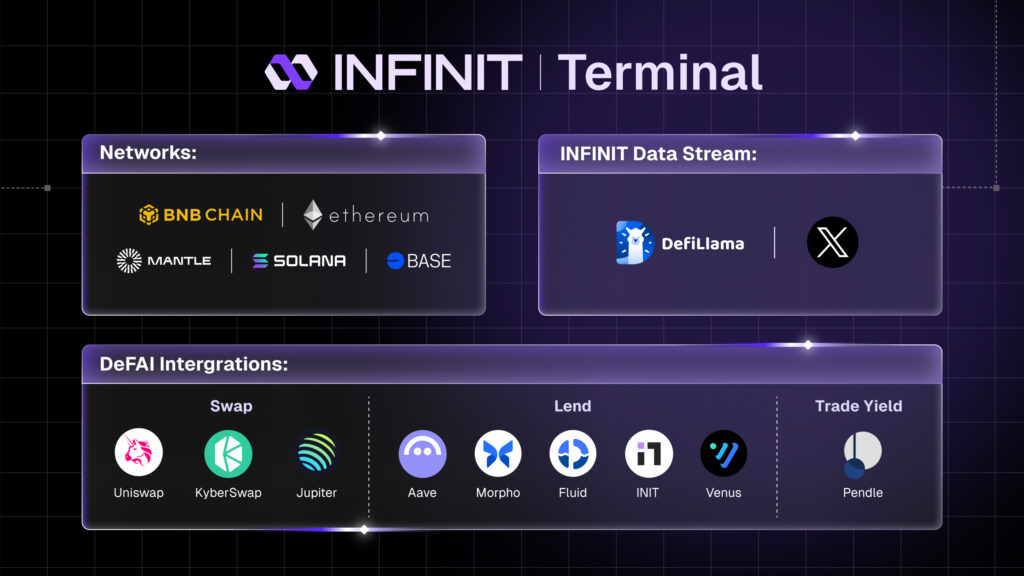

Ecosystem Overview

The INFINIT ecosystem includes:

- DeFi Agents: Smart agents executing swaps, loans, and bridging on behalf of users.

- Strategy Creators: KOLs and advanced DeFi users who generate strategies via natural language prompts and earn from their usage.

- INFINIT Strategy Hub: A central hub for discovering, testing, and applying strategies.

- IN Stakers: Participants sharing in protocol revenue and governance through staking.

Features & Technical Highlights

- One-Click Multi-Step Transactions

- Social Strategy Integration

- Direct Monetization for KOLs

- Cross-Chain Execution Support

- Real-Time Web3 Insights

- Discovery, Yield & Insight Agents

- Prompt-to-Strategy Builder

- Wallet-Based Suggestions & Simulation Preview

- Private Strategies & Institutional Integration (Q1 2026)

Adaptive Roadmap

Q3 2025

- One-Click AI Agent Swarm Execution

- Social Strategy Integration (KOL content → executable strategies)

- Binance announced INFINIT (IN) listing on both Binance Alpha and Binance Futures.

Q4 2025

- INFINIT Trust Score

- Public Strategy Creation Tools

Q1 2026

- Private Strategy Infrastructure

- Permissionless Agent Development

- Institutional Bridging (TradFi, Web2, Fintech)