Minneapolis Fed President Neel Kashkari stated that the U.S. economy is slowing down, and this situation could bring new steps in terms of interest rate policy. Recent statements have strengthened rate cut expectations in the markets.

Clear Signs of Economic Slowdown

In his remarks, Kashkari clearly stated that the economy is slowing. On the other hand, he noted that the impact of tariffs on inflation is still not fully understood. Despite this uncertainty, he said it may still be appropriate to begin adjusting the policy rate in the short term.

Two Rate Cuts Still Possible This Year

Kashkari stated that two rate cuts by the end of 2025 are still a valid scenario. However, there is an important condition here: if inflation starts to rise due to tariffs, the Fed may halt these cuts or even shift to a rate hike if necessary.

“Reversing Course May Be Better Than Waiting”

Kashkari emphasized that the time may have come to reverse course in rate policy, stating, “Reversing course may be better than waiting.” This message supports expectations that the Fed could move toward a monetary easing path in the fall.

Tariffs and Inflation Uncertain, But the Data is Clear

Kashkari said, “We don’t yet know what will happen with inflation, but the data we have on the slowdown is quite clear.” This indicates that the Fed may act based on growth data, even in the face of a murky inflation outlook.

Polymarket Data: Strong Rate Cuts Expectations

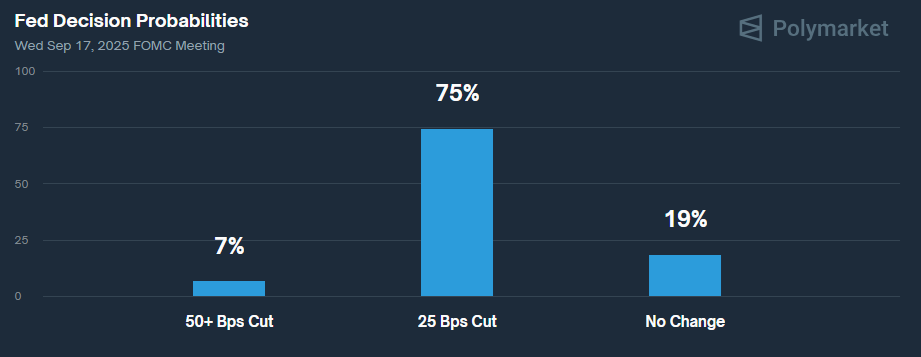

Meanwhile, with only 41 days left until the FOMC meeting on September 17, 2025, market expectations are already forming. According to Polymarket data:

-

A 7% chance of a 50 basis point cut is expected,

-

A 75% probability of a 25 basis point cut is projected,

-

A 19% likelihood suggests no change in rates.

These figures indicate that markets are largely positioning toward a rate cut scenario.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.