Balancer is a decentralized automated market maker (AMM) protocol built on Ethereum. Its goal is to provide a flexible and efficient platform where investors can swap tokens and earn passive income by providing liquidity. Thanks to its pool architecture, Balancer allows users to create custom pools and customize parameters such as swap fees.

Team and Investors

Balancer’s founding team consists of experienced names from the tech and finance sectors. The project gained early support from prominent investors and partners.

- Founder: Fernando Martinelli

- Mike McDonald: Co-founder and CTO of Balancer

Key Investors and Partners:

Investors: Major crypto funds such as Pantera Capital, Alameda Research, and Blockchain Capital have invested in Balancer, signaling strong confidence in the project.

Strategic Partners: Integrations with DeFi giants like Aave and Gnosis Protocol enabled innovative features such as “Boosted Pools.” Balancer is also integrated with chains like Polygon zkEVM, Avalanche, and Base, strengthening its multichain strategy and broadening its user base.

Project Vision

Balancer’s core idea is to bring flexibility and customization to liquidity pools in decentralized finance (DeFi). Unlike traditional AMMs, Balancer allows for pools with unequal token ratios, offering broader use cases. This enables users to build diversified portfolios and perform more efficient swaps.

How the Project Works

- The protocol is based on a system of pools where users can act as liquidity providers (LPs) and perform token swaps.

- Pools: Smart contracts combining multiple tokens. These pools range from fixed-weight to dynamic-fee types.

- Routers: Interfaces that simplify complex interactions with the Vault, making the user experience more accessible.

- Vault: The central component that manages all token and liquidity activities. All pools operate on top of the Vault.

Roadmap

Balancer’s roadmap emphasizes continuous innovation. The launch of V3 is a key milestone. Future plans include:

- More network integrations

- New pool types

- Enhanced decentralized governance

Past Milestones:

2020: Balancer launched and introduced weighted pools, allowing for flexible token ratios beyond the standard 50/50.

2021: Balancer V2 released with a single-vault architecture, lower gas fees, flexible pool types, and oracle integration.

2024 & Beyond: Balancer V3 introduced a modular structure with developer-friendly features like hooks and customizable pools.

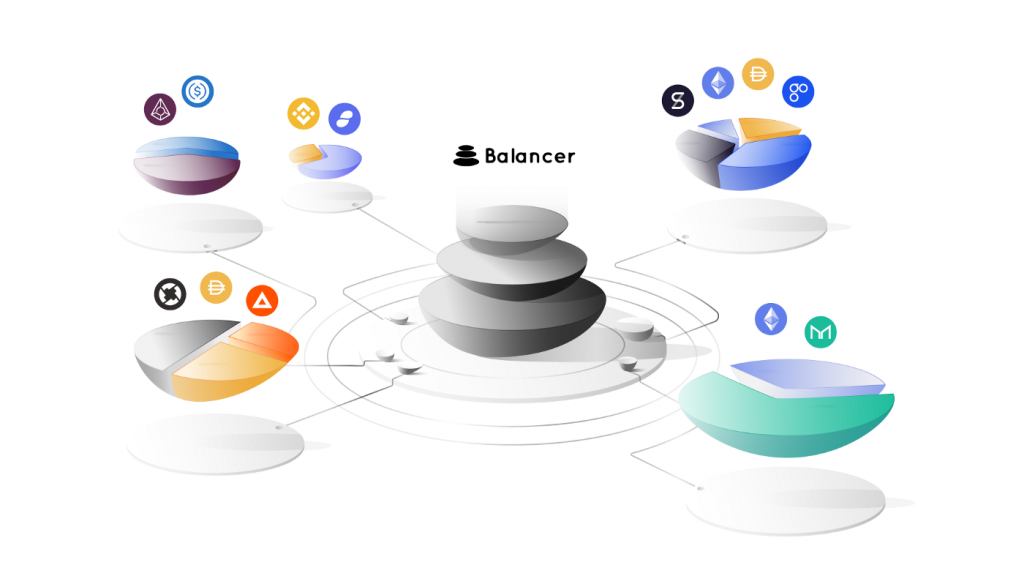

Ecosystem

The Balancer ecosystem hosts a variety of projects and products built on the protocol.

Gyroscope and Xave: Developed custom pool types leveraging Balancer’s flexible architecture.

veBAL: Represents locked BAL tokens, granting increased rewards and governance power to participants, supporting decentralization.

What Is the BAL Token?

BAL is the governance token of the Balancer protocol, giving holders the right to vote on protocol decisions. veBAL holders have increased voting power.

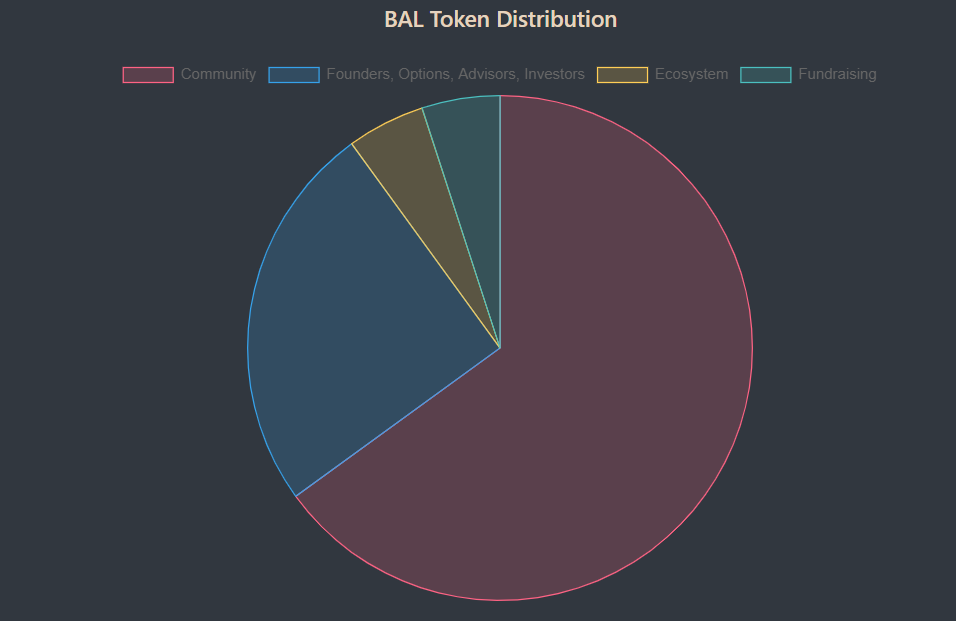

BAL Token Distribution:

- Liquidity Providers: Earn BAL based on emission schedules and veBAL voting.

- Founders, Advisors, and Investors: 25 million tokens allocated with vesting schedules.

- Ecosystem Fund: 5 million tokens for ecosystem growth and partnerships.

- Balancer Labs Fund: 5 million tokens to support operations and development.

Token Info:

- Total Supply: 69.32M BAL

- Max Supply: 96.15M BAL

- Circulating Supply: 66.66M BAL

BAL Token: Liquidity Mining & Governance

BAL is a Proof-of-Stake (PoS) token distributed through liquidity provision and governance participation—not traditional mining. The protocol rewards users for contributing liquidity instead of computational power.

Ways to Earn BAL:

- Liquidity Provision: Users earn BAL by depositing assets into Balancer pools, offering passive income and supporting liquidity depth.

- Governance Participation: BAL holders can vote on key protocol decisions, actively shaping the future of Balancer.

What Makes Balancer Unique?

Customizable Liquidity Pools: Users can create pools with any token ratio, offering flexibility compared to traditional AMMs.

Ecosystem Incentives: BAL rewards attract liquidity providers and strengthen long-term protocol growth, while promoting decentralization through governance participation.

Official Links

You can share your thoughts and comments about the topic in the comment section. Additionally, please don’t forget to follow us on our Telegram, YouTube and Twitter channels for the latest news.