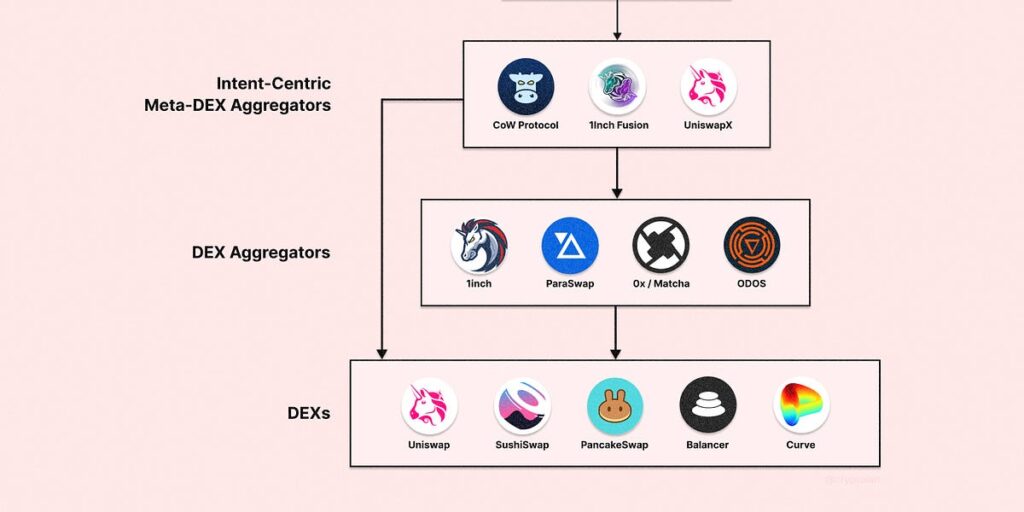

CoW Protocol is an innovative decentralized exchange (DEX) protocol built on the Ethereum network, aiming to make user transactions more efficient, secure, and profitable. Based on the principle of “Coincidence of Wants,” the system goes beyond traditional DEXs with its meta-DEX architecture—reducing transaction costs while offering full protection against MEV (Maximum Extractable Value) attacks.

What Makes CoW Protocol Unique?

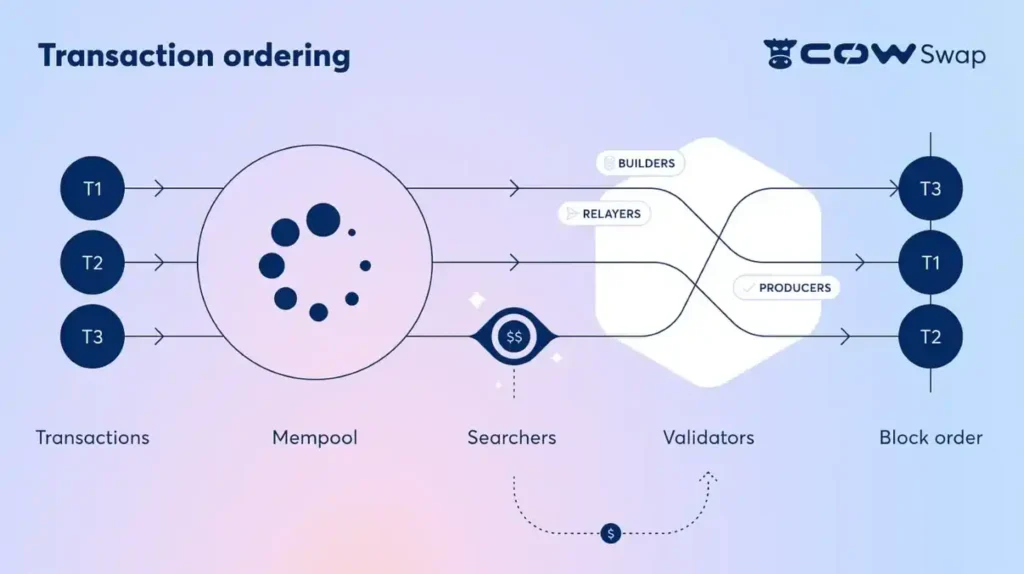

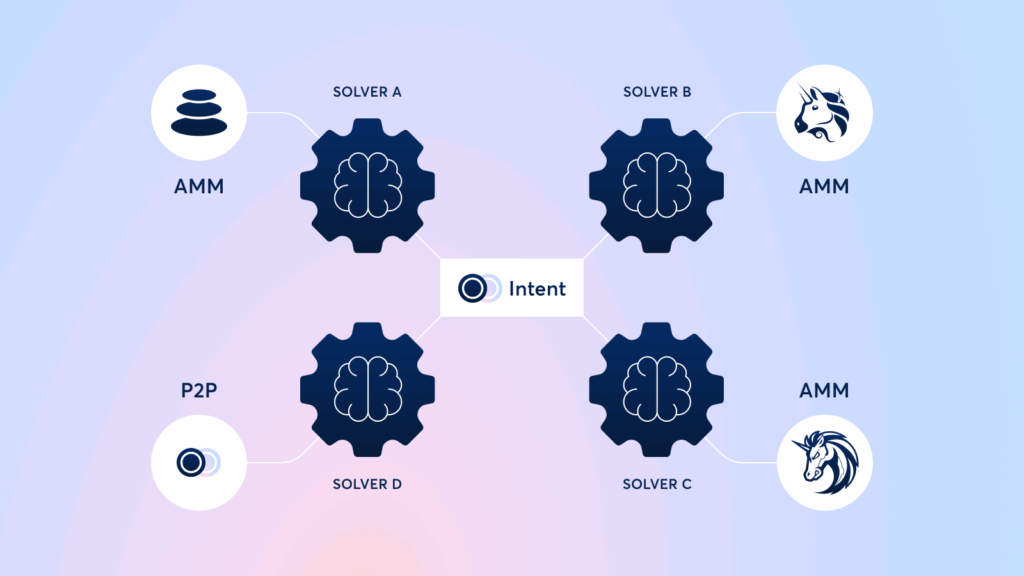

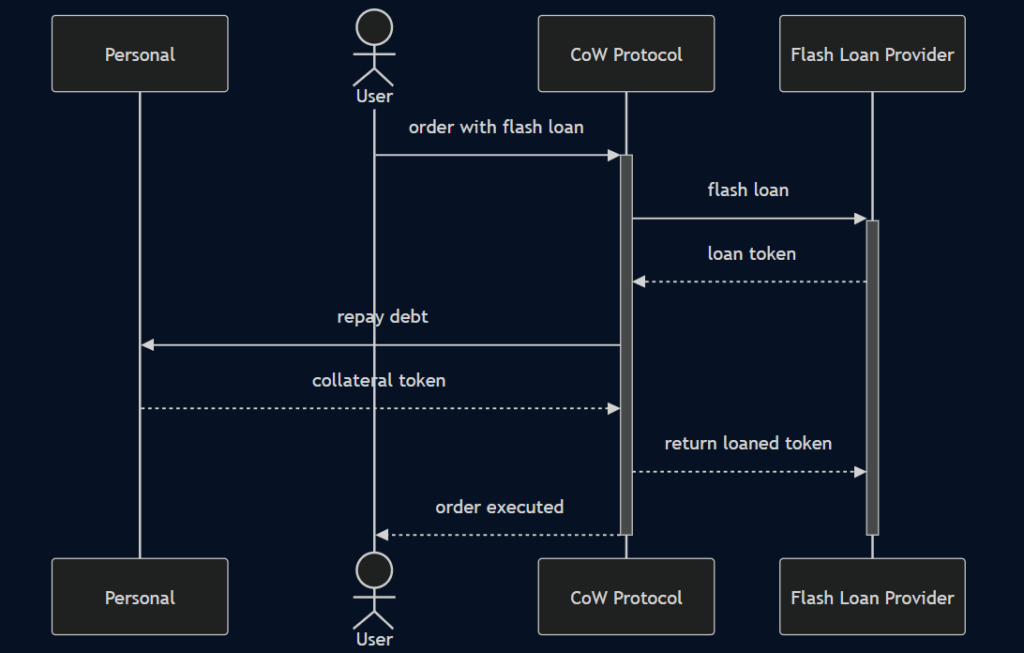

Unlike traditional order book or constant liquidity pool models, CoW Protocol operates based on the concept of “intents.” Users submit the assets they wish to swap as off-chain signed intents. These intents are collected by independent actors known as “solvers”, who find the most efficient swap combinations. Transactions are then executed through batch auctions, enabling:

- Lower transaction costs

- Protection against failed transaction gas fees

- Full prevention of MEV attacks like front-running

What Is CoW Swap?

CoW Swap is the first and most popular interface built on CoW Protocol, allowing users to swap tokens using the CoW infrastructure. The user-friendly interface includes features like wallet history, mini-games, and the legendary “Moo” sound. CoW Swap also integrates with other DeFi apps like Balancer, providing access to multi-protocol liquidity.

What Is the COW Token?

COW is the native governance and utility token of the CoW Protocol. It is used to pay transaction fees for cross-chain and cross-application asset transfers within the protocol. As an ERC-20 token built on Ethereum, it does not have its own blockchain but benefits from Ethereum’s security and infrastructure.

COW token holders participate in the protocol’s decentralized governance structure (DAO), gaining the right to vote on important decisions like protocol upgrades and grant programs. Thus, holders have both economic and governance influence within the ecosystem.

COW Token Use Cases

- Governance: Voting rights via Snapshot

- Incentives: Rewards for solvers and developer contributors

- Community Participation: Grant programs and ecosystem funds

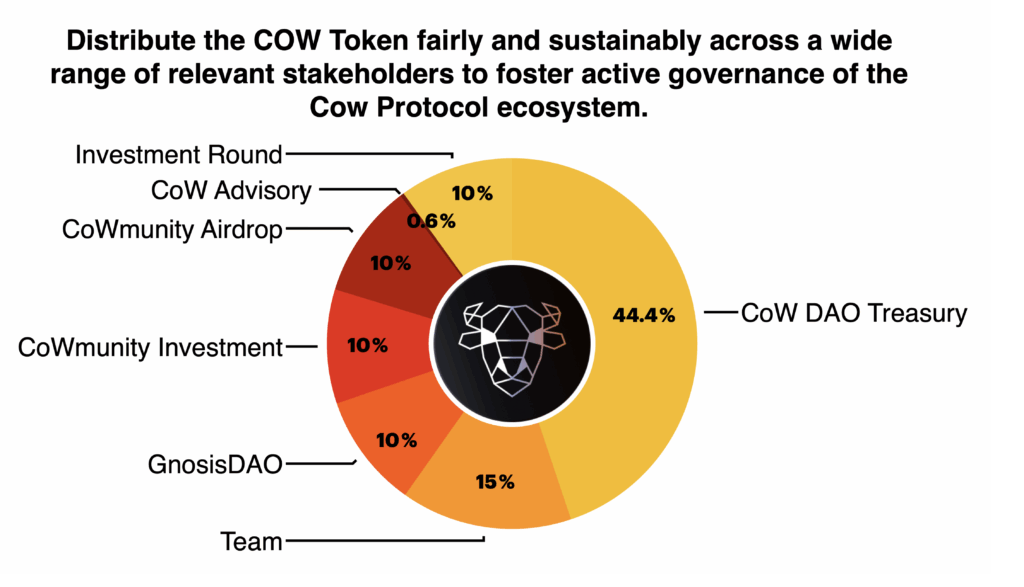

Token Distribution and Supply

- Total Supply: 1,000,000,000 COW

- Circulating Supply: 498,467,084.15

- Max Annual Inflation: 3%

- Token Release Policy: New tokens can only be issued once per year

Main Distribution:

- CoW DAO Treasury (44.4%) – For long-term development and governed by the community

- Team (15%) – Reserved for core developers

- GnosisDAO (10%) – For early technical and strategic contributions

- CoWmunity Airdrop (10%) – For early users and contributors

- Community Sale (10%) – For early users who supported the protocol financially

- Strategic Round (10%) – For institutional investors

- Advisors (0.6%) – For strategic and expert contributions

- Note: The vesting version of the token, vCOW, gradually converts into COW and is considered in circulating supply metrics.

Founding Team and Partnerships

CoW Protocol was launched in 2021 under the leadership of Anna George in collaboration with GnosisDAO.

- Anna George (CEO & Co-Founder): Former APAC Director at Gnosis; previously worked with the UNDP and GIZ.

- Felix Leupold (Technical Co-Founder): Joined the Ethereum ecosystem in 2018 and worked on fair trade mechanisms at Gnosis.

Why CoW Protocol Matters

- MEV Protection: Off-chain intent model prevents miners or bots from manipulating transactions.

- Efficient Pricing: Solver competition ensures optimal pricing and access to both on- and off-chain liquidity.

- Expanding Ecosystem: Integrated with various DeFi protocols and backed by a growing community.

How It Works

- Intent Submission: Users sign their swap intentions off-chain.

- Batch Auctions: Intents are grouped periodically.

- Solver Competition: Solvers scan all liquidity sources for the best match.

- On-Chain Settlement: The solver offering the highest surplus executes the batch in one transaction.

- Advantages: Reduced gas costs, full MEV protection, and best price guarantees.

Core Components of the CoW Ecosystem

- CoW DAO: The protocol’s governance body; token holders vote on major decisions.

- COW Token: The native token used for governance and protocol sustainability.

- Solvers: Independent actors who compete to match intents and execute transactions.

- Users: Anyone utilizing the protocol via CoW Swap for secure and low-cost token swaps.

- CoW Swap: The front-end interface of CoW Protocol for retail and DeFi users.

Investors

- GnosisDAO (founder and strategic partner)

- 1kx (Web3-focused VC)

- Blockchain Capital

- Protofire (SDK and interface development partner)

- mgnr

- SevenX Ventures

Other contributors include: Delphi Ventures, Dialectic, Cherry Ventures, Collider Ventures, Ethereal Ventures, Robot Ventures, imToken Ventures, 0x Labs, Atka, Kronos Research, The LAO, Hack VC, and 30+ angel and institutional investors.

Roadmap

January 2023: Roadmap planning and spec drafting by backend/frontend teams

Q2 2023: Finalized roadmap

Prototype of hard/multiple order cancellations and advanced batch auction features

2024: Launch of CoW AMM module and V3 “hooks” architecture

MEV Blocker rollout from testnet to mainnet

2025 and Beyond: Expansion to multiple chains (Arbitrum, Base, Avalanche, etc.)

Developer SDK and dApp tooling improvements

Official Links

Also, you can freely share your thoughts and comments about the topic in the comment section. Additionally, please follow us on our Telegram, YouTube and Twitter channels for the latest news and updates.