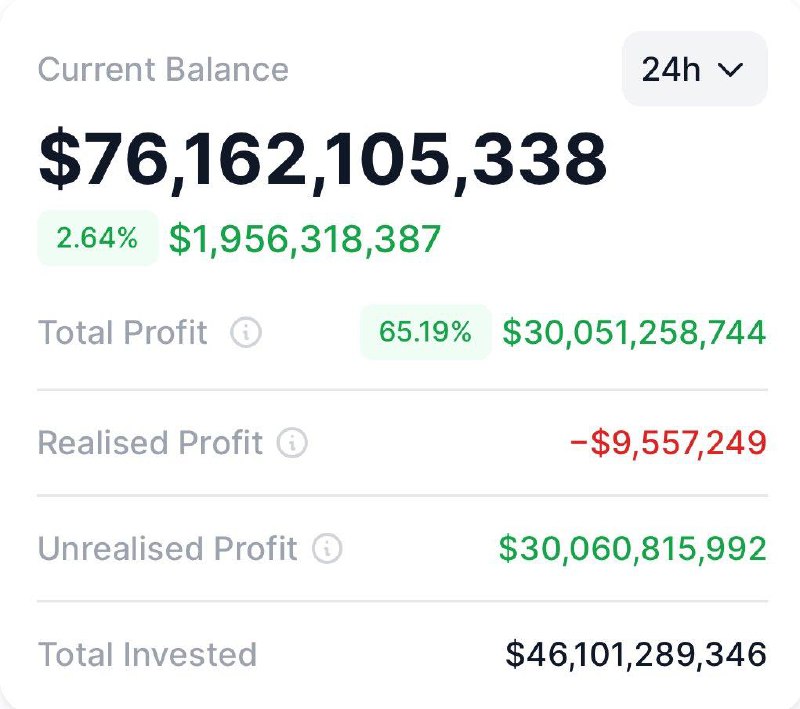

A notable development has caught the attention of the crypto market. Strategy has secured more than $30 billion in unrealized profit from its massive Bitcoin portfolio. This achievement highlights both the success of the company’s long-term investment strategy and Bitcoin’s strong price performance in recent months.

Portfolio Value and Performance

Strategy’s total investment stands at $46.1 billion, while the current portfolio value has surged to $76.16 billion. These figures correspond to holdings of ₿628,791. With the current Bitcoin price at $121,151, the portfolio’s total market value is maintained at $76,179 million.

Returns and Profit Figures

In the third quarter of the year, the portfolio delivered a return of 4.4%. Year-to-date performance stands at 25%, while the overall gain for 2024 has reached 74.3%. In terms of volume, Bitcoin gains for 2024 total ₿140,538, translating to $13.13 billion in dollar value.

Volatility Metrics

The 30-day historical volatility of the portfolio is measured at 21%, while the one-year volatility is 45%. Implied volatility currently stands at 39%, offering important insight into the portfolio’s risk profile.

Overall, Bitcoin’s impressive performance in 2024 combined with Strategy’s disciplined, long-term approach has been the key driver behind this massive unrealized profit.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.