Last week, BitMine announced that it purchased over 300,000 ETH, increasing its total holdings to 1,150,000 ETH. This significant acquisition highlights once again the growing impact of institutional investors on Ethereum.

BitMine’s Massive ETH Position

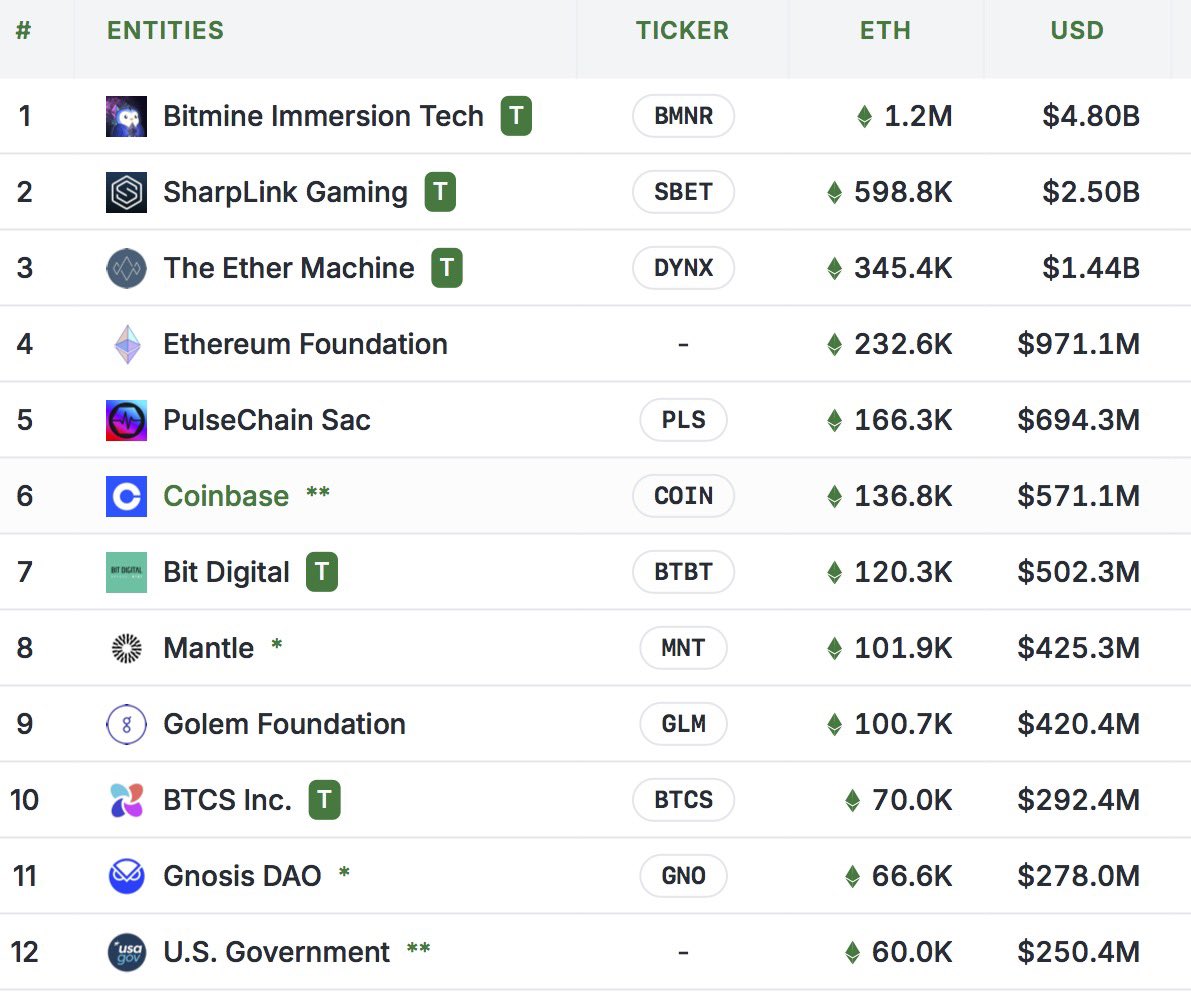

As part of its public purchases, BitMine Immersion acquired an additional 317,126 ETH, valued at approximately $1.32 billion. With this, BitMine’s total Ethereum holdings reached 1.2 million ETH, representing a massive accumulation worth nearly $5 billion.

What Does Bitmine Buying Mean for the Market?

Following BitMine, SharpLink holds the second-largest position with around 598,800 ETH, worth roughly $2.5 billion. These large-scale acquisitions provide strong support for market liquidity and are seen as positive signals for Ethereum prices. The increasing interest of institutional investors in Ethereum suggests strong market confidence and optimistic future expectations.

Overall, the rapid accumulation of Ethereum by companies in what appears to be a panic buying phase is creating notable momentum in the digital asset market, with expected positive effects on Ethereum’s price movement.

This content does not constitute investment advice. Markets carry high risks, and it is important to conduct your own research before making any investment decisions.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.