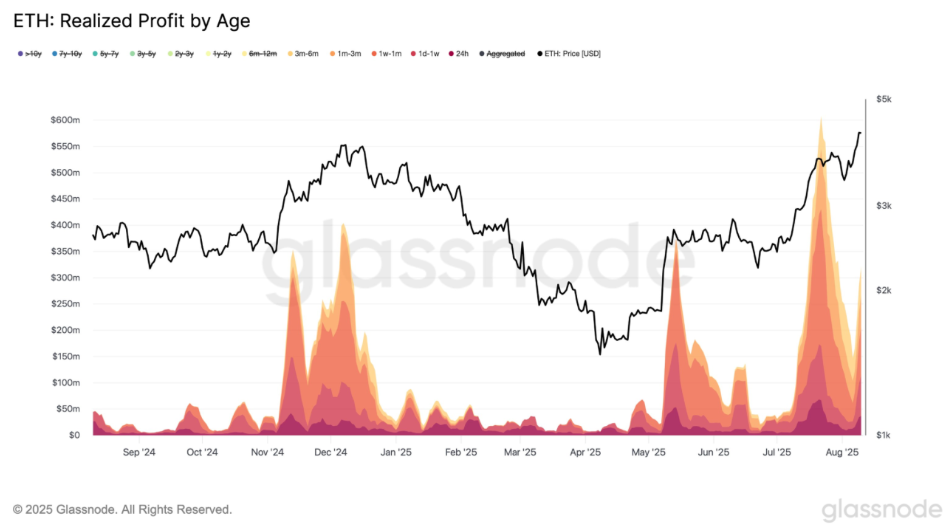

Ethereum price rose 43% in the last 30 days, reaching $4,366. This sharp rally triggered profit-taking among short-term investors. On-chain data provider Glassnode reports an average daily profit-taking of $553 million over the past week. Most of this comes from investors who bought ETH recently.

Long-term holders are less aggressive. The profit-taking rate of investors holding ETH for more than 155 days remains around December 2024 levels. This is 39% lower compared to the highest daily profit-taking average seen last month when ETH was at $3,500.

ETH price currently trades 12.7% below its November 2021 peak of $4,828. According to CoinGlass, if the price reaches $4,700, around $2.23 billion worth of positions could be liquidated.

Increasing Institutional Demand Amid Price Resistance

ETH has recently crossed the $4,300 level multiple times but failed to hold above it. Meanwhile, institutional investors are increasing their Ether holdings. Companies with crypto treasuries now hold a total of 3.04 million ETH, equivalent to about $13 billion.

Additionally, BitMEX co-founder Arthur Hayes resumed Ethereum buying after selling $10.5 million last week. Hayes’ move is seen as a confidence signal for breaking the critical resistance.

Santiment analysts note that large institutional buys becoming public could trigger FOMO but may also lead to short-term price pauses or declines. The market remains cautious after failed rallies earlier this year.

Breaking above the $4,300 resistance zone could create new momentum in the market, opening fresh opportunities for both short- and long-term investors.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.