The US federal debt has reached a record $37 trillion, and rising budget deficits alongside potential money supply expansion are fueling expectations that Bitcoin could reach $132,000 by the end of the year.

US Debt and Money Supply Growth

US Representative Thomas Massie noted that the federal debt surpassed $37 trillion thanks to the One Big Beautiful Bill Act. US President Donald Trump signed the legislation on July 4, stating it could cut up to $1.6 trillion in federal spending.

Analysts suggest that growing budget deficits may prompt central banks to adopt looser policies like quantitative easing (large-scale bond purchases). This could inject liquidity into the financial system, creating a favorable environment for Bitcoin.

Bitcoin’s Growth Potential

Ryan Lee, chief analyst at Bitget crypto exchange, highlights that US debt rose from $26.7 trillion in 2020 to $37 trillion over five years—a 38% increase—while Bitcoin gained 925% during the same period. According to Lee, as debt grows, the likelihood of BTC reaching new all-time highs also increases.

Moreover, the US government might consider Bitcoin as a tool to manage its debt, potentially boosting BTC’s value in correlation with global money supply and inflation.

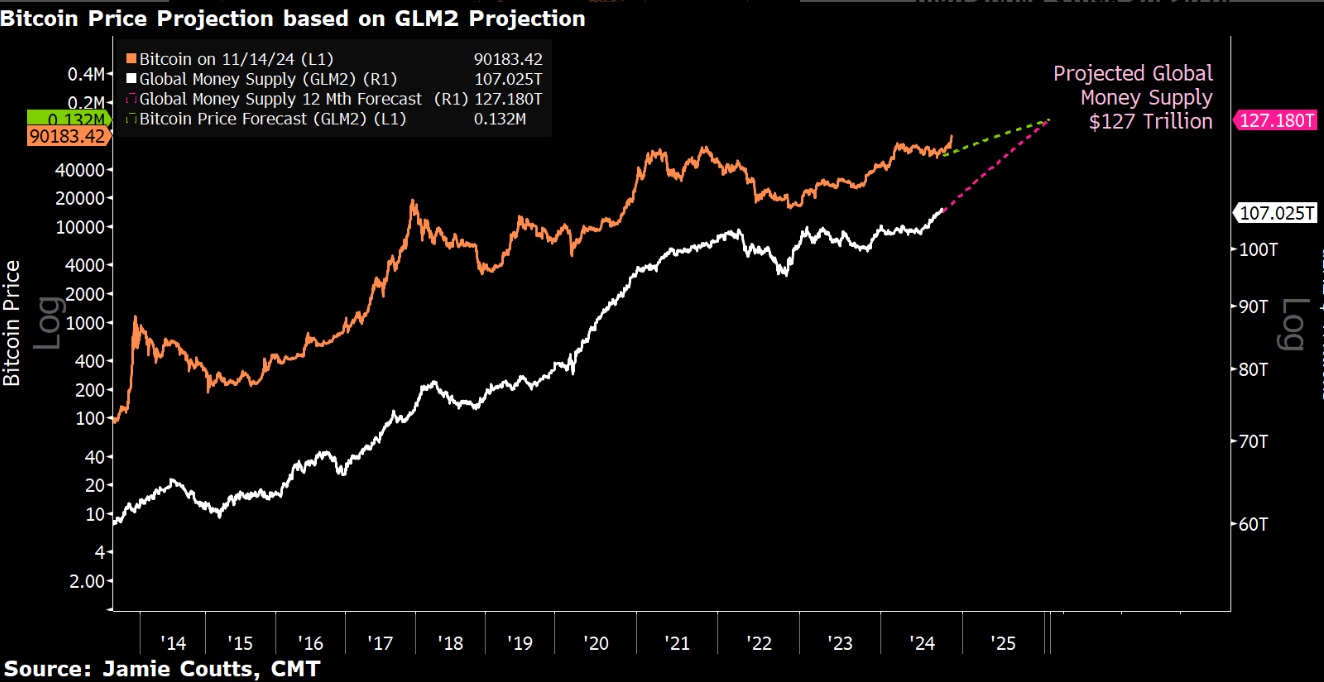

M2 Money Supply and Inflation Effects on Bitcoin Price

Debt servicing could drive a rise in the global M2 money supply, acting as a new catalyst for Bitcoin price. Jamie Coutts, chief crypto analyst at Real Vision, estimates that this could push BTC above $132,000 by the end of 2025.

Arthur Hayes, co-founder of BitMEX, adds that if the US Federal Reserve returns to QE and inflation pressures rise, BTC could climb as high as $250,000.

These developments indicate that rising inflation and expanding money supply could serve as significant bullish catalysts for Bitcoin.

This content is not financial advice. Markets carry high risk, and it’s essential to conduct your own research before making investment decisions.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.