Vaulta ($A), formerly known as EOS, rebranded in March 2025 to focus on Web3 banking. Positioned as a platform combining traditional finance with decentralized finance (DeFi), Vaulta has captured attention with its rich features, fast and low-cost transactions, following its May 2025 launch.

Vaulta’s Foundations and Vision

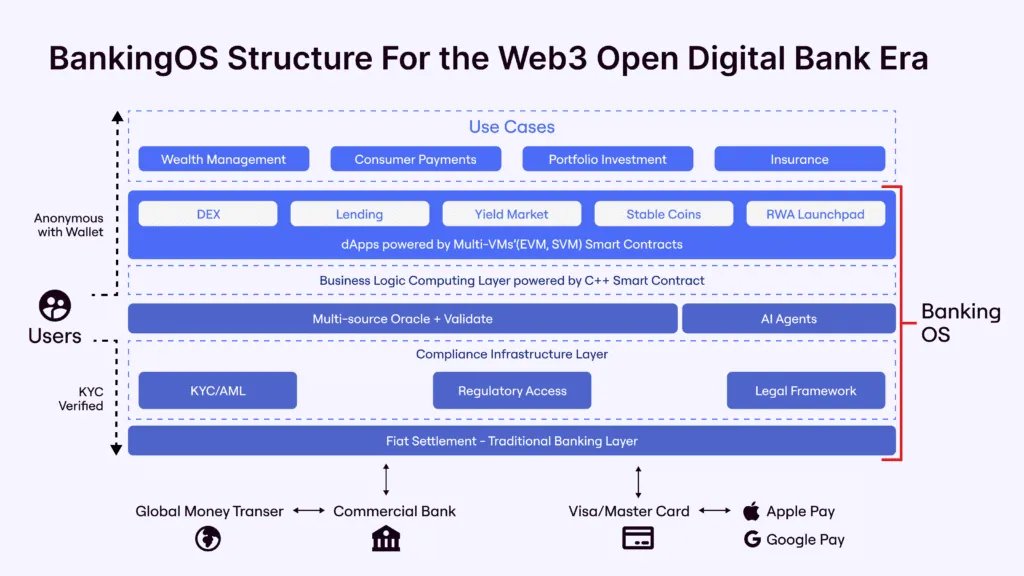

Token is an Ethereum-compatible Layer-1 blockchain with high-speed infrastructure enabling one-block finalization per second. Its core vision is to provide users with Web3-powered banking and financial services, including:

- Consumer payments and stablecoin integration

- Asset management and staking solutions

- Insurance products and risk management

Tokenization of real-world assets

Vaulta targets both individual and institutional users. Individuals benefit from secure savings, stablecoin payments, and insured staking opportunities, while institutions can tokenize real estate and commodity assets, access DeFi loans, and utilize payment solutions.

Technology and Operations

- Consensus and Transaction Speed :Vaulta enhances the Delegated Proof of Stake (DPoS) algorithm inherited from EOS with its custom Savanna system. This allows instant block finalization, making transactions irreversible.

- Chain Structure and Cross-Chain Support :Vaulta supports Bitcoin-compatible smart contracts via sidechains and the exSat solution. The Antelope IBC infrastructure enables seamless integration with other blockchains.

- Network Resource Management :Users stake $A tokens to access network resources: CPU, RAM, and NET (bandwidth). Processing power depends on staking, and users receive a share of block rewards.

- Insurance Mechanism :In collaboration with Blockchain Insurance Inc., Vaulta can insure user funds against specific risks—a rare feature in DeFi that differentiates Vaulta.

Goals

Vaulta aims to create a decentralized banking infrastructure, making financial services fairer, more open, and globally accessible. Especially in unbanked regions, users can save, invest, and transfer money through Vaulta.

Additionally, the platform supports tokenization of real-world assets, giving small investors access to large-scale investments. Through VirgoPay infrastructure, Vaulta offers fast and low-cost payments.

Founding Team and Organization

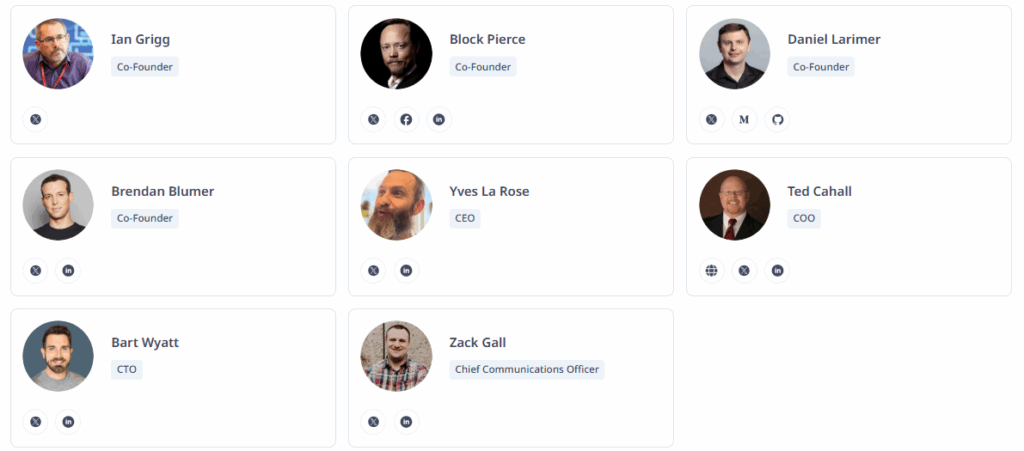

Token was developed by the core team behind EOS. Key figures include:

- Daniel Larimer – Founder, former EOS leader, founder of BitShares and Steem

- Ian Grigg – Co-Founder

- Block Pierce – Co-Founder

- Brendan Blumer – Co-Founder

- Yves La Rose – CEO

- Ted Cahall – COO

- Bart Wyatt – CTO

Organizational Structure:

- Vaulta Foundation – Governance and vision

- Vaulta Labs – Developer community and tech infrastructure

- Greymass & Vaulta Ventures – Ecosystem growth and project investments

- Block Producers (BPs) – Network security and sustainability

- The Vaulta Banking Advisory Council consists of both Web3 and traditional finance experts.

Investors and Market

- Vaulta’s investors include significant names from both traditional finance and crypto:

- Fosun Wealth – Testing regulated Web3 finance infrastructure in Hong Kong

- Binance, OKX, Kraken, Coinbase – Increasing liquidity and user access

- Block.one – Indirect support via investments during EOS era

$A Tokenomics and Use Cases

Vaulta’s native token $A powers the network and provides benefits to users.

Key Data:

- Total Supply: 2.1 billion $A

- Circulating Supply: 1.57 billion $A

Use Cases:

- Accessing network resources (RAM, CPU, NET)

- Governance and block producer voting

- Purchasing insurance products

- Paying network fees and transaction costs

- Providing liquidity for DeFi applications

Staking Rewards:

- Approximately 85,600 $A daily

- Around 17% APY

- Rewards balanced with 4-year halving intervals

Vaulta ($A) Token Distribution

- Token Swap: Old EOS tokens are exchanged for new Vaulta ($A) tokens at a 1:1 ratio. This means that EOS’s original distribution model continues to apply for Vaulta.

- Staking Rewards: A new regulation has been introduced to incentivize long-term token holders. Under this system, 250 million tokens are allocated for staking rewards. These rewards will be distributed according to a halving schedule every 4 years.

- Preservation of Distribution: The token swap does not alter the existing token supply, allocations, or vesting schedules. This ensures that EOS’s economic framework continues unchanged under Vaulta.

Social Media and Communities

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.