Open interest in the altcoin market has climbed to $47.01 billion. This level marks the highest point since the peak of November 2021. Glassnode data shows that increased leverage makes price movements sharper. Investors are focusing on large-cap coins. However, smaller-cap altcoins have yet to show strong activity.

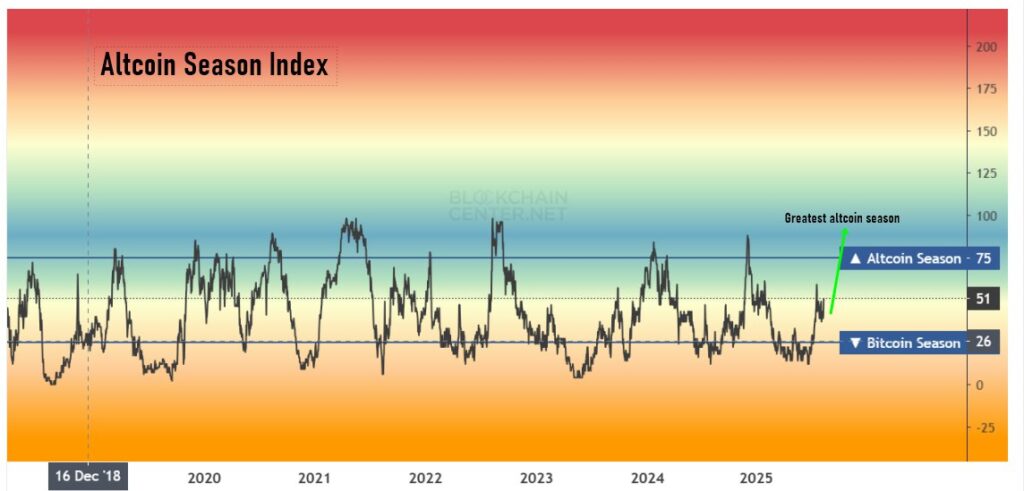

The Altcoin Season Index currently stands at 51. The index must surpass 75 to confirm a true altcoin season. At that level, 75% of the top 50 altcoins outperform Bitcoin. For now, this signal remains distant.

Open interest across major #altcoins has surged to an all-time high of $47B. This concentration of leverage elevates reflexivity, amplifying both upside and downside price reactions and increasing fragility in market structure. pic.twitter.com/GwJp8dsjBp

— glassnode (@glassnode) August 13, 2025

Ethereum Has Yet to Take the Lead

Bitcoin’s market dominance fell from 65% to 58.9% over the past month. This drop indicates capital is shifting from BTC to altcoins. However, Ethereum is not leading this rotation. ETH dominance remains below 15%, far from its 2024 peak of 22.5%. The ETH/BTC pair continues sideways, with no strong breakout yet.

Ethereum accounts for $23.6 billion of the total open interest. Solana follows with $7.4 billion, and XRP ranks third with $3.9 billion. Popular assets like AVAX, DOGE, LINK, and BNB complete the list. High leverage can trigger severe liquidations if prices fall, so investors are staying cautious.

Google Trends data shows a rise in “Altcoin Season” searches over the past week. However, interest is still below the 2021 peak. In 2025, the larger number of altcoins means even more interest is needed to reach similar sentiment levels. Market excitement is building, but a confirmed altcoin season signal has not yet appeared.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.