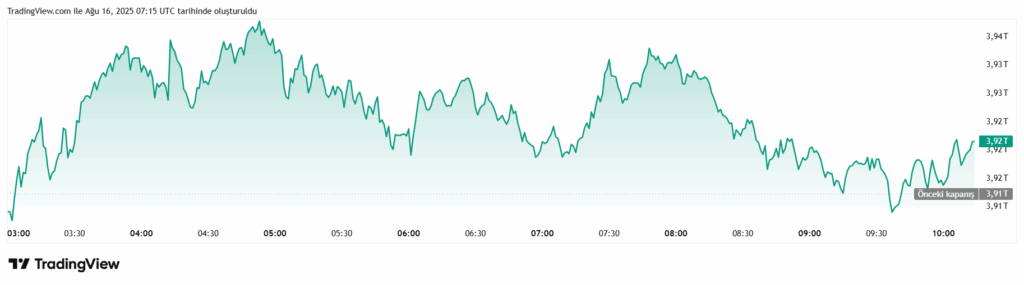

The crypto market lost $25.8 billion in the last 24 hours, with the total market capitalization falling to $3.92 trillion. However, it managed to hold at the $3.89 trillion support level, which is critically important for overall market stability.

The sharp decline over the past two days has slowed, giving the market a temporary breather. This pause has provided cryptocurrencies a chance to regain momentum. However, a break below support could trigger another pullback toward $3.81 trillion. Investors are closely monitoring potential moves within this range.

In the altcoin sector, a different picture emerged. According to Binance data, sharp movements were recorded. The biggest losers included SKALE (SKL), dropping 23.43%, followed by Juventus Fan Token (JUV) with a 12.96% loss, and EigenLayer (EIGEN) falling 9.37%. Syntropy (SXT) also fell 9.03%, while Arbitrum (ARB) declined 8.51%, and AS Roma Fan Token (ASR) dropped 8.24%.

On the other hand, the top gainers were led by Measurable Data Token (MDT), soaring 47.06%. Alpine F1 Team Fan Token (ALPINE) followed with a strong 42.19% rise. Additionally, LATAM Airlines (LA) gained 28.34% and Porto Fan Token (PORTO) climbed 18.62%.

Meanwhile, the industry saw significant developments. Gemini submitted an S-1 filing for an IPO on Nasdaq under the ticker GEMI, planned for 2025. Giants like Goldman Sachs, Morgan Stanley, and Citi are leading the process. At the same time, the U.S. Treasury’s OFAC sanctioned the ruble-pegged stablecoin A7A5 and its developer A7 LLC, targeting Russia’s attempts to bypass financial restrictions through crypto.

Bitcoin Price at $117,500 Support

Bitcoin is currently trading at $117,547. The $117,261 support line is a critical threshold. As long as this level holds, BTC maintains strong bullish momentum.

The RSI indicator is in the positive zone, signaling buyer dominance. This opens the possibility of Bitcoin retesting $120,000. However, if selling pressure rises, the price could fall below $117,261. In such a scenario, losses toward $115,000 may accelerate.

Ultimately, the market’s direction depends on whether key support levels hold. In the short term, these price moves will directly shape investor strategies.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.