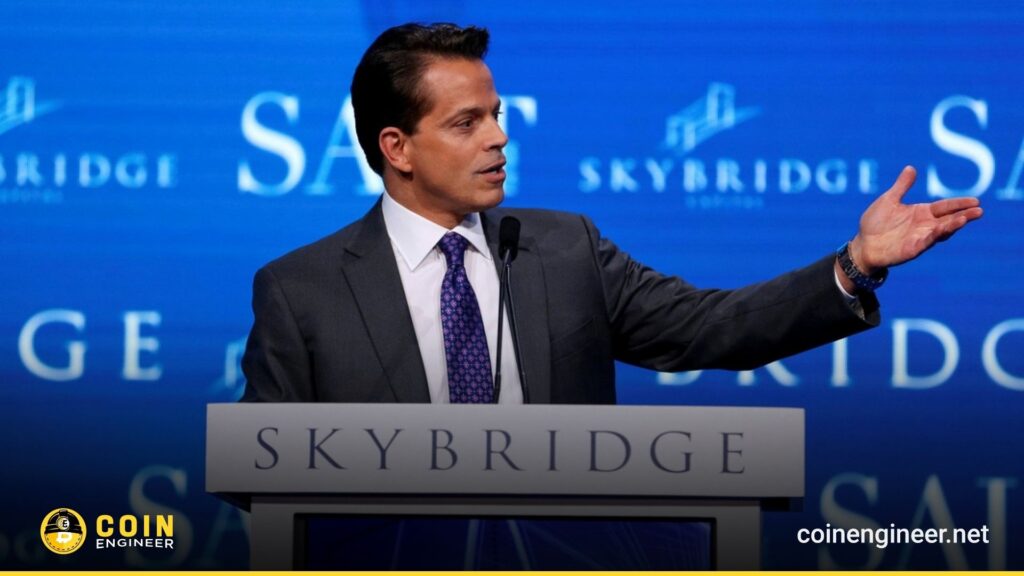

Another investment firm is moving its funds to the blockchain. Anthony Scaramucci, founder and CEO of SkyBridge Capital, announced that the company plans to hold around $300 million from two funds in the form of tokenized assets. This move aligns with the growing interest in tokenization within the crypto sector. The process involves creating digital token versions of real-world assets, such as Treasury bills, which can be easily traded on the blockchain just like Bitcoin or stablecoins.

The Future of Tokenization

Scaramucci, a former Goldman Sachs executive who briefly served in the White House during Trump’s presidency, told Fortune, “I basically see the period from 2026 to 2027 as the age of real-world tokenization.”

SkyBridge Capital plans to deploy its tokenized funds on the Avalanche blockchain network. According to crypto analytics provider DefiLlama, Avalanche currently holds nearly $2 billion in assets on its network.

Fund Structure and Crypto Investments

Scaramucci stated that the amount being tokenized represents about 10% of the firm’s assets under management. One of the two funds focuses on cryptocurrencies like Bitcoin that have not been classified as securities. The other is a fund-of-funds, which includes SkyBridge’s other investment vehicles, covering both venture capital and crypto funds.

Reducing Transaction Fees and Cutting Out Middlemen

Experts say offering investment funds on decentralized networks can reduce fees and eliminate intermediaries. In traditional finance, there are often multiple parties between buyers and sellers, each verifying the origin of the asset, which slows down the process and adds costs.

Blockchain is a decentralized database, meaning no single party can tamper with stored information. Theoretically, ownership and authenticity of a financial asset can be verified directly on the blockchain without a middleman. Users can check the details themselves.

Moves by Institutional Giants

Although the benefits of tokenization have been praised for some time, putting real-world assets on the blockchain is still an emerging trend—but it is gaining momentum. Financial heavyweights like BlackRock, Franklin Templeton, and VanEck have recently issued money market funds on blockchains such as Solana and Aptos. In the future, investors may be able to buy and transfer their stakes in various funds directly, without repeatedly calling banks.

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.